When a 1-bedroom loft in District 9’s Up@Robertson Quay was sold last month at a $403,000 loss, it raised eyebrows. After all, this is prime Singapore real estate: a District 9 address by the Singapore River, surrounded by dining, lifestyle, and within a short driving distance to Orchard Road and the CBD. And yet, despite its location, the condo has recorded 10 unprofitable transactions and only one profitable sale since its launch in 2012.

EdgeProp rightly highlighted some key reasons — an 18.5% decline in average PSF since launch, a unit mix of mostly compact 1- and 2-bedders, and stiff competition from neighbouring developments like Martin Modern and Riviere. But what else might explain why so many owners have struggled to exit profitably?

Let’s take a deeper look at other possible factors at play, and what lessons buyers and sellers can draw from this case study.

Loft Layouts: Attractive on Paper, Tricky in Practice

Loft units are often marketed with a premium. High ceilings, mezzanine spaces, and a sense of architectural novelty make them appealing at launch. Developers tend to price them higher on a PSF basis, knowing the “wow factor” will attract investors and younger buyers.

But here’s the catch: lofts do not always translate into functional living spaces. Ceilings in loft areas can be uncomfortably low, stairs eat into usable floor area, and layouts may feel awkward. For older buyers or families, stairs inside a compact apartment are more of a hassle than a lifestyle perk.

Resale buyers, who are often more practical and less swayed by marketing gimmicks, may discount such features. A loft that looked sleek in a showroom can become a white elephant in the secondary market.

Compact Unit Sizes Limit Resale Demand

With only 70 units, Up@Robertson Quay is a boutique project made up largely of 1- and 2-bedders, many under 1,000 sq ft. This unit mix tilts heavily toward investors and singles, rather than families.

At launch, investor appetite for small units was strong, especially during the early 2010s when shoebox and loft apartments were seen as an easy entry into prime districts. But investors eventually look to exit — and when most buyers in the resale pool are also investors, resale demand becomes thin.

Families, who tend to be more resilient buyers in downturns, generally prefer developments with larger units, family-friendly layouts, and stronger communal facilities. Without them, resale prices lack support during market shifts.

Shifting Tenant and Expat Dynamics

Robertson Quay has long been a magnet for expatriates, especially those who value riverside living and dining. For years, landlords could command solid rents from this tenant pool.

But the landscape has changed. Expat packages have slimmed down post-COVID, with fewer companies providing housing allowances at the same levels as before. Many tenants now choose city-fringe locations where they get more space for less rent.

For a development like Up@Robertson Quay, which leans heavily on rental demand to sustain investor interest, weaker rental prospects directly impact resale appetite. If landlords cannot achieve competitive yields, resale values eventually soften.

Leasehold Disadvantage in a Freehold-Dense Neighbourhood

One of the less obvious, but critical, factors is tenure. Within 500m of Up@Robertson Quay, there are 31 condos, but only five are 99-year leasehold. The rest are freehold or 999-year leasehold.

For buyers deciding between leasehold and freehold in the same neighbourhood, freehold often wins out, especially for longer-term stays or legacy planning. Unless a leasehold development offers exceptional facilities, scale, or price advantage, it will struggle to command buyer confidence.

This is exactly what happened here. Compared to larger, newer leasehold neighbours like Riviere and Martin Modern, which brought strong branding and sizeable facilities, Up@Robertson Quay appears less compelling as a resale proposition.

The Scale and Facilities Factor

Boutique projects like Up@Robertson Quay can feel exclusive initially, but the resale market tends to favour scale. Larger developments with hundreds of units usually offer more extensive facilities — gyms, pools, landscaped grounds, function rooms — and a stronger sense of community.

With only 70 units, Up@Robertson Quay’s facilities are understandably limited. For resale buyers comparing options in the same district, the appeal of larger developments often outweighs boutique exclusivity.

The lack of an MRT station within a short walk compounds this weakness. For small-scale projects, proximity to MRT is often the single most important draw. Without it, resale buyers see limited reasons to prioritise the development.

High Launch Prices Set Owners Up for Losses

Another important factor is the high entry prices at launch. Buyers who entered in 2012–2016 paid PSFs north of $2,500, reflecting both the novelty of loft layouts and the exuberant market sentiment at the time.

When the market corrected and broader District 9 prices stabilised around $2,000–2,300 psf, these buyers were locked into negative equity scenarios. Smaller units are particularly vulnerable, because premiums are magnified on a per-square-foot basis.

This means even modest declines in PSF can translate into large absolute dollar losses — just as we saw in the $403,000 shortfall for the 1-bedder loft.

Changing Buyer Preferences Post-Pandemic

The pandemic has reshaped what buyers look for. Home offices, larger kitchens, more storage, and efficient, flexible layouts are now top priorities.

Compact lofts, which rely on partitioned rooms and novelty design, don’t quite fit this bill. Buyers today want space that supports hybrid work and long-term family needs, not gimmicky layouts that sacrifice practicality.

A loft may look impressive on Instagram, but when buyers evaluate daily usability, many see limited value compared to more conventional apartments of similar size.

Market Psychology: A Reputation Trap

Another overlooked factor is market psychology. When a development racks up repeated unprofitable sales, it gains a reputation that sticks.

Savvy buyers comb transaction records and use them as negotiation leverage. If most sellers at Up@Robertson Quay lost money, new buyers are likely to push harder for discounts, perpetuating the cycle of weak resale performance.

In contrast, developments like Martin Modern and Riviere have built reputations for profitable exits, which attracts more confident buyers and sustains higher resale benchmarks.

Strategic Lessons for Buyers and Sellers

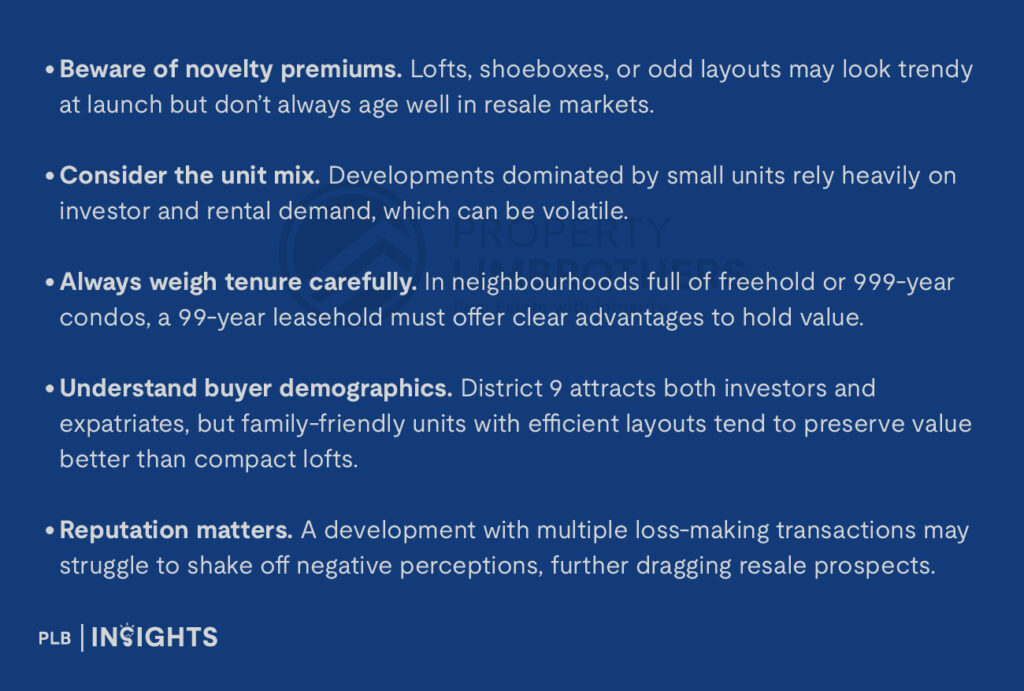

The case of Up@Robertson Quay offers several takeaways:

Conclusion

The $403,000 loss at Up@Robertson Quay isn’t just about a single unlucky transaction. It reflects a mix of factors — from loft layouts with limited practical appeal, to a tenant pool that has shifted, to stiff competition from nearby freehold and larger-scale developments.

Most importantly, it underscores a key truth in Singapore’s property market: not all prime addresses guarantee strong capital preservation. Buyers need to look beyond location and marketing appeal, and instead assess long-term fundamentals — unit mix, tenure, functionality, and neighbourhood competition.

For sellers, the lesson is just as clear: pricing strategy and timing are everything, especially when past transaction records weigh heavily on buyer perception.

As always, the smart move is not just to buy into a property, but to buy into a property that future buyers will also want.

If you’re considering a purchase or sale in Singapore’s prime districts, it pays to look beyond glossy brochures and headline locations. Our team of consultants can help you assess the fundamentals — from unit mix to resale track record — and chart the best strategy for your property journey. Click here to get in touch with our sales consultants.