In this week’s #AskPLB, we’re tackling a burning question from our readers—how does the future Government Land Sale (GLS) in Telok Blangah affect nearby condo prices, especially for a freehold 2-bedroom + study unit? And the best time to sell for maximum gains — when the new project just got launched or after the new launch attains its Temporary Occupation Period (TOP)?

With GLS sites launching regularly, market dynamics are constantly evolving. If you’re a homeowner wondering how to time your sale strategically, here’s what you need to know.

A new GLS site has just been announced near your condo—does that mean property values will rise, and if so, when’s the right time to sell? While there’s no foolproof formula, past trends and key market factors can offer valuable insights.

In this article, we’ll break down a real-life case study and explore how GLS cycles impact condo prices. But one thing’s certain—chasing the ‘perfect’ timing is risky. Instead, understanding market fundamentals is your best bet to make a well-informed decision. Let’s dive in!

‘Case In Point’ Example

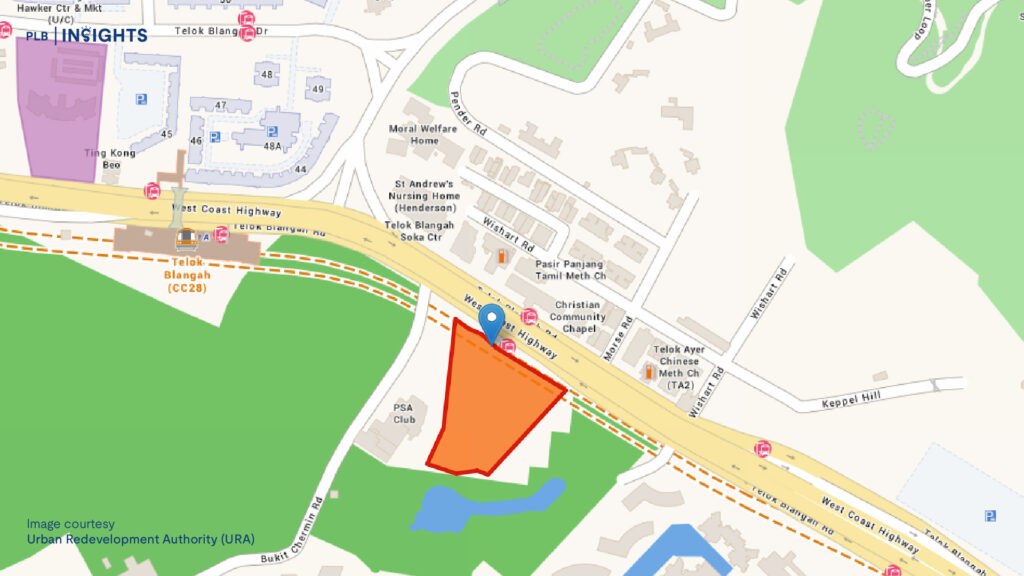

Our case study focuses on a freehold 2-bedroom, 2-bathroom unit in the Telok Blangah region, a specific query from one of our readers.

To illustrate key market trends, we’ll analyse a 2-Bedroom + Study, 2-Bathroom unit at The Foresta @ Mount Faber, a freehold condo situated near the upcoming Telok Blangah GLS site, which is slated for bidding in June 2025. By examining this example, we’ll explore how new GLS launches can influence property values and when might be the ideal time to sell.

Price Trends of 2-Bedroom + Study units at The Foresta @ Mount Faber

First, let’s explore the pricing trend for a 2B2B at The Foresta @ Mount Faber.

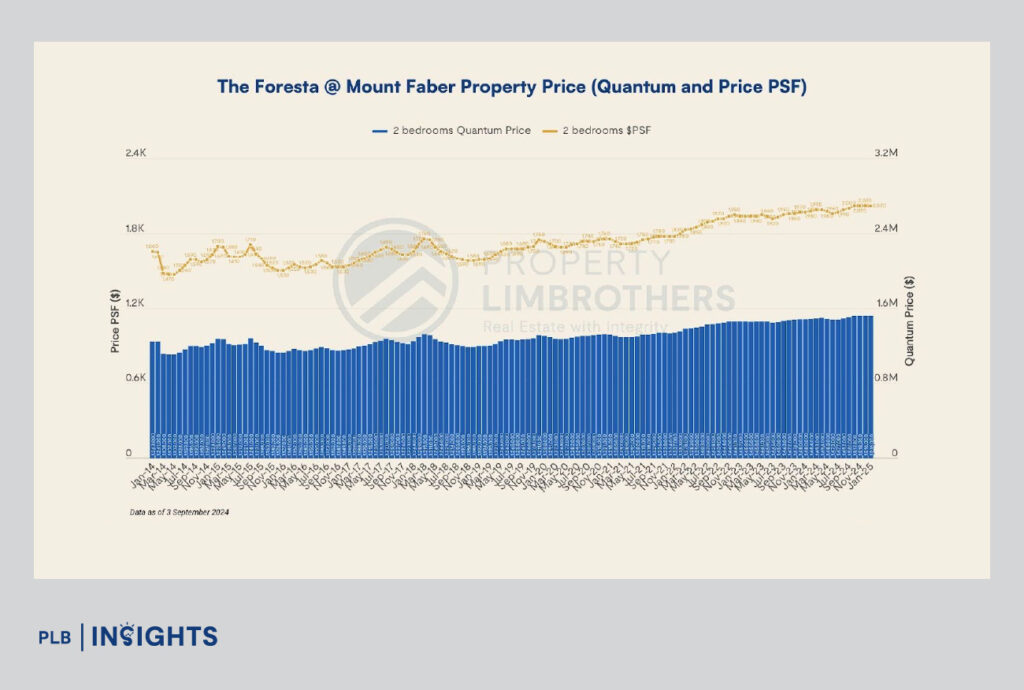

The price trajectory of 2-bedroom + Study units at The Foresta @ Mount Faber over the past decade reveals a steady upward trend, punctuated by periods of stagnation and market-driven fluctuations.

Between 2014 and 2018, prices remained relatively stable, with some fluctuations. This was largely due to government cooling measures and the market’s adjustment to earlier GLS sites in Telok Blangah coming to market. During this period, price PSF prices ranged between approximately $1,580 and $1,660, reflecting a more muted price appreciation compared to the strong growth seen in later years.

From 2020 onwards, a strong upward trend emerged. The price surge coincided with a low-interest rate environment, heightened demand during the pandemic-driven property boom, and the enduring appeal of freehold properties in the RCR. As seen in the chart, price PSF values steadily climbed from around $1,740 in early 2020 to over $2,020 by the end of 2024, while quantum prices also followed an upward trajectory, exceeding average $1.5 million for a 2-bedroom, 2-bathroom unit .

This trend suggests that freehold properties in well-located areas like Telok Blangah remain highly resilient. With the upcoming GLS site in June 2025, the area is poised for further revitalisation, new pricing benchmark, and therefore potentially supporting price appreciation in the mid-to-long term.

However, market conditions, new supply, and macroeconomic factors will ultimately influence whether prices continue their upward trajectory at the same pace.

Will This Freehold Condo Appreciate? Key Factors to Watch

With the Telok Blangah GLS site launching in June 2025, the potential price appreciation of this 2-bedroom + Study unit at The Foresta @ Mount Faber is worth evaluating. Several key factors influence its capital appreciation, from the GLS site’s impact on market dynamics to broader economic conditions.

1. Price Appreciation Potential from the Upcoming GLS Site

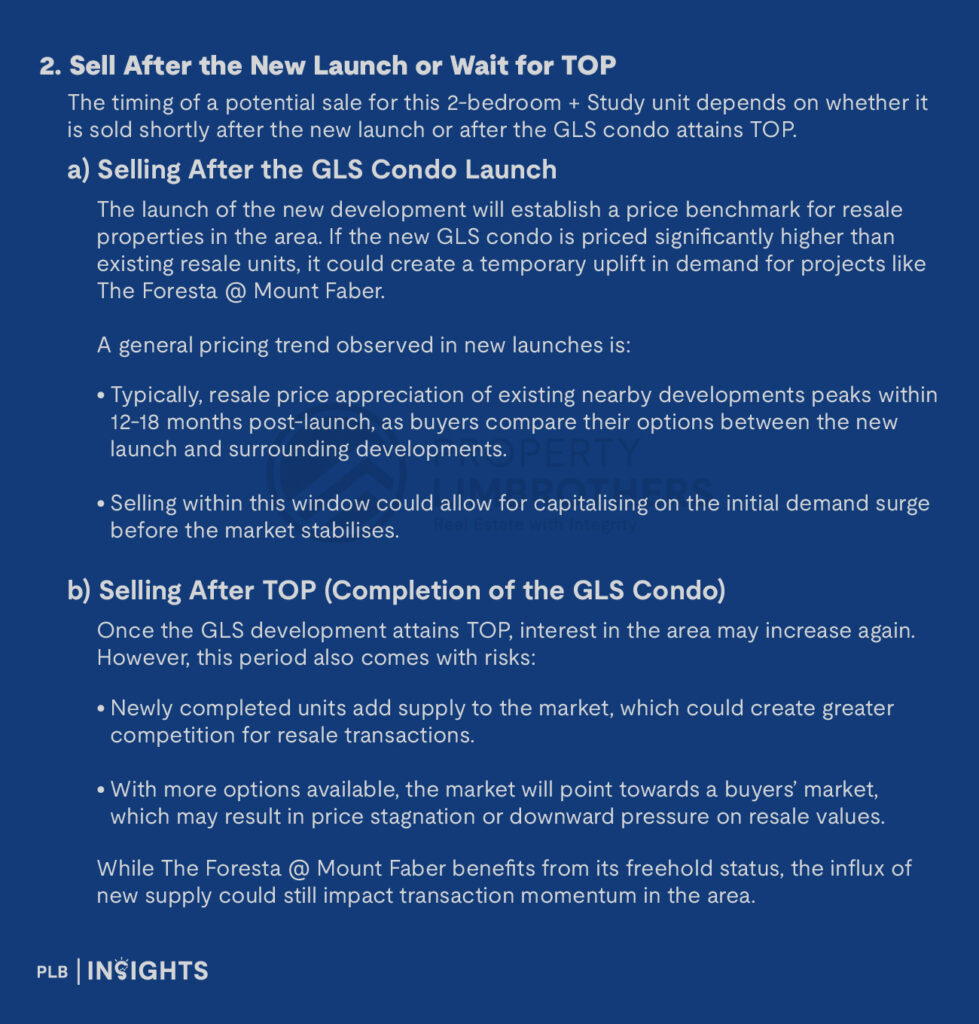

2. Sell After the New Launch or Wait for TOP

3. Broader Market Considerations

Key Takeaways and Considerations for This Unit

Final Thoughts

The upcoming Telok Blangah GLS site is expected to influence pricing trends for The Foresta @ Mount Faber, with potential appreciation of 5%-10% leading up to the new launch.

While selling within 12-18 months post-launch may present a good opportunity to ride the initial demand wave, waiting until TOP may introduce greater resale competition. The final decision should consider market conditions, GLS tender results, and individual financial objectives to maximise capital gains.

Need guidance on the best time to sell your property? With market dynamics constantly shifting—whether due to upcoming GLS sites, new launches, or broader economic conditions—having a solid exit strategy can make all the difference. If you’re looking for expert insights to maximise your property’s value, reach out to our consultants today. We’re here to help you navigate the market with confidence.

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice or any buy or sell recommendations.

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. Whilst every effort has been made to ensure that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be excluded, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this web site or for any resulting loss or damage suffered by the recipient or any other person.