District 14 (D14)—covering Kembangan, Eunos, Geylang, and Paya Lebar—has always stood out as a city-fringe address where heritage meets modernity. While neighbouring districts like D15 and D16 often dominate the spotlight, D14’s landed enclaves quietly deliver a compelling case for buyers who value freehold tenure, connectivity, and long-term wealth preservation.

This article takes a deep dive into the landed property market in D14, examining transaction volumes, price trends, absorption ratios, and inventory dynamics between June 2024 and August 2025. The findings highlight a market defined by its resilience, diversity, and strong holding power among homeowners.

Why D14? Location, Character, and Connectivity

D14 is unique in that it blends the vibrancy of heritage-rich Geylang and Telok Kurau with the suburban charm of Kembangan and Eunos. Within the district, landed enclaves such as Jalan Senang, Jalan Selamat, Lengkong, and Jalan Grisek remain tightly held, reflecting the long-standing appeal of freehold ownership.

Connectivity is another defining factor. Eunos and Kembangan sit along the East-West MRT Line, while Ubi is on the Downtown Line. Major roads like Changi Road and Sims Avenue provide quick access to the Central Business District (CBD) and Changi. On the lifestyle front, residents enjoy everything from authentic hawker fare at Geylang Serai to shopping at Paya Lebar Quarter (PLQ) and outdoor access via the Park Connector Network.

Schools such as Haig Girls’ School, Geylang Methodist, and Kong Hwa Primary add to the district’s family appeal, anchoring strong demand for homes within 1 km of these institutions.

Market Fundamentals: Resilient and Enduring

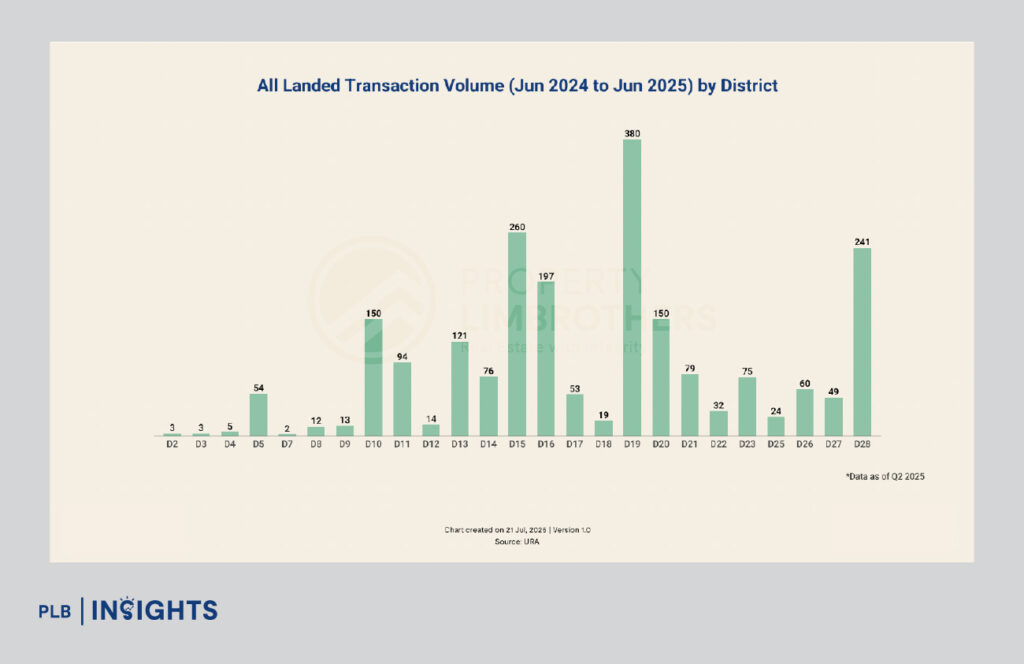

Despite broader headwinds—rising interest rates, higher mortgage costs, and tighter cooling measures—D14 recorded 76 landed transactions between June 2024 and June 2025, reflecting steady demand compared with other city-fringe districts.

Freehold tenure remains a cornerstone of the district. Nearly all landed stock in D14 is freehold, reinforcing its scarcity value and making it attractive for long-term holders. From 2015 to 2025 YTD, landed homes in D14 achieved a compound annual growth rate (CAGR) of 4%, slightly below the Outside Central Region (OCR) average of 5% but nonetheless consistent and resilient.

Semi-detached homes were the best-performing category with a CAGR of 4.8%, followed by detached homes at 4.3% and terraces at 3.2%. This reflects strong upgrader demand for mid-tier landed options, coupled with scarcity-driven value at the top end.

Inventory Snapshot: August 2025

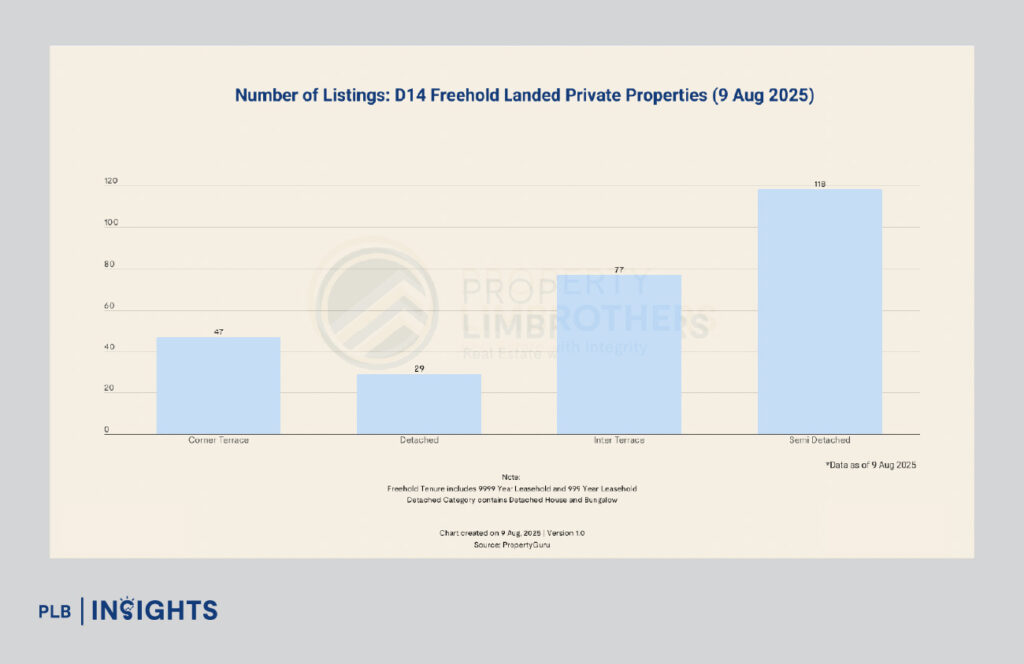

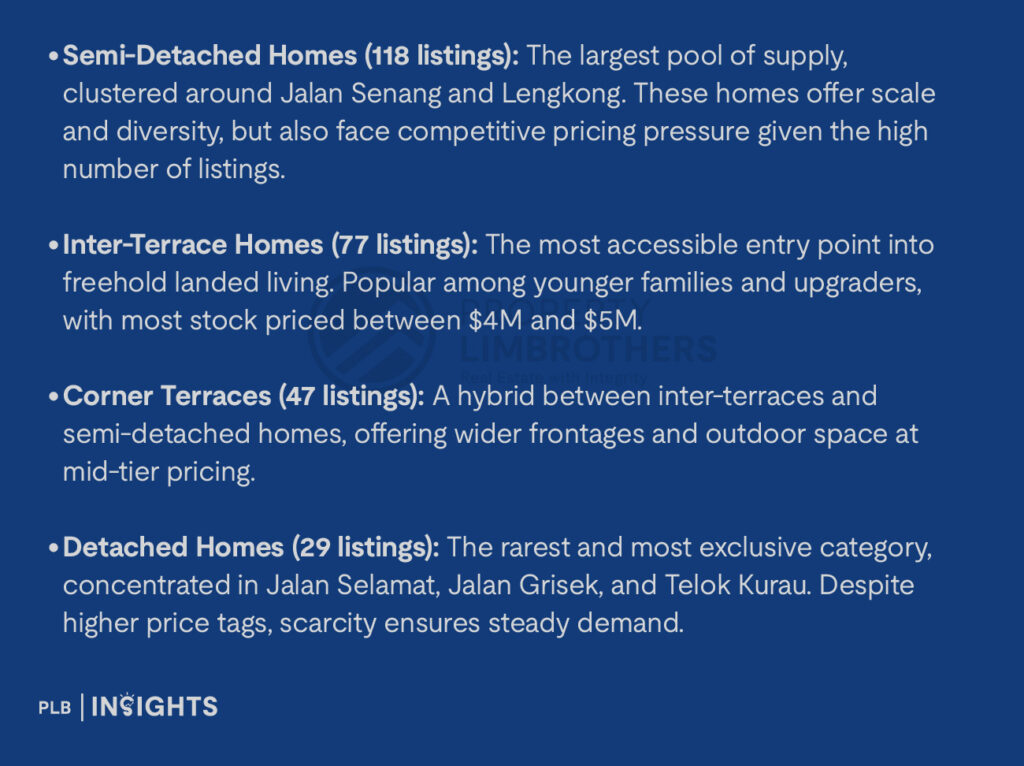

As of August 2025, D14’s landed market displayed clear segmentation:

Together, semi-detached and inter-terraces make up nearly three-quarters of inventory, underlining the district’s orientation toward family living with scalable entry points. Detached homes, while limited, represent the pinnacle of exclusivity.

Quantum Distribution: Pricing Anchors Across Segments

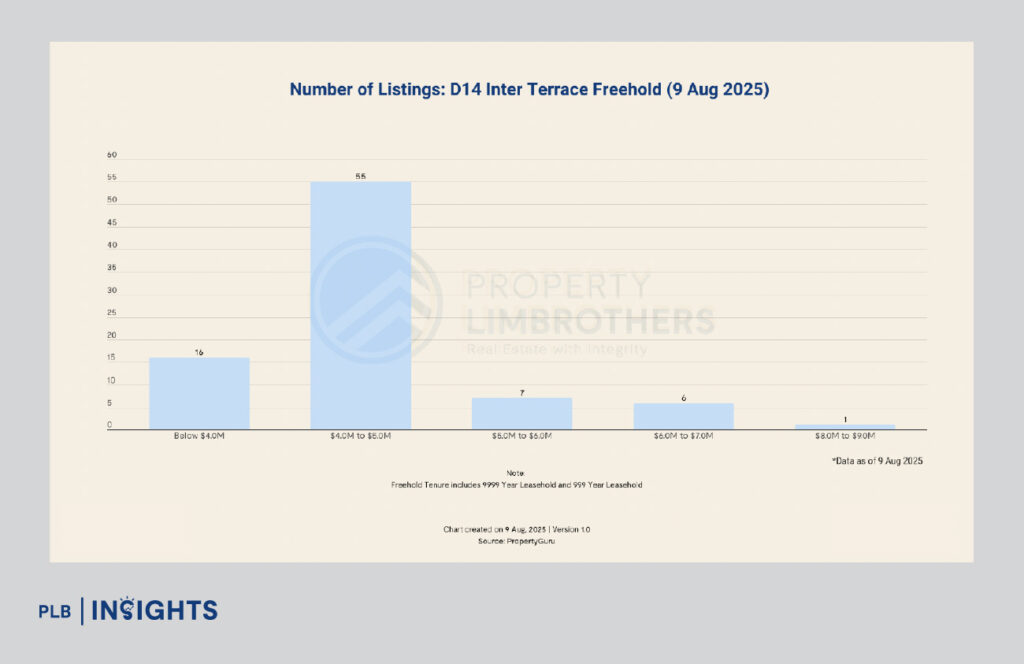

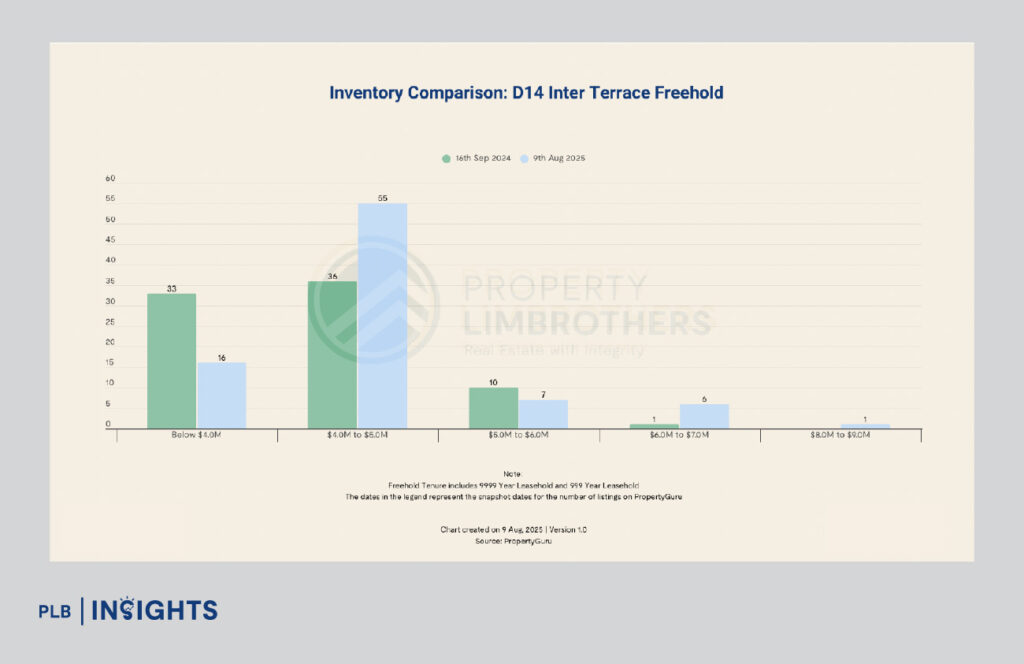

Inter-Terraces

The heartbeat of D14’s affordability story, inter-terraces are anchored in the $4M–$5M range, which accounts for over 70% of listings. A smaller number fall below $4M, serving as entry-level opportunities, while listings thin out rapidly above $6M. The lack of high-quantum stock underscores strong holding power among owners of redeveloped inter-terraces.

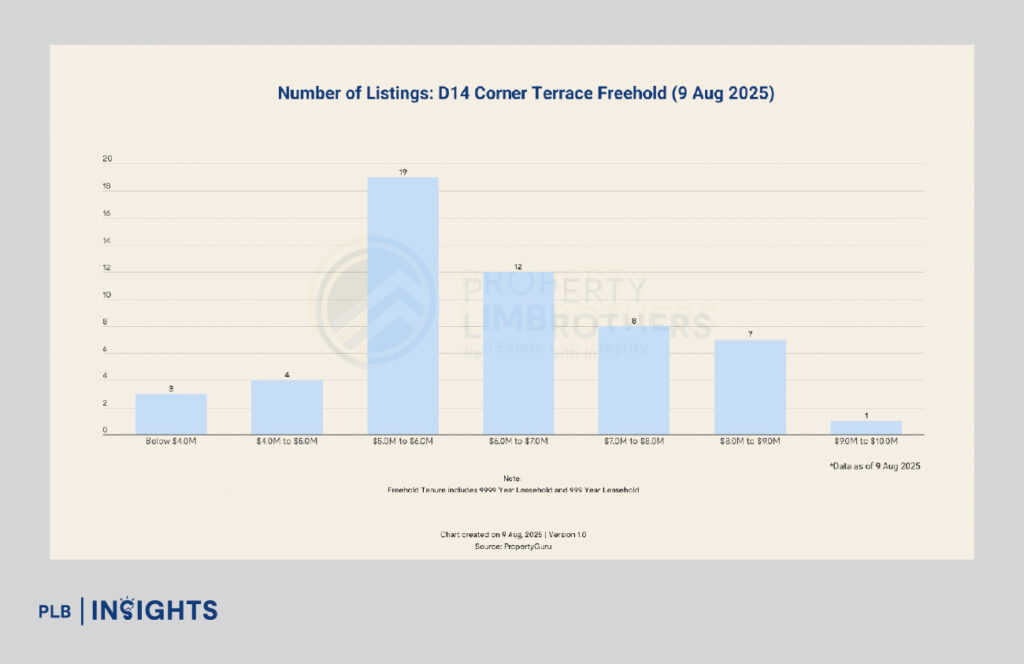

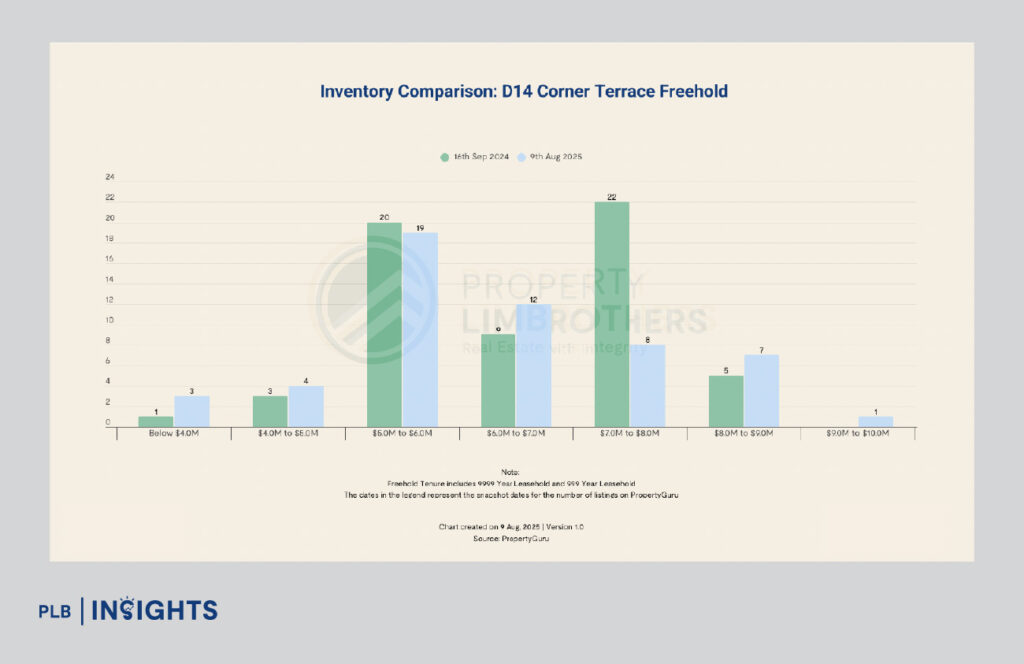

Corner Terraces

The bulk of corner terrace inventory lies in the $4M–$5M band, positioning them as a natural step-up from inter-terraces. Limited affordability below $4M reflects their premium over inter-terraces, while only a handful of listings breach $9M.

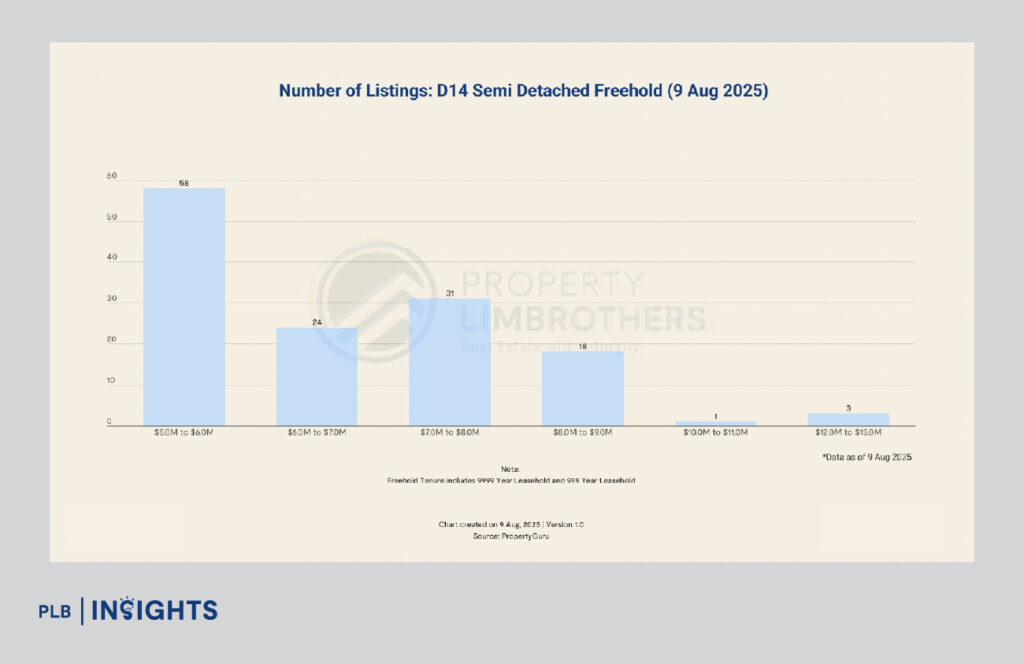

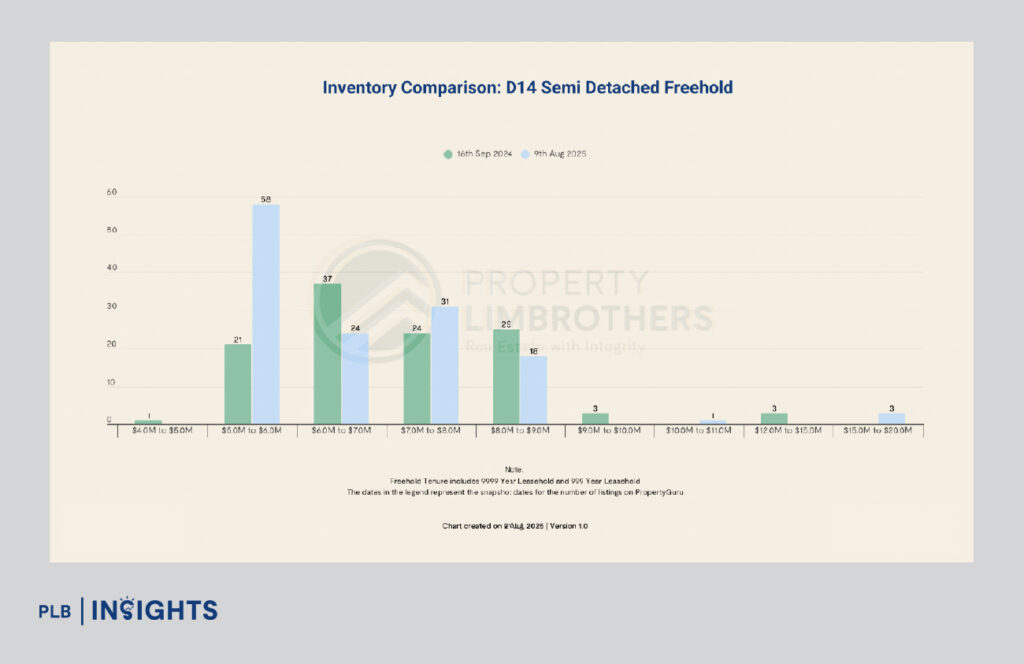

Semi-Detached Homes

With 135 listings, semi-detached homes form the backbone of D14’s landed segment. Nearly half fall in the $5M–$6M range, cementing this band as the core anchor. Another 55% are distributed between $6M and $8M, showing healthy mid- to upper-tier depth. At the very top, only a few listings cross $12M, highlighting scarcity and holding power.

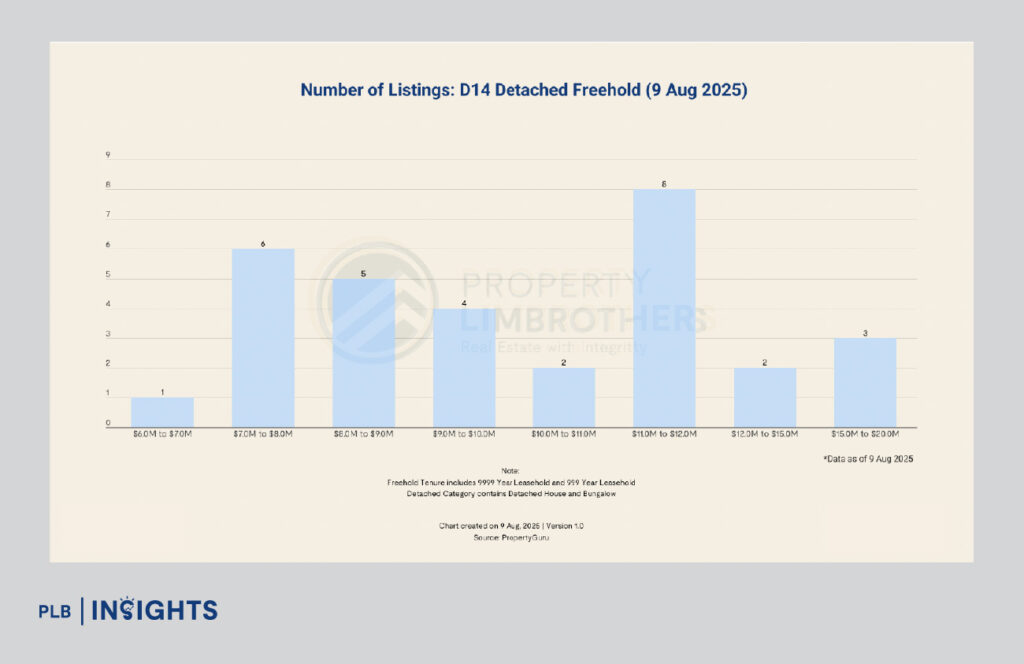

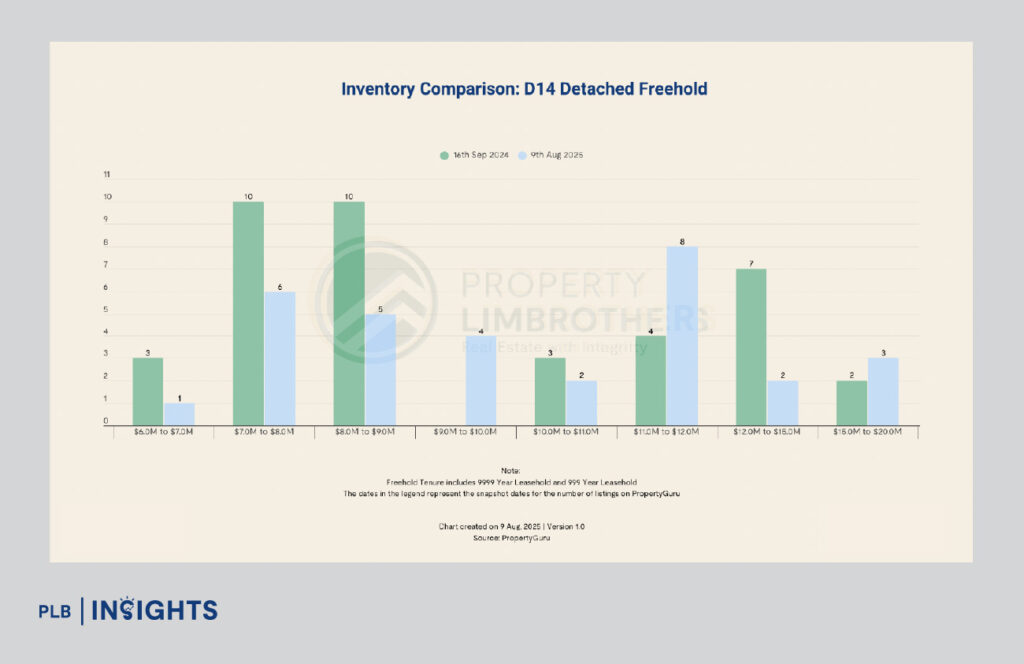

Detached Homes

The rarest category displays a balanced spread, with most activity in the $7M–$12M range. The $11M–$12M band is the strongest cluster, while ultra-luxury homes above $15M remain extremely limited. Entry-level detached options below $7M are almost non-existent, reinforcing exclusivity.

Liquidity and Absorption Ratios

Absorption ratios provide critical insights into demand-supply dynamics:

Terraces (Inter + Corner)

139 listings, 35 transactions: 4.0 months absorption. Liquidity is healthy, with strong demand concentrated in the $4M–$6M range.

Semi-Detached

134 listings, 12 transactions: 11.2 months absorption. This is the slowest segment, as elevated supply at $5M–$6M has given buyers greater bargaining power.

Detached

29 listings, 5 transactions: 5.8 months absorption. Faster than semi-detached, reflecting steady demand at the $7M–$12M quantum.

Price Growth and Market Drivers

From 2015 to 2025 YTD, D14’s landed homes collectively grew at 4% CAGR. Key drivers include:

The takeaway: terraces remain the most liquid, semi-detached homes face near-term oversupply pressures, while detached homes hold their ground due to scarcity.

PLB Landed Framework: Categories 1 to 4

D14’s pricing bands align closely with the PLB Landed Framework:

This segmentation ensures that buyers across different budgets and renovation appetites can find viable options within the district.

Market Implications and Investment Outlook

Terrace Homes

The most efficient entry point into freehold landed living in D14. Strongest liquidity is in the $4M–$6M band, with limited stock below $4M absorbed quickly. Inter-terraces cater to first-time landed buyers, while corner terraces offer wider plots at mid-tier quantum.

Semi-Detached Homes

The core of D14’s landed market, but absorption has slowed due to oversupply. Buyers have leverage here, while sellers need to adopt competitive pricing and highlight A&A/redevelopment potential to stand out.

Detached Homes

A niche but resilient segment. Though transaction volumes are modest, demand remains focused on the $7M–$12M range, where homes are relatively attainable compared with prime-core districts. Their rarity ensures long-term preservation value and redevelopment appeal.

Conclusion: D14’s Balanced Proposition

District 14’s landed market is defined by resilience and quiet strength. While its pace of growth has been steady rather than spectacular, it offers buyers a unique proposition—heritage-rich enclaves that combine freehold tenure, strong connectivity, and an evolving lifestyle landscape. The presence of schools, MRT links, and commercial transformation around Paya Lebar reinforces the district’s family-oriented appeal, while scarcity ensures that value is preserved across every segment, from inter-terraces to detached homes.

What makes D14 compelling is not a single defining feature, but the balance it strikes between accessibility, diversity, and exclusivity. Inter-terraces provide an affordable entry into freehold landed living, semi-detached homes give families scale and options, and detached homes embody the pinnacle of rarity and prestige. Together, they create a market that remains attractive to both upgraders and long-term holders.

As Singapore’s landed stock remains structurally scarce, D14’s blend of heritage character and city-fringe convenience will continue to anchor its position as a district where homes are more than residences—they are enduring assets for the generations to come.

If you’re considering a landed home in District 14—or simply want expert guidance on navigating Singapore’s landed market—our PLB consultants are here to help. Get in touch with us today to explore the right opportunities tailored to your needs.

Thank you for reading, and stay tuned! For more detailed insights regarding the landed property market, join our Landed VIP Club and stay updated with the latest market trends and expert advice.