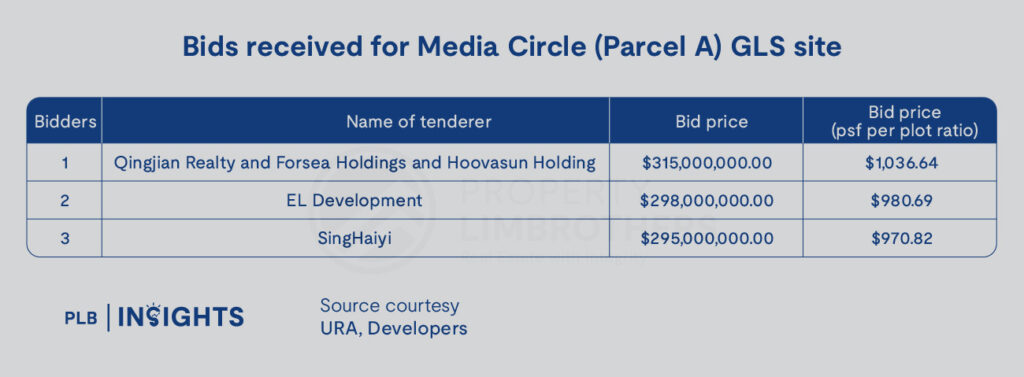

The Government Land Sales (GLS) tender for Media Circle (Parcel A) officially closed on 4 March 2025, drawing a total of three bids. A consortium comprising Qingjian Realty, Forsea Holdings, and minority investor Hoovasun Holding emerged as the highest bidder with an offer of $315 million, translating to $1,037 per square foot per plot ratio (psf ppr) for the 99-year leasehold site.

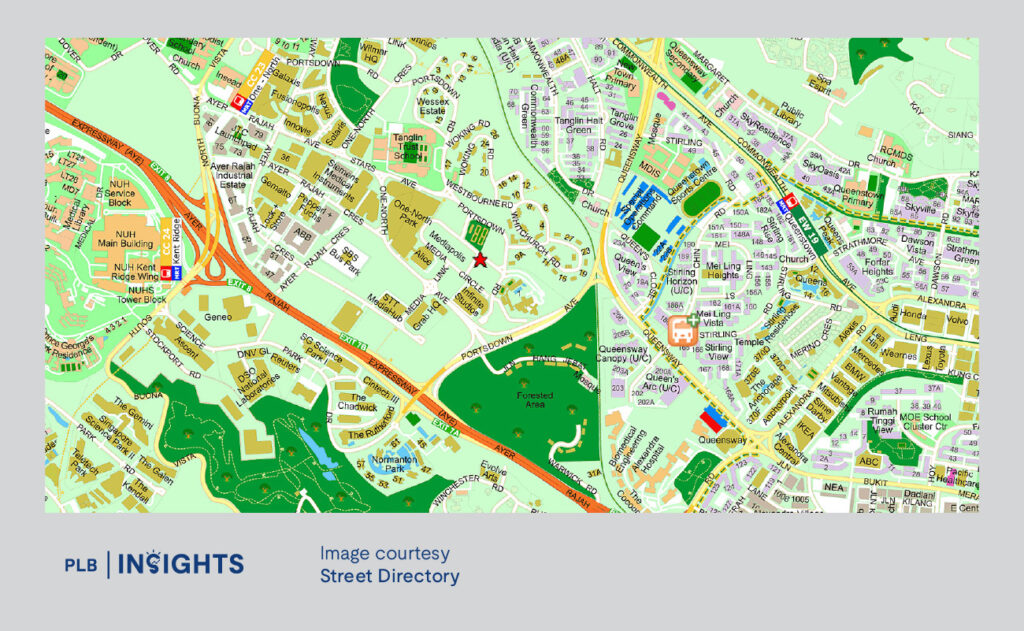

Located in one-north, a precinct known for its research, development, and technology-driven industries, the 82,125 square-foot site is zoned for residential use with commercial space on the first storey. It is estimated to yield approximately 325 housing units, with a maximum allowable gross floor area (GFA) of 303,865 square feet.

Competitive Tendering with Moderated Land Pricing

Despite drawing a modest number of bids, the tender process remained competitive, with the Qingjian-Forsea consortium’s offer exceeding the second-highest bid by 5.7%. EL Development placed a bid of $298 million ($981 psf ppr), while SingHaiyi Group submitted the lowest offer at $295 million ($971 psf ppr).

Interestingly, the winning bid for Media Circle (Parcel A) falls below the land rate secured for a neighbouring GLS site in January 2024. The adjacent plot, which is now being developed into the 358-unit Bloomsbury Residences, was awarded at $1,191 psf ppr—14.8% higher than the latest transaction for Parcel A.

This suggests a more measured approach by developers towards land acquisition in the current market environment. Industry observers note that while one-north remains a highly sought-after precinct due to its positioning as a hub for innovation and technology, market sentiment has shifted towards a more cautious outlook, particularly in light of economic uncertainties and evolving government policies.

Strategic Expansion and Market Positioning

The latest acquisition reinforces Qingjian Realty and Forsea Holdings’ commitment to strengthening their presence in the one-north precinct. The Qingjian-Forsea consortium has now secured three major residential sites within a relatively short timeframe, highlighting confidence in the area’s long-term growth potential.

Following the successful bid, the consortium has announced plans to develop two high-rise residential towers, incorporating ground-floor commercial spaces that will add to the retail offerings within the precinct. Given the nature of one-north as a business and innovation hub, the integration of residential and retail elements is expected to contribute to a more vibrant live-work-play environment.

The latest bid also aligns with the broader transformation plans for Media Circle, which is part of ongoing government efforts to enhance the one-north precinct. The district continues to see infrastructure improvements, commercial expansion, and increasing residential demand, factors that have collectively positioned it as a key residential and investment destination.

Recent Transaction Trends in One-North

The GLS tender results come amid ongoing activity in the one-north residential market, where new project launches have seen strong price benchmarks despite cautious buyer sentiment.

A notable example is The Hill @ one-North, a 142-unit development launched in April 2024 at Slim Barracks Rise. The project saw 30% of its units taken up on launch weekend at an average price of $2,595 psf. This price point represents one of the highest in recent years for private residential launches within one-north, reflecting a new pricing benchmark in the area.

Market watchers note that while new launches in one-north have witnessed steady take-up rates, buyers are becoming more discerning, focusing on projects with strong locational attributes, efficient layouts, and proximity to amenities and transportation nodes.

Given the relatively limited supply of private homes in the area, competition among buyers is expected to remain keen, particularly for projects that offer a balance of lifestyle convenience and investment potential.

Future Supply Pipeline and Market Outlook

With the award of the Media Circle (Parcel A) site, attention now turns to future GLS tenders within the precinct. Another nearby residential plot, Media Circle (Parcel B), remains available for tender under the 2H2024 GLS Programme, with the closing date set for 29 April 2025.

Parcel B, which spans 107,936 square feet, has the potential to yield approximately 500 new residences. Given its larger land area, market expectations suggest that it could attract a wider pool of bidders, possibly drawing interest from both established and mid-sized developers.

Beyond the Confirmed List sites, another residential plot within Media Circle has been placed on the Reserve List of the 1H2025 GLS Programme. Unlike the current sites, this plot is designated for long-stay serviced apartments with a 60-year lease tenure, further diversifying the housing options within the district.

Looking ahead, industry sentiment remains cautiously optimistic about the future trajectory of one-north’s residential market. The district’s positioning as a key employment and innovation hub continues to underpin strong rental demand, making it an attractive proposition for both investors and homebuyers seeking proximity to economic growth centres.

In Summary: A Strategic Move in a High-Growth Precinct

The Qingjian-Forsea consortium’s successful bid for Media Circle (Parcel A) marks another milestone in the evolving landscape of one-north’s residential market. While the lower land rate compared to past transactions suggests a more measured approach from developers, the strategic location and continued transformation of the precinct are expected to sustain buyer interest.

With new supply in the pipeline and sustained investment into the area, one-north remains a key focal point in Singapore’s urban planning efforts. The upcoming developments, coupled with the continued expansion of commercial and lifestyle amenities, are set to further reinforce the precinct’s appeal as a dynamic, knowledge-driven residential enclave.

Looking to stay ahead in the evolving one-north property landscape? With new GLS sites, upcoming launches, and shifting market conditions shaping investment opportunities, understanding the right entry strategy is key. Whether you’re exploring options in Media Circle or assessing potential returns in one-north, having expert insights can give you an edge. Get in touch with us today to make informed decisions and secure the best opportunities in this dynamic precinct.