In a recent Landed VIP Club poll, one question stood out clearly: Which landed type will still grow?

With price quantum ceilings becoming more visible, and homeowners increasingly selective, many buyers are no longer asking whether landed homes will hold value, but which type still offers room to grow meaningfully.

This article does not attempt to predict prices or time the market. Instead, it aims to provide a practical, data-led gauge— drawn from observed behaviour across multiple landed districts — to help readers understand how different landed types tend to grow, where resilience comes from, and what “growth” actually means at this stage of the cycle.

An Important Caveat on the Data

Before diving in, it is important to state clearly that some of the transaction, inventory, and absorption data referenced in this article were retrieved earlier in the year. Market conditions may have shifted marginally since then, particularly at the micro-location or individual listing level.

However, landed homes — by nature — move far more slowly than non-landed segments. Structural characteristics such as supply scarcity, buyer depth, holding power, and liquidity profiles do not change meaningfully in a matter of months. For that reason, while this article should not be read as a short-term forecast, it remains a useful directional gauge for understanding how different landed types tend to behave over time.

First, Reframing the Question: What Does “Growth” Mean?

One of the biggest pitfalls in landed property discussions is treating “growth” as a single outcome.

In reality, landed homes grow in different ways, depending on their position in the market. Broadly, growth tends to take three forms:

Understanding which form of growth applies to each landed type is far more useful than simply comparing headline PSF or overall quantum price numbers.

Inter-Terrace Homes: The Liquidity Engine That Keeps Moving

Across districts such as D14, D16, D20, and D28, one pattern appears consistently: inter-terrace homes are the most liquid segment of the landed market.

This is not accidental. Inter-terraces typically sit at the lowest quantum entry point into pure landed ownership. That alone gives them access to the deepest buyer pool — including HDB upgraders, mass-market private condo owners, and families moving out of strata living.

Because the buyer pool is wide, inter-terraces tend to:

Liquidity matters because it enables prices to move in small, consistent steps. Rather than relying on a handful of high-value transactions, inter-terrace pricing is continuously “refreshed” by real buyer activity.

This is why, across multiple districts, inter-terraces often show:

Inter-terraces may not spike dramatically in any single year, but they remain the most dependable growth engine within the landed ecosystem.

Corner Terraces: Scarcity-Led Growth That Appears Quiet — Until It Doesn’t

Corner terrace homes sit in an interesting middle ground.

They share some affordability overlap with inter-terraces, yet offer additional land, frontage, and privacy. However, unlike inter-terraces, their supply is structurally thin.

Across districts studied, corner terraces consistently show:

This creates a different growth profile. Corner terraces do not grow through volume; they grow through scarcity-driven repricing, often in discrete jumps.

Growth in this segment typically appears when:

Corner terraces tend to reward patience. They may appear quiet for long stretches, but when repricing occurs, it is often decisive rather than incremental.

Semi-Detached Homes: The Most Misunderstood Landed Segment

If there is one landed type that generates the most mixed signals, it is the semi-detached home.

On the surface, semi-Ds appear attractive: larger land plots, family-friendly layouts, and strong owner-occupier appeal. Yet transaction data across districts shows that semi-Ds often experience slower absorption than terraces.

The reason lies in heterogeneity.

Semi-detached homes are not one market, but several overlapping ones:

When inventory builds up — especially in the older categories — buyers gain leverage. This can temporarily suppress price momentum, even while underlying demand remains intact.

However, it would be a mistake to conclude that semi-Ds do not grow.

Well-located, structurally sound, or rebuilt semi-Ds continue to:

The key takeaway is that growth in the semi-detached segment is selective. It depends far more on condition, land efficiency, and micro-location than on the property type alone.

Detached Homes: Growth Is Not the Point — Preservation Is

Detached homes occupy a very different role in the landed market.

They are:

Across districts, detached homes show low transaction volumes — but this should not be mistaken for weakness. Instead, it reflects extraordinary holding power.

Detached homes tend to be owned by households with:

As a result, detached homes typically exhibit:

Growth here is not driven by frequent repricing. It is driven by land scarcity and time. Detached homes preserve capital first — and allow it to compound gradually over long periods.

Putting It Together: So, Which Landed Type Will Still Grow?

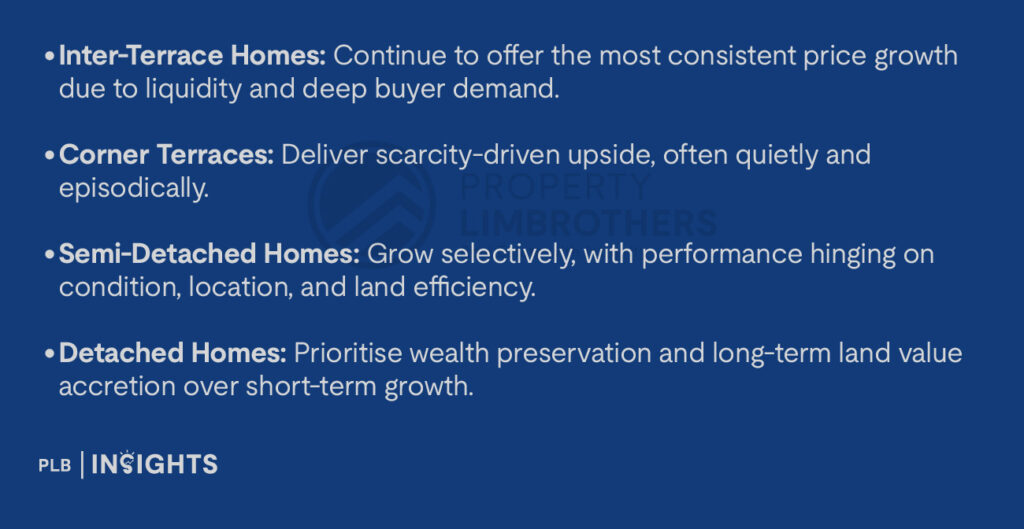

When viewed through the right lens, the answer becomes clearer — and more nuanced.

There is no single “winner”. Each landed type grows — but in different ways, at different speeds, and for different buyer profiles.

Using This as a Practical Gauge

Rather than asking which landed type will grow the most, buyers may find it more useful to ask:

Matching the landed type to one’s capital structure and life stage matters far more than chasing abstract growth narratives.

A Better Question to End On

Perhaps the most useful conclusion is this:

The landed market has not become less attractive — it has simply become more differentiated.

The better question today is not which landed type will still grow, but which landed type grows in a way that fits my objectives.

And in a market defined by scarcity, patience, and real end-user demand, clarity on that distinction is often the most valuable insight of all.

If you’d like to understand which landed type best aligns with your holding horizon and capital profile, our sales consultants are available to guide you.

Thank you for reading, and stay tuned! For more detailed insights regarding the landed property market, join our Landed VIP Club and stay updated with the latest market trends and expert advice.