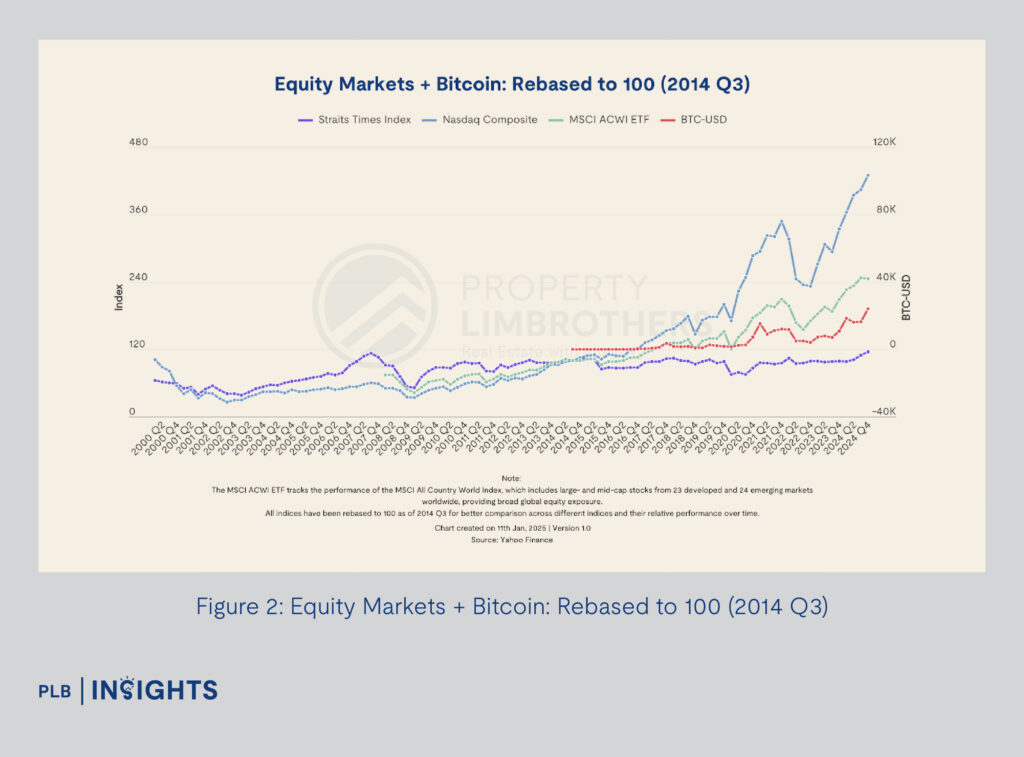

Bitcoin, the pioneering cryptocurrency, has become a symbol of digital financial evolution, captivating investors with its astronomical price movements and potential for high returns, especially since the fourth quarter of 2024. As it continues to dominate discussions in global finance, its impact on traditional asset classes like real estate is a subject of increasing interest. Could Bitcoin, with its sentiment-driven price surges, influence the real estate market, or are the two too fundamentally different? This article explores the connection, focusing on the Singapore context.

The Sentiment-Driven Nature of Bitcoin

Bitcoin’s value is predominantly shaped by market sentiment rather than intrinsic economic fundamentals. This distinct characteristic sets it apart from traditional asset classes like real estate, where prices are grounded in tangible factors such as supply and demand, land scarcity, and broader economic conditions. A recent example of Bitcoin’s sentiment-driven volatility occurred during Donald Trump’s inauguration in 2025.

In December 2024, the announcement of a Strategic Bitcoin Reserve by the U.S. administration sparked a wave of investor optimism, catapulting Bitcoin’s price beyond $100,000 within days. This euphoric surge underscored the cryptocurrency’s susceptibility to external influences, including geopolitical developments, endorsements by influential figures, and policy shifts. However, the euphoria was short-lived. Shortly after Federal Reserve Chairman Jerome Powell clarified that Bitcoin would not be held as part of U.S. reserves and no legislative changes were being considered to allow such inclusion, Bitcoin’s price plummeted to approximately $89,000 within three days.

This dramatic fluctuation highlights the speculative nature of Bitcoin’s market, where perception and sentiment often overshadow its underlying utility. The rapid rise and fall in value reveal the challenges of viewing Bitcoin as a reliable or stable store of value, let alone a medium for high-stakes transactions like real estate.

In contrast, real estate prices—particularly in Singapore—exhibit remarkable stability. Influenced by long-term fundamentals such as interest rates, government regulations, and demand-supply dynamics, the property market is largely insulated from the emotional swings and speculative frenzies that define Bitcoin’s value. This makes real estate a far more predictable and secure asset class for investors seeking long-term growth and resilience against market volatility.

The Stability of Singapore’s Real Estate Market

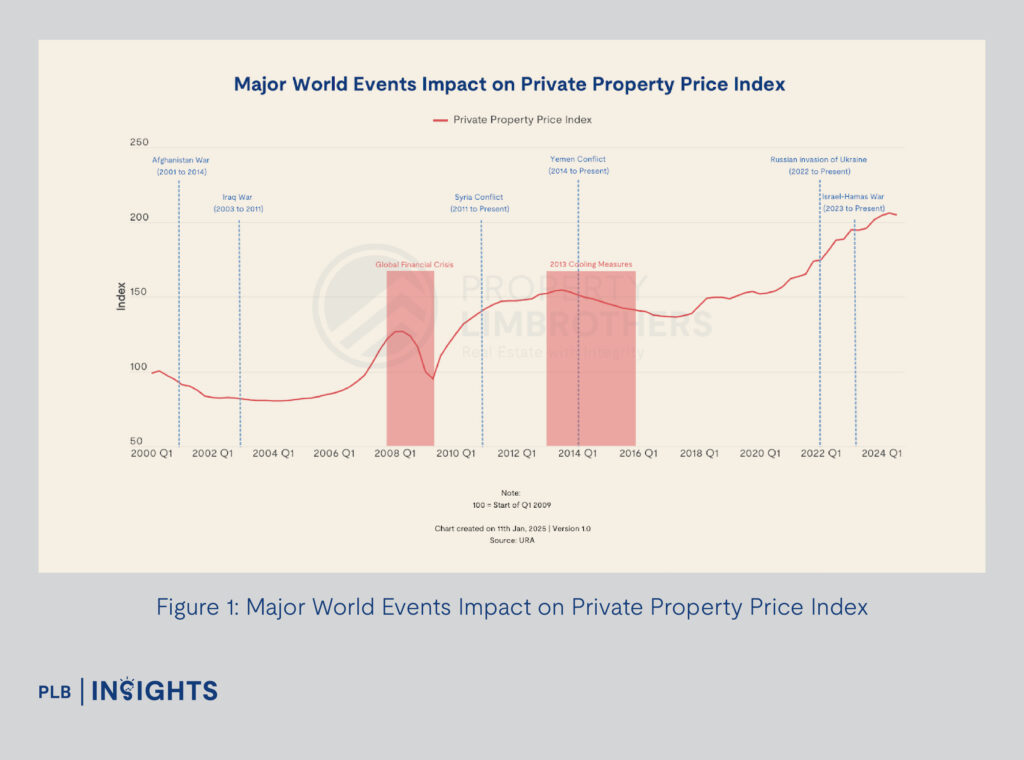

Singapore’s real estate market has long been a pillar of stability and reliability. Both public housing (HDB flats) and private non-landed properties have shown steady growth over decades, even weathering global economic shocks like the 2008 Financial Crisis and the COVID-19 pandemic with resilience, as seen in Figure 1 where property prices recovered post-crises. This stability is underpinned by:

1. Interest Rates: Property prices tend to rise in a low-interest-rate environment, as borrowing becomes more affordable. Conversely, higher rates can moderate growth.

2. Government Policies: The Monetary Authority of Singapore (MAS) actively manages the market through measures like Additional Buyer’s Stamp Duty (ABSD) and loan-to-value (LTV) limits to prevent overheating.

3. Demand-Supply Dynamics: Limited land availability in Singapore ensures long-term price appreciation, supported by a consistent demand for housing.

These fundamentals ensure that property prices in Singapore remain predictable and less susceptible to the speculative volatility seen in Bitcoin.

Comparative Analysis: Bitcoin vs Real Estate

The divergence between Bitcoin and real estate is stark, driven by their contrasting characteristics:

Volatility: Bitcoin’s price can skyrocket or plummet within hours, influenced by speculative trading and external factors like market sentiment or geopolitical developments. For instance, Bitcoin’s recent surge from around $68K in September to $109K in January (merely in four months) after Trump’s inauguration – thus reflecting its reactionary nature. Real estate prices in Singapore, on the other hand, grow at a steady pace and rarely experience sharp declines, even during crises.

Investment Drivers: Bitcoin attracts risk-tolerant investors seeking high returns in the short term, while real estate appeals to those prioritising long-term stability and consistent growth. Property remains a preferred asset in Singapore due to its tangible value and government-backed stability.

Crisis Resilience: Bitcoin tends to exhibit heightened volatility during economic uncertainty, while Singapore’s real estate market has proven resilient, recovering swiftly from global crises.

Why Bitcoin is Unlikely to Impact Singapore’s Real Estate Prices

Despite Bitcoin’s growing prominence, its direct impact on Singapore’s real estate prices remains limited. Several factors contribute to this:

1. Regulatory Environment: The MAS maintains a cautious stance on cryptocurrencies, classifying them as speculative assets. As MAS Managing Director Ravi Menon noted in 2022, “The extreme price volatility of cryptocurrencies rules them out as a viable form of money or investment asset.” This view restricts Bitcoin’s integration into Singapore’s real estate market.

2. Market Fundamentals: Unlike Bitcoin, real estate prices in Singapore are deeply tied to local economic factors, including housing demand, interest rates, and government intervention. These fundamentals shield the property market from the speculative swings of cryptocurrencies.

3. Limited Adoption in Transactions: While some markets, such as Dubai or the United States, have seen Bitcoin used in real estate transactions, this trend is absent in Singapore. The regulatory and practical hurdles, combined with Bitcoin’s volatility, make it an unattractive option for property sellers and buyers in Singapore.

Conclusion: A Tale of Two Asset Classes

Bitcoin and real estate represent two vastly different investment paths. Bitcoin thrives on sentiment, which provides opportunities for rapid gains in a short period but with significant risk. Its price movements, like the surge following Trump’s inauguration, illustrate its susceptibility to external factors and speculative mania. In contrast, Singapore’s real estate market stands as a model of stability, driven by tangible and sound fundamentals, as well as proactive government policies – especially in Singapore.

While Bitcoin may capture headlines and intrigue investors with its meteoric rise, its impact on Singapore’s property prices is negligible. For most Singaporeans, real estate remains a cornerstone of wealth accumulation, offering reliability and long-term growth that Bitcoin, with its volatility and unpredictability, simply cannot match. In this tale of two assets, real estate continues to stand firm as Bitcoin ebbs and flows with the tides of sentiment.

Stay Updated and Let’s Get In Touch

Our goal is to provide you with insightful real estate commentaries. Should you have any questions, do not hesitate to reach out to us!