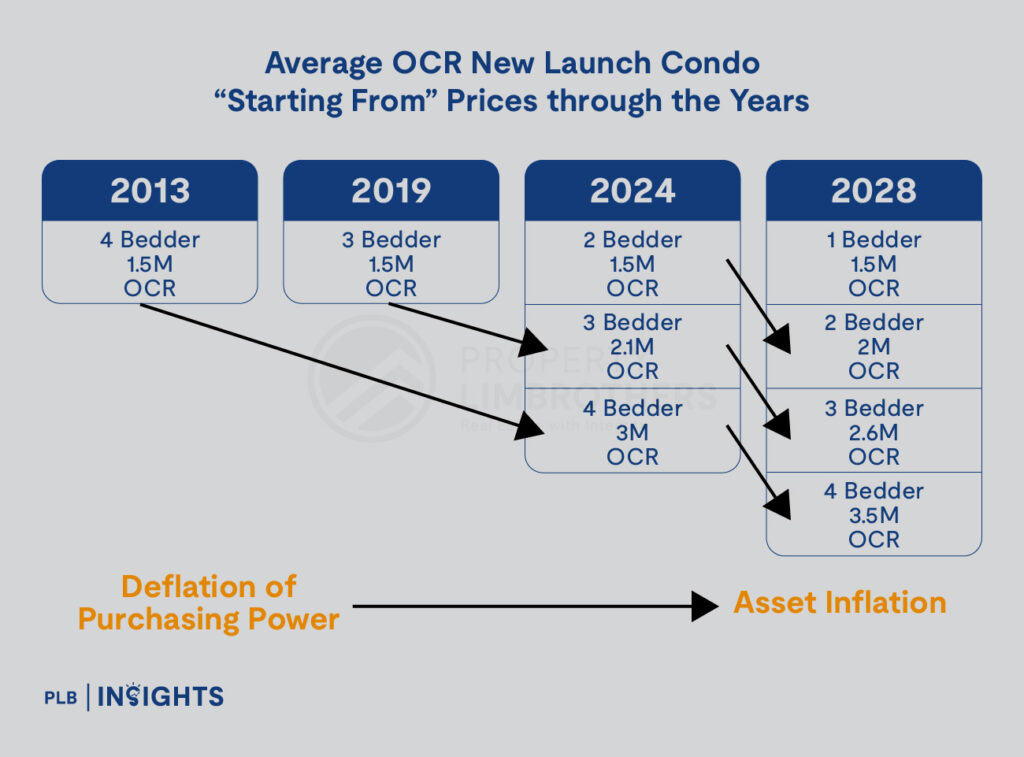

20 years ago, a $1,000 PSF property was unimaginable. The same thing could be said 10 years ago about $2,000 PSF properties. But fast forward to 2024, new launches are averaging at $2,500 PSF, with some Core Central Region (CCR) properties exceeding $3,000 PSF. This begs the question – what kind of new launch prices will we see in 2028?

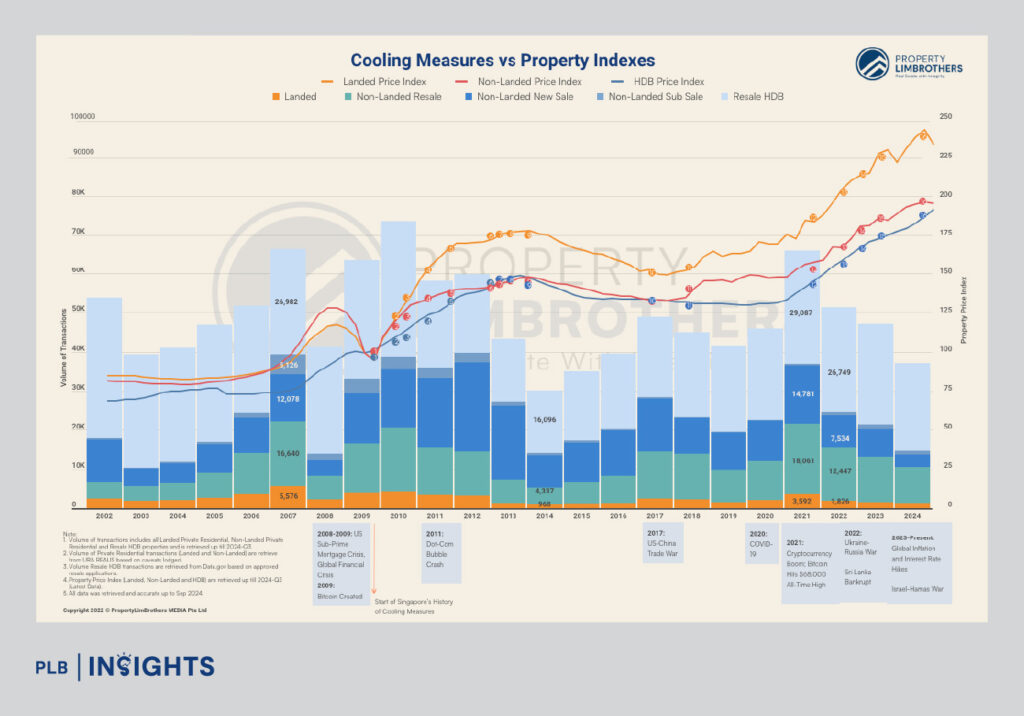

While no one can predict with certainty, historical patterns provide valuable insights. Since 2013, the Singapore private property market has demonstrated resilience despite facing multiple rounds of cooling measures. 16 rounds of such measures, with the latest being the Loan-to-Value adjustment for HDB loans, have shaped market behaviour and pricing trends. Yet, despite these interventions, prices have continued their upward climb, with every 4-5 years seeing a shift in quantum for new launches. For instance, the same $1.5 million budget that once secured a 4-bedroom unit might now only afford a 2-bedroom unit in the same price bracket.

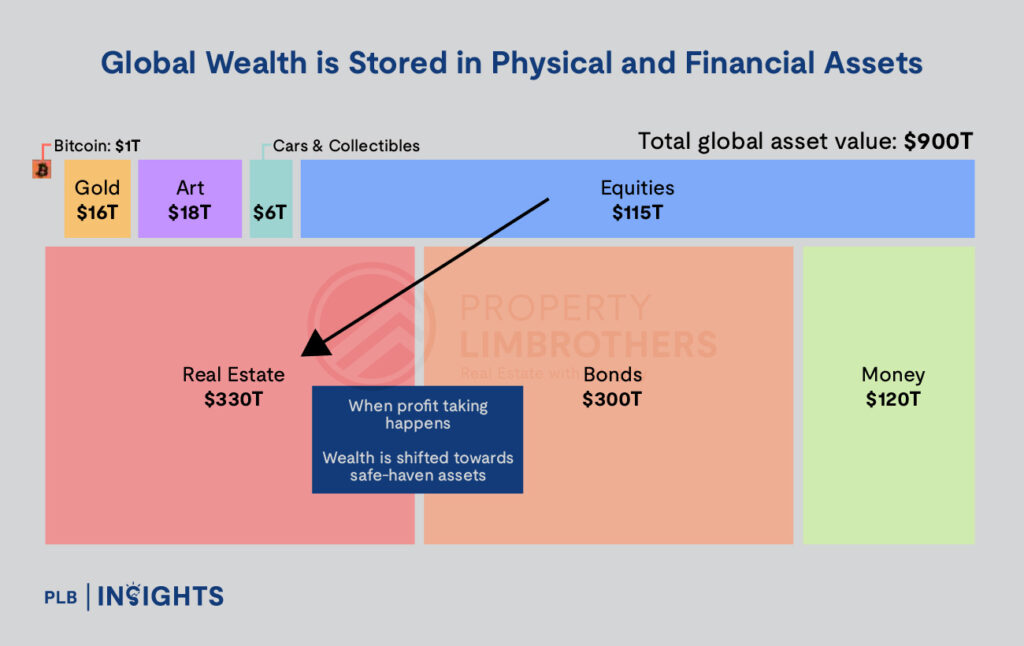

The drivers behind this trend are manifold. Global macroeconomic forces such as quantitative easing (QE), asset inflation, and fluctuating interest rates all play a role. These factors have ripple effects on the value of money and, subsequently, the pricing of hard assets like property. But in Singapore, the trajectory of private property prices is influenced by a hidden yet powerful engine—land supply and land bid prices.

Government Control Over Land Sales

In markets where land is abundant and government control over land sales is minimal, the dynamics of property pricing can paint a very different picture compared to land-scarce environments. For instance, if you live in an area where new condo developments frequently spring up near your existing property, it may give cause for concern. This is because new launches in such markets where there is a supply overhang often maintain similar price levels to what you paid for your property four to five years ago.

This stagnation in pricing stems from the abundance of land, which allows developers to continuously access new sites for development at relatively stable costs. Without stringent policies to regulate how much land is released to the market or control the pricing of land sold to developers, supply can often outpace demand, limiting significant price growth over time.

In such scenarios, while buyers may find affordability appealing, existing property owners may worry about the lack of price appreciation, which could dampen the long-term investment potential of their properties. The absence of price differentiation between older and newer projects highlights the critical role of land scarcity and strategic government planning in driving sustained value growth in real estate markets.

How Singapore Controls Land Bid Prices

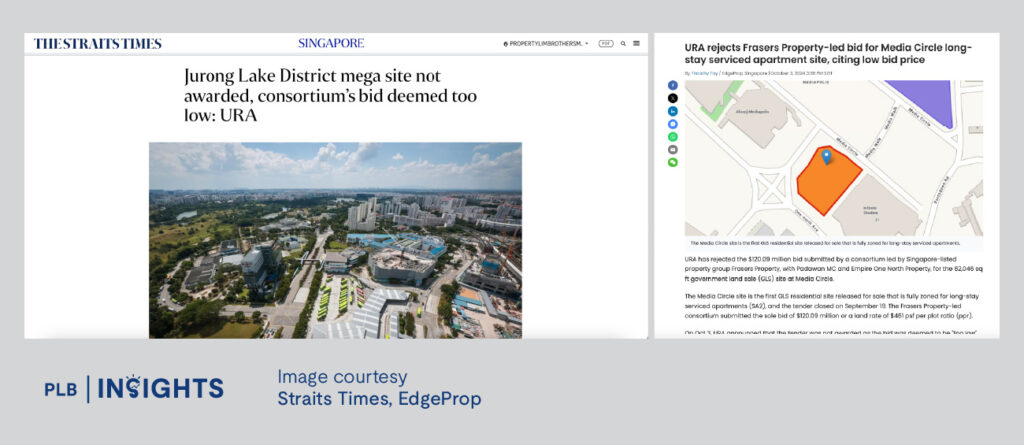

Land bid prices are a critical factor influencing the launch prices of new condominiums in Singapore. By examining launch price trends over four to five-year intervals, we can gauge the implicit annual growth rate that the government deems acceptable. This careful calibration of land prices is not random—it reflects a strategic effort to protect and sustain private property values.

Why does this matter? Private properties in Singapore serve as a cornerstone of aspiration for many citizens, representing not just a higher quality of life but also a key avenue for wealth creation and personal capital growth. This aligns closely with the government’s broader economic and social objectives. A thriving private property market creates a positive ripple effect: it boosts consumer confidence, fuels economic prosperity, and strengthens the nation’s GDP.

In countries where private property values are steadily rising, the wealth effect translates into increased purchasing power for citizens. This growth cycle has profound implications for the overall economic ecosystem, as it encourages spending, investment, and long-term stability.

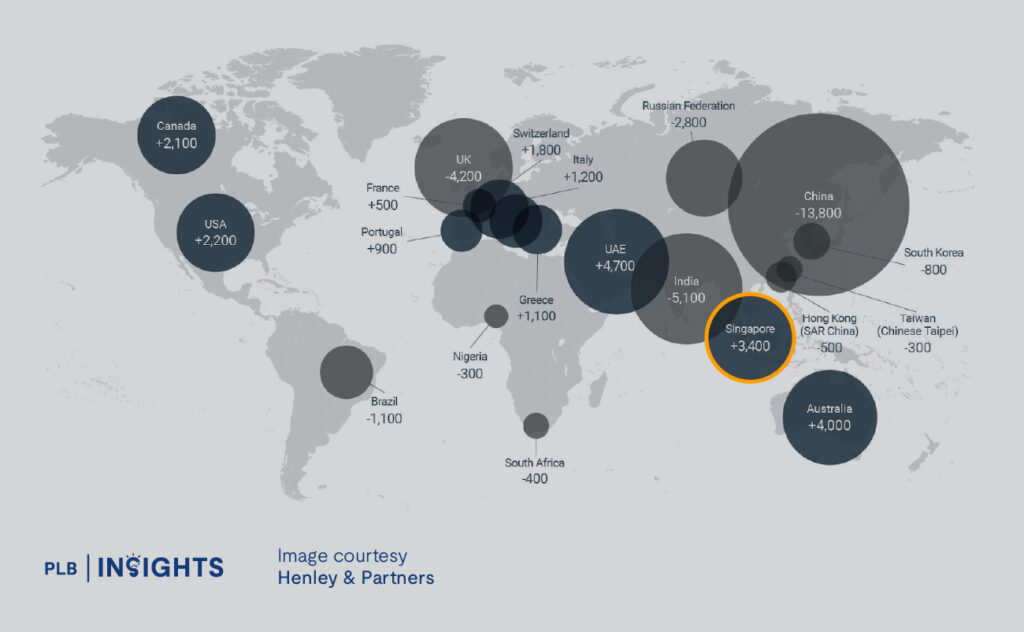

In contrast, when property markets falter due to lacklustre growth or inconsistent policies, affluent individuals and High Net Worth Individuals (HNWIs) often seek safer havens for their capital. The draw of markets with strong governance, low taxes, political stability, robust educational systems, and—most importantly—a reliable growth trajectory in wealth assets cannot be understated. Singapore’s well-regulated property market positions it as an attractive destination for such investors, reinforcing its status as a hub for global wealth.

The government’s careful control over land supply and pricing ensures that private property remains a valuable asset, driving not just individual wealth creation but also contributing to Singapore’s reputation as a stable and prosperous nation. This calculated approach safeguards long-term growth and positions private properties as a cornerstone of the country’s economic resilience.

The recent rejection of three low land bids by the Singapore government sends a strong and deliberate signal—private property prices will be protected, that is, the government will not allow prices to rise or fall too exponentially. Historically, the government has shown a willingness to tolerate single-digit to low double-digit growth in private property prices, striking a balance between affordability and asset appreciation. This approach ensures that property ownership remains a viable aspiration for citizens while safeguarding the long-term stability of the market.

For property investors, this measured growth, coupled with the leverage provided by mortgages, creates a compelling proposition. With a typical loan-to-value ratio of 75%, investors can achieve significant returns on capital over a relatively short period, as the capital would appreciate faster than interests accrued on the mortgage. On that note, “harder” assets typically appreciate faster as well – so a landed property would see faster and more exponential appreciation compared to a 2-bedder condo for example.

Real estate’s stability as an asset class further reinforces its appeal. Unlike equities or cryptocurrencies, which can experience extreme volatility, real estate provides a tangible and reliable store of value. It has long been regarded as a hedge against inflation, offering investors a way to preserve the value of their capital over time. Moreover, the psychological comfort of owning a physical asset with intrinsic value often drives individuals and families to funnel profits from riskier investments into real estate.

Closing Thoughts

This interplay of government intervention in the form of control over land supply and bid prices, strategic leverage, and the enduring perception of real estate as a safe haven underscores why the private property market in Singapore continues to attract both domestic and international investors. As market dynamics evolve, this stability and calculated growth ensure that property investment remains a cornerstone of wealth creation and preservation in the country.

Let’s get in touch

At PropertyLimBrothers, we adopt a strategic three-step approach to property investment. Starting with Macro trends, moving to Micro market dynamics, and concluding with Selection criteria tailored to individual goals. Understanding the macro landscape—how global trends and Singapore’s position as a financial hub shape the market—gives investors the confidence to navigate uncertainties and make informed decisions. Coupled with micro-level insights on neighbourhood trends and carefully curated property selection, this framework ensures a holistic perspective for successful investment in Singapore’s real estate market.

Ready to take the next step? Connect with us here today for expert guidance on identifying the right opportunities that align with your financial goals. Let us help you maximise your returns and secure your dream property with confidence.