The Federal Reserve has reduced interest rates by 0.25 percentage points in response to growing concerns about the US labour market and economic slowdown.

While the rate cut aims to stimulate growth in the US, its effects are being felt globally, including in Singapore. For the island nation, the latest Fed actions have significant implications for the housing market, labour market, and overall economic trajectory.

Housing Market: Lower Borrowing Costs, Limited Impact

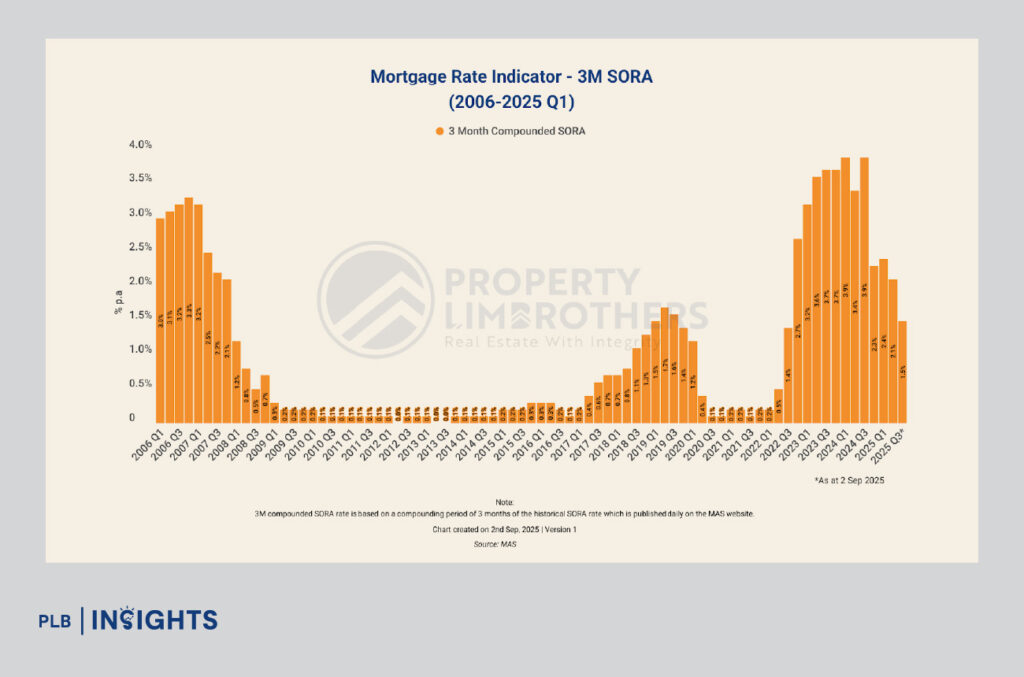

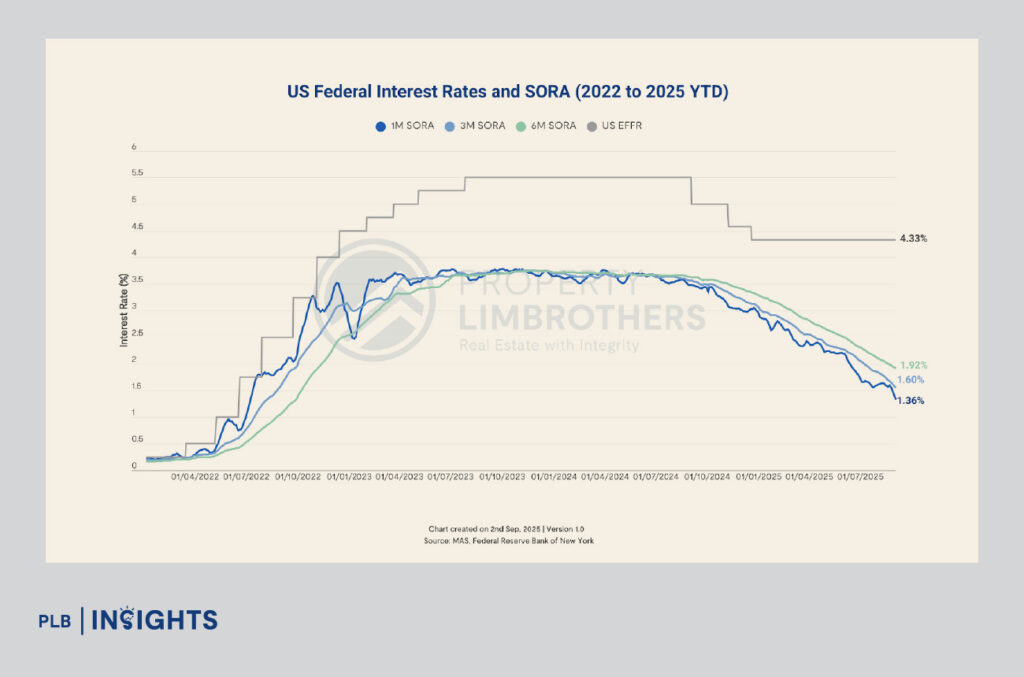

The Fed’s rate cut is expected to influence global borrowing costs, including Singapore’s SORA (Singapore Overnight Rate Average), which has already been trending downward. As of 18 September, the 1-month compound SORA stands at 1.3033%, the 3-month at 1.5036%, and the 6-month at 1.8402%. These rates are relatively low and may continue to decline in response to the Fed’s actions.

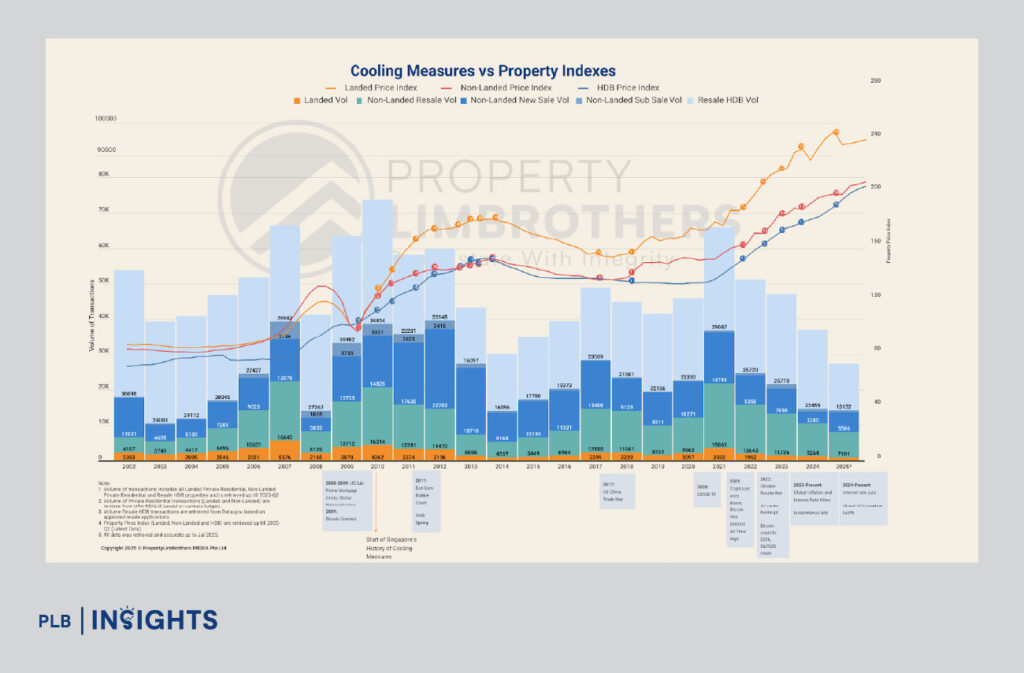

For the housing market, lower borrowing costs could make mortgages more affordable, particularly for those with loans linked to SORA. This might stimulate some demand, especially in the more affordable segments of the market. However, Singapore’s real estate market remains largely stable due to government cooling measures. Even with the potential for cheaper loans, significant price increases are unlikely, as policies such as the Additional Buyer’s Stamp Duty (ABSD) and tightened loan-to-value (LTV) ratios continue to keep the housing market in check.

Labour Market: Rising Unemployment Among Younger Workers

While Singapore’s overall unemployment rate remained stable at 2% in June 2025, there has been a concerning rise in unemployment among residents under 30. The unemployment rate for this age group increased to 5.7%, up from 4.8% in the previous quarter. This trend highlights challenges faced by younger workers entering the job market, including increased competition for roles and potential skill mismatches.

The Fed’s rate cut may indirectly affect Singapore’s labour market. While lower borrowing costs could encourage business investment, the global economic slowdown may dampen demand for Singapore’s exports, particularly in sectors like electronics, pharmaceuticals, and logistics. This could lead to slower hiring in these industries, affecting job opportunities for younger workers.

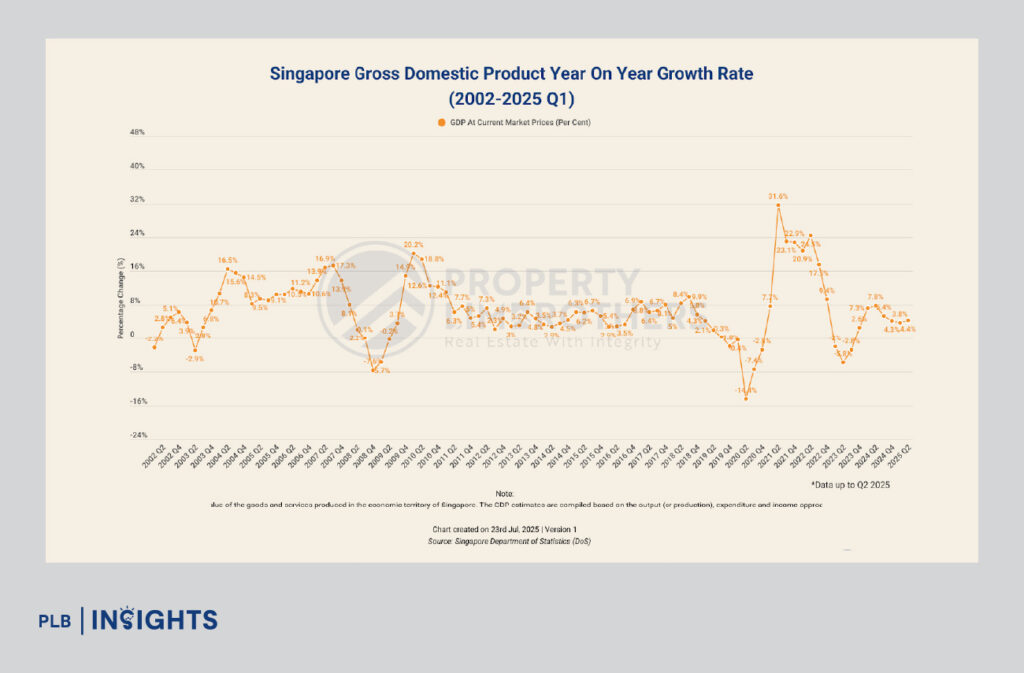

Economic Growth: Modest Outlook Amid Global Uncertainty

Despite the Fed’s rate cut, Singapore’s GDP growth forecast remains modest, with projections for 2025 at around 1.5% to 2.5%. The global economic slowdown, particularly in key markets like the US and China, poses challenges for Singapore’s export-driven economy. While lower borrowing costs may stimulate investment, the overall economic recovery is likely to be slow.

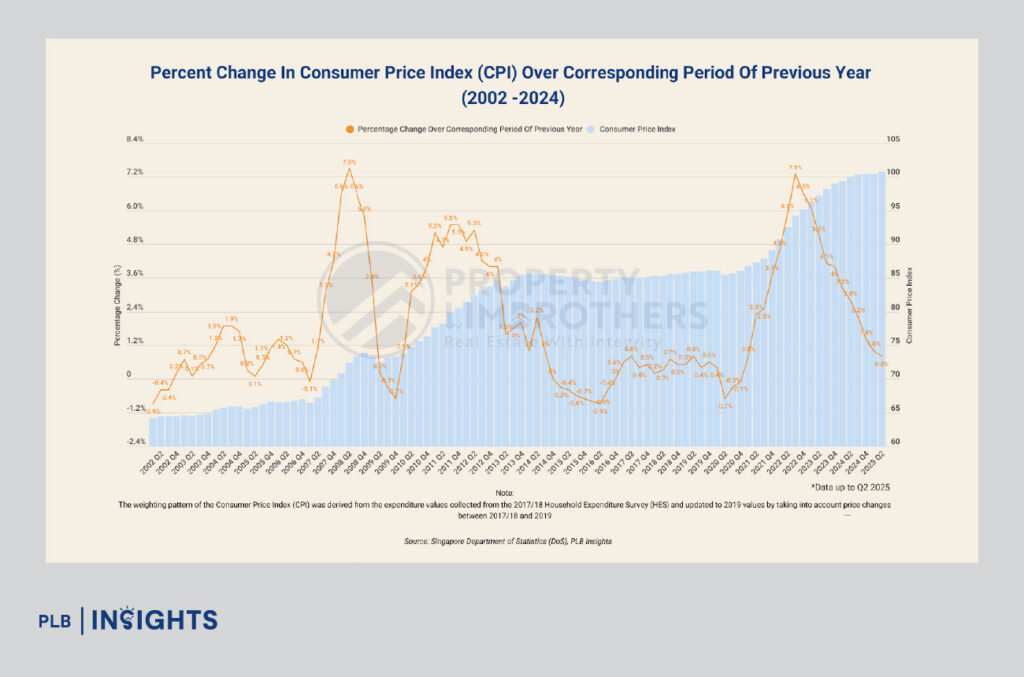

Inflation concerns also persist, with rising costs in housing and essential goods potentially affecting consumer spending. The Monetary Authority of Singapore (MAS) will need to carefully balance monetary policy to support growth while managing inflationary pressures.

SORA’s Path Forward: What to Expect

Given the recent Fed rate cut and the prevailing global economic conditions, SORA rates are likely to continue their downward trajectory in the near term. For borrowers, this could mean lower mortgage rates, providing some relief. However, the pace of decline may be more gradual compared to previous periods, and borrowers should remain cautious of potential fluctuations.

Impact on Singapore’s Housing Market: What the Fed’s Rate Cut Means

Let’s break down the potential implications for Singapore’s housing market.

Cheaper Borrowing Costs for Homebuyers

A key effect of the Fed’s rate cut on Singapore will be the likely decrease in SORA rates in the near future. Since SORA influences the rates for floating-rate loans in Singapore, a reduction in SORA could lower mortgage rates.

For homebuyers, this presents an opportunity to secure cheaper financing, particularly for those with loans tied to SORA, such as home loans with floating interest rates.

With more affordable loans, this will likely incentivise buyers who waited at the sideline to enter the market, especially first-time buyers who may find housing more within reach. Lower borrowing costs would help ease the financial burden, potentially boosting demand for housing in the short term.

Limited Impact on Property Prices

However, while lower rates may prompt more buyers to enter the market, the cooling measures in place by the Singapore government are likely to keep property prices from experiencing any dramatic increases. Measures like the ABSD and tighter LTV limits have already kept price growth in check, and they will likely continue to temper demand for more speculative buying.

For the luxury property market, lower borrowing costs may attract foreign investors who see Singapore as a safe haven amidst regional economic uncertainties. This could contribute to price resilience in high-end properties, though price gains are expected to be moderate overall, especially with the current 60% ABSD in place for foreigners.

Price Stabilisation in the Mass Market

In the mass-market segment, the impact of lower interest rates may be more noticeable. For many buyers who are sensitive to mortgage rates, cheaper loans could ease the financial stress of purchasing a home, particularly in the Outside Central Region (OCR).

Potential for Increased Investment in Property

In addition to lower interest rates making mortgages more affordable, the Fed’s actions could spur more real estate investment, especially in sectors like residential and commercial properties. When borrowing costs remain low, developers are more inclined to move forward with new projects. This could increase supply coming into the market and potentially spur institutional transactions.

Global Economic Factors and Singapore’s Property Demand

Although the Fed’s rate cut may lower borrowing costs, the broader global economic slowdown remains a concern. Lower demand for exports, especially from key partners like the US and China, could weaken Singapore’s economy. With unemployment rates rising among younger workers and economic uncertainty, the rental market could also face pressure if fewer people are able to afford to buy homes or rent larger properties. Economic factors will still play a dominant role in shaping the overall market conditions, particularly in the rental and mass-market housing sectors.

A Mixed Outlook for Singapore’s Housing Market

While the Fed’s rate cut is likely to provide some short-term relief to Singapore’s housing market by lowering borrowing costs, the overall market will likely remain stable. The cooling measures in place will ensure that any price increases are moderate. Foreign investment may continue to drive the luxury property market, but broader demand across other segments may be more subdued.

With SORA rates expected to decline further, homebuyers may benefit from cheaper loans, but the underlying market forces — including economic uncertainties and government policies — will keep the market from seeing any sharp price fluctuations. Ultimately, stability rather than a sharp upturn will define Singapore’s housing market in the near future.

Stay Updated and Let’s Get In Touch

Our goal is to provide you with relevant insights. Should you have any questions, do not hesitate to reach out to us!