Landed homes are still holding their ground in 2025, but the “everything goes up” storyline is no longer true. Prices are still rising in many areas — yet the market has become far more picky. Buyers are still willing to pay, sometimes even pay a premium, but only when the home ticks the right boxes. Where those boxes aren’t met, they negotiate hard, or they simply walk away.

That’s why district headlines can look confusing this year. One district can show strong gains, while another looks flat or down — and it doesn’t always mean the district suddenly became “good” or “bad”. A lot of the movement is now driven by three very practical factors everyday buyers understand:

To make sense of it, it helps to stop treating “landed” as one big category. In reality, it’s three sub-markets that behave very differently: terrace, semi-detached, and detached. And in 2025, they are telling three different stories.

The map view: what’s up, what’s down (and why the heatmap matters)

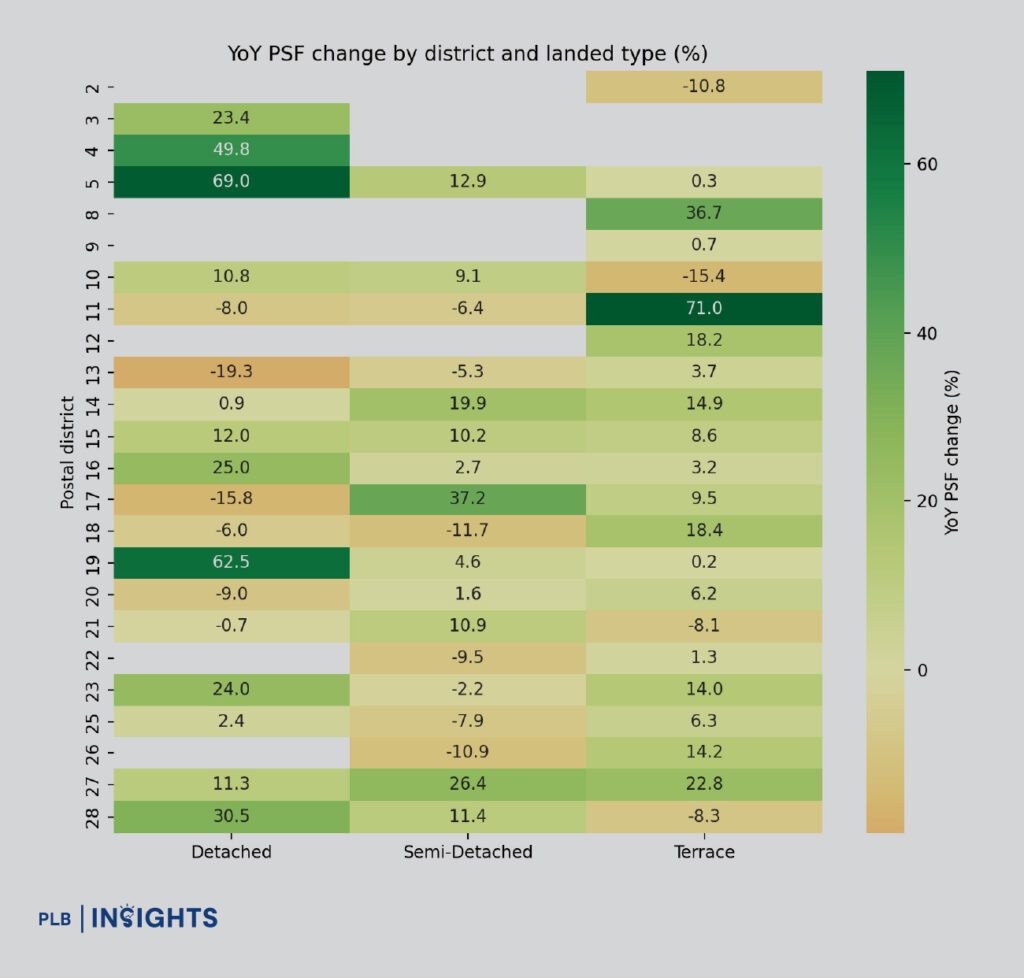

The simplest way to understand what’s happening in landed this year is to look at the heatmap by district and landed type (terrace / semi-detached / detached).

It shows two things at the same time:

In other words, you can’t just say “District X is down.” You have to ask: down for what — terrace, semi-detached, or detached? Because the answer can be totally different.

The key takeaway: 2025 isn’t a “landed crash” — it’s a “more picky buyers” year

When you see the heatmap, the big message isn’t that the market is slowing. It’s that the market has become more split. More clear winners and losers depending on:

This is exactly what you’d expect when budgets tighten and buyers become more careful. People are still buying but they’re buying more selectively.

The biggest shift in 2025: median prices are moving because what sold changed

One of the most important findings from the URA data drill-down is that in several “poor performing” districts, the median moved down not because every home got cheaper, but because the distribution of transacted homes shifted.

This is the difference between:

That distinction matters for anyone reading market signals—investors, developers, bankers and homeowners—because mix-driven median declines can reverse quickly when the transaction composition changes.

Terrace homes: the steadiest “family upgrade” segment

If there’s one landed segment that feels the most stable this year, it’s terraces. The reason is simple: terraces sit at the sweet spot for many buyers who want landed living but still need to stay within a reasonable budget. That buyer pool is bigger: families upgrading for more space, multi-generational households, people who want their own parking and privacy without jumping straight into detached pricing.

Because demand is broader, terrace transactions tend to be more consistent. That’s why, across districts, terraces generally show more steady performance with fewer “shock” drops.

Where terraces did especially well in 2025, it’s usually because of a powerful mix:

But terraces are not “up everywhere.” In a few premium or near-prime areas, the market is clearly showing price resistance. If sellers push prices too far beyond what buyers see as fair — especially compared to nearby alternatives — buyers don’t chase. They wait, negotiate, or shift to another pocket.

In simple terms: terrace demand is deep, but buyers are very focused on value-for-money now.

Semi-detached: the most “negotiation heavy” segment

Semi-detached is the segment where selectivity becomes most obvious.

Semis cost meaningfully more than terraces, but they don’t always have the same “rare trophy” feel that detached homes can carry. So buyers tend to compare semis very aggressively against alternatives:

This “in-between” position makes semis more sensitive to pricing, layout, and condition. When a semi is well-positioned, well-designed, and fairly priced, it can still perform very strongly. But if the home has compromises — awkward layout, heavy renovation, less attractive street — buyers push back hard.

That’s why semi-detached performance looks more patchy across districts. It’s not that buyers dislike semis. It’s that in 2025, they want semis to feel like a clear upgrade — not just “bigger than terrace” but still “not detached”.

In practical terms, semi-detached is the segment where sellers can’t rely on the market to carry them. Pricing right matters more here than anywhere else.

Detached: biggest upside — but also the biggest gaps

Detached homes produce the loudest headlines in 2025 because they are the most extreme in both directions. In some districts, detached PSF can jump sharply. In others, it can fall — even within the same year where the overall landed market feels “okay”.

This is because detached is a different game:

So when the “right” detached homes are transacted — good land, good streets, strong rebuild potential, prices can re-rate quickly. Wealthy buyers will pay for what is hard to replicate.

But when the year’s detached transactions lean toward less ideal plots or older homes, the numbers can swing down. Importantly, that doesn’t always mean demand is gone. It often means the quality of homes sold was different this year compared to last.

Detached in 2025 is basically this: buyers will pay up for the best and ignore the rest.

Districts with >50% y-o-y median PSF growth: what’s really going on

This “buyers are picky” market is also why 2025 can throw up some very eye-catching numbers. In the district-by-landed-type table above, there are only three district–type combinations that show more than 50% year-on-year growth in median price psf.

But before anyone reads that as “prices exploded” in those districts, there’s one key question to ask:

Did the whole market in that district truly get more expensive… or did the numbers jump because of what happened to transactions this year?

Because in landed — especially detached homes — a district’s median can swing wildly if:

Terrace, District 11 (Newton / Novena / Thomson fringe): “more expensive homes transacted”, not “everything got 70% pricier”

District 11 terraces didn’t suddenly become 70% more expensive across the board. The data is telling us the homes that transacted in 2025 skewed more premium than the homes that transacted in 2024 — and that pulls the median up.

This one is not a small-sample fluke. The number of transactions is basically the same (24 in 2024 vs 23 in 2025), so the result is meaningful.

What stands out is this: the higher end of the market (top quartile) moved up much more than the lower end.

In plain terms: 2025 saw more high-quality terrace homes transacting in District 11.

Think: “better” streets, more prime micro-pockets, newer rebuilds, more “move-in ready” stock. When more of these premium homes are the ones that transact, the median jumps even if the cheaper end didn’t move as much.

Detached, District 5 (Buona Vista / Pasir Panjang / Clementi fringe): “one deal moved the number”

This is not proof that District 5 detached homes surged across the board. It’s essentially a single-transaction effect, like judging the “average” price of a restaurant by looking at one bill.

This is the classic trap of reading landed stats without checking volume.

URA REALIS shows:

With numbers that small, the “median” is basically just the price of that one transaction. So if that single 2025 home was a rebuild, a better plot, a better street — the median will look like it “jumped” even though it’s not reflecting a district-wide change.

Detached, District 19 (Serangoon Gardens / Hougang / Punggol fringe): a real uplift, because the whole range strengthened

District 19 detached looks like a genuine strengthening. It’s not a “one deal” story, and it’s not only the top end. More of the market moved up.

This is the most credible “50%+” jump because the volume is healthy and stable: 18 transactions in 2024 vs 19 in 2025

More importantly, it wasn’t just the top end rising. Both the lower end and the upper end moved up, which suggests the increase is more broad-based, not just one trophy deal.

The breakdown also suggests that more prime enclaves within the district transacted in 2025, rather than the median being dominated by an outlier street.

What this means for buyers and sellers in the next 6–12 months

Here’s the most practical takeaway: district labels alone are no longer enough.

In 2025, pricing is being decided at the micro level: street by street, plot by plot, condition by condition.

If you’re a buyer

Don’t assume “hot district” = “good deal.” A district can print a big y-o-y jump simply because more premium homes transacted that year. Likewise, a district can look “down” because more older-condition homes transacted — not because the entire area suddenly weakened.

So the smart move is to compare:

If you’re a seller

This isn’t a market where you can just price high and wait for buyers to chase. Buyers are still paying strong prices but only for homes that are:

Terraces remain the most supported overall because the buyer pool is deepest. Semi-detached tends to be the most price-sensitive. Detached can still command premiums but only when the home is truly best-in-class.

Bottom Line

Singapore’s landed market in 2025 is still resilient — but it has become brutally selective. The market is not rewarding “landed” as a label anymore. It’s rewarding the right home, in the right micro-location, at the right price.

And that’s why the biggest shift this year isn’t whether landed is up or down — it’s that buyers are choosing carefully, and the winners are increasingly decided property by property, not district by district.

Stay Updated and Let’s Get In Touch

Should you have any questions, do not hesitate to reach out to us!