When it comes to landed homes in the East, few names carry as much weight as District 15 (D15). Encompassing Katong, Joo Chiat, and East Coast, it has long been regarded as the benchmark for prestige — a district where sea-view bungalows, heritage shophouses, and cafe enclaves shape its cultural fabric.

In last week’s series, we looked at how Districts 14 and 16 — often seen as the younger siblings — are quietly carving their own place in the market with their accessibility and liquidity. This week, we place District 14 side by side with District 15, to see how the challenger stacks up against the elder statesman of the East’s landed market.

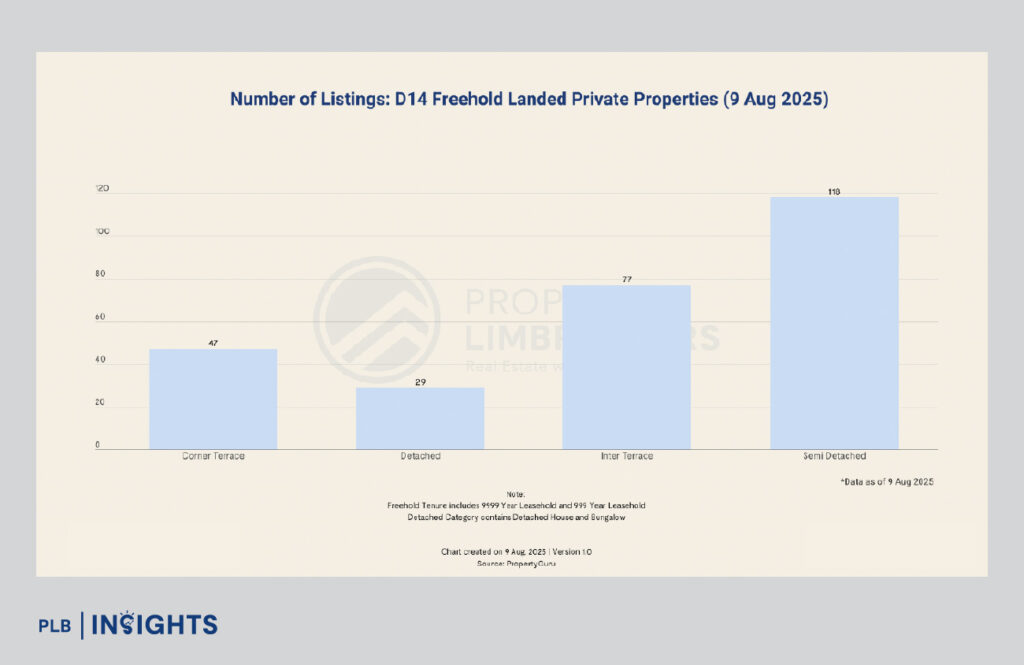

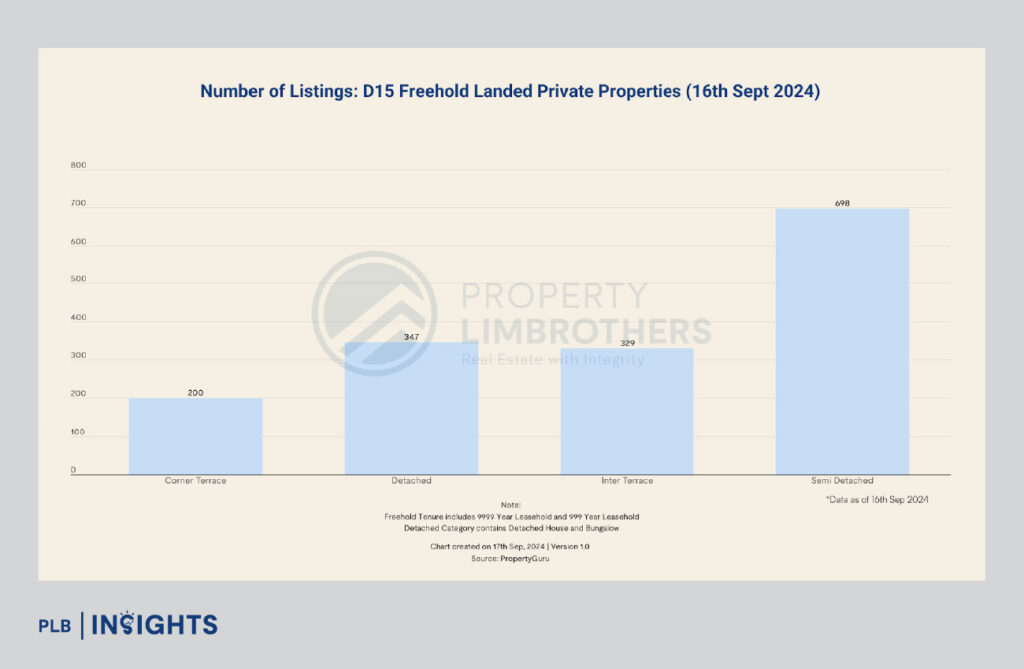

This article examines how these two districts compare in terms of pricing, inventory, liquidity, and long-term growth, drawing on data from 2015–2025 YTD as well as recent inventory snapshots from August 2025 (D14) and September 2024 (D15). The picture that emerges is one of duality: D15 as the prestige benchmark, and D14 as the pragmatic alternative.

Location and Identity: The Benchmark vs The Challenger

District 15

D15’s identity is defined by its heritage and prestige. Landed enclaves here enjoy proximity to East Coast Park, established lifestyle hubs, and top schools such as Tao Nan, CHIJ Katong, and Victoria School. Its cultural depth — from Peranakan shophouses to a thriving cafe scene — makes it a perennial favourite among families and high-net-worth buyers seeking a blend of lifestyle and legacy.

District 14

D14, on the other hand, is positioned as a city-fringe contender. It combines the vibrancy of Geylang and Telok Kurau with the suburban charm of Kembangan and Eunos. Connectivity is its standout feature: Eunos and Kembangan MRT stations sit along the East-West Line, Ubi is on the Downtown Line, and major roads such as Sims Avenue and Changi Road provide seamless access to the CBD and Changi. Paya Lebar’s ongoing transformation into a decentralised commercial hub further strengthens D14’s long-term proposition.

In essence, D15 is about prestige and lifestyle heritage, while D14 is somewhat more about practicality and accessibility.

Market Fundamentals: Growth vs Resilience

District 14

From 2015 to 2025 YTD, landed homes in D14 recorded a compound annual growth rate (CAGR) of 4%, slightly below the OCR average of 5%. Semi-detached homes led growth with a CAGR of 4.8%, followed by detached at 4.3% and terraces at 3.2%. Between June 2024 and June 2025, D14 recorded 76 landed transactions, reflecting steady demand despite broader headwinds such as rising rates and cooling measures.

District 15

Over the same 2015 to 2025 YTD period, D15 outpaced D14 with a CAGR of 5.3%, driven largely by Detached and Inter-Terrace segments. Transaction volumes are significantly higher compared to D14, though liquidity varies sharply across categories — some segments move briskly, while others are weighed down by oversupply.

The Contrast: D15 has historically delivered stronger capital gains, but D14 demonstrates steady resilience and an affordability story that appeals to long-term holders.

Inventory Snapshots: August 2025 (D14) vs September 2024 (D15)

District 14 (as of August 2025)

District 15 (as of September 2024)

The Contrast: D15’s sheer depth of inventory comes with high price tags and slower turnover in premium brackets, while D14 offers more approachable quantum levels and a balance between accessibility and exclusivity.

Liquidity and Absorption Ratios

Liquidity reveals whether a district’s homes are being transacted at a healthy pace.

District 14 (June 2024 – June 2025)

District 15 (as of September 2024)

The Contrast: D14’s liquidity is healthier in the entry and mid-tier segments, while D15’s prestige homes often trade slowly.

Pricing and Quantum Distribution

District 14 (as of August 2025)

District 15 (as of September 2024)

The Contrast: D14 caters to upgraders and younger families with mid-tier affordability, while D15 is firmly positioned in the luxury bracket.

Outlook: Benchmark vs Challenger

Framing these two districts side by side, it’s less about elder and younger siblings and more about benchmark versus challenger.

D15 — The Benchmark of Prestige: Established, cultural, and highly desirable. But premium price points and slow-moving segments may not suit every buyer.

D14 — The Challenger of Pragmatism: Resilient, accessible, and balanced. Its growth may be steadier, but its liquidity and affordability story make it attractive for younger families and long-term holders.

Conclusion: Two Different Stories, One Common Thread

District 15 will likely remain the East’s benchmark for prestige, its reputation deeply entrenched by heritage and lifestyle. But District 14 is no longer just a fringe alternative. With steady growth, stronger liquidity in mid-tier segments, and approachable pricing, it offers a different pathway into landed living — one that is pragmatic, resilient, and quietly compelling.

In the end, both districts share one critical truth: landed homes remain structurally scarce, making either choice a long-term asset class with enduring value. The real question is whether buyers prefer prestige at a premium (D15) or balance at a practical entry point (D14).

Whether you’re considering prestige in D15 or pragmatism in D14, our team is here to help you make the right move — contact our consultants today.

Thank you for reading, and stay tuned! For more detailed insights regarding the landed property market, join our Landed VIP Club and stay updated with the latest market trends and expert advice.