Earlier this month, the Government Land Sales (GLS) results revealed that bids for two sites, Canberra Crescent and De Souza Avenue, were awarded at the lower end of expectations. The Canberra Crescent site, covering 20,437.3 square metres, received a top bid of $279 million, equating to $793 per square foot per plot ratio (PSF PPR). This bid was submitted by a joint venture between Kheng Leong and builder Low Keng Huat. Meanwhile, the De Souza Avenue site, spanning 19,245.4 square metres, was awarded to developer Sustained Land with a bid of $278.9 million, or $841 PSF PPR.

The bids for these two sites were lower than expected, highlighting developers’ cautious approach due to uncertainties in the local real estate market and the broader economy. Could this be an early sign of a real estate market downturn? In this article, we will summarise the recent GLS tenders, explore the potential growth of the developments on these sites, and examine the trajectory of the real estate market based on recent trends.

Overview of the Canberra Crescent and De Souza Avenue GLS

The site at Canberra Crescent covers 20,437.3 square metres and is expected to accommodate approximately 375 units upon completion. The top bid of $279 million, submitted by a joint venture between Kheng Leong and Low Keng Huat, narrowly beat two other bids. The second-highest bid was $275.1 million, translating to $782 PSF PPR, while the lowest bid was $228.8 million, or $650 PSF PPR. This awarded bid marks the lowest land rate for a GLS site in the Outside Central Region (OCR) since 2020, excluding Executive Condominium sites. Notably, the winning bid was only 10% higher than the most recent GLS for an Executive Condominium in October 2023, which sold for $543.3 million, or $721 PSF PPR in Tampines.

The De Souza Avenue site, which covers 19,245.4 square metres, was awarded with a winning bid of $278.9 million, narrowly surpassing a $228 million bid from Capital Development, which equates to $688 PSF PPR. Despite being located in the Rest of Central Region (RCR), the winning bid of $841 PSF PPR is more typical of sites in the OCR. Notably, this winning bid is 37.4% lower than a nearby Bukit Timah site sold through a GLS exercise in 2022.

The low bids for these two sites reflect developers’ apprehension in the face of a slowing global economy and a cooling local real estate market, compounded by rising construction costs and associated risks. Around the same time these GLS bids were announced in July, data showed that sales of new private residences had dropped to a record half-yearly low of 1,916 units, even lower than the figures from the second half of 2018.

In addition to the sluggish local real estate market, developers’ confidence may have been further dampened by the fact that these two sites are not near MRT stations, potentially leading to lower anticipated demand. Specifically for the De Souza Avenue site, the requirement to improve pedestrian access around the development may have deterred developers, resulting in only two bids being submitted.

Canberra Crescent and De Souza Avenue: Neighbouring Developments That Could Shape Market Dynamics

Canberra Crescent

Analysts estimate that the upcoming development at Canberra Crescent will have a launch price between $1,700 and $2,100 PSF. According to the URA Master Plan, this site is primarily surrounded by residential developments, with only a few commercial and business sites nearby.

Despite this, the potential for growth of this upcoming development at Canberra Crescent shows genuine promise when considering the average transacted PSF prices and demand for nearby properties. The Visionaire, located about a 10-minute walk from the GLS site, currently has an average PSF price of $1,355, according to the most recent transaction data as of 2024. This reflects a 38% increase from its average PSF in 2020. Although this average is lower than the estimated launch price for the new development at Canberra Crescent, which aligns with recent new launch prices in the area, the significant growth at The Visionaire demonstrates strong potential for capital appreciation in this vicinity. However, it’s important to note that The Visionaire is closer to an MRT station, which may contribute to its higher demand.

Additionally, the high demand for Parc Canberra, an Executive Condominium located closer to the GLS site than The Visionaire, further suggests a positive outlook for the new development. Parc Canberra, completed last year, comprises 495 units and achieved a 64% sell-out rate during its launch from January 31 to February 2, 2020, with 316 out of 496 units sold.

In summary, the impressive price growth at The Visionaire and the strong initial demand for Parc Canberra indicate that the upcoming development at Canberra Crescent has solid potential for both demand and capital appreciation. Nevertheless, each development has its unique characteristics, and the developers at this GLS site will need to carefully strategise to ensure strong demand for the new project.

One advantage of this GLS site is its proximity to several HDB flats. Residents of these flats who aspire to upgrade to private residences in the future could become potential buyers, providing a pool of exit audience.

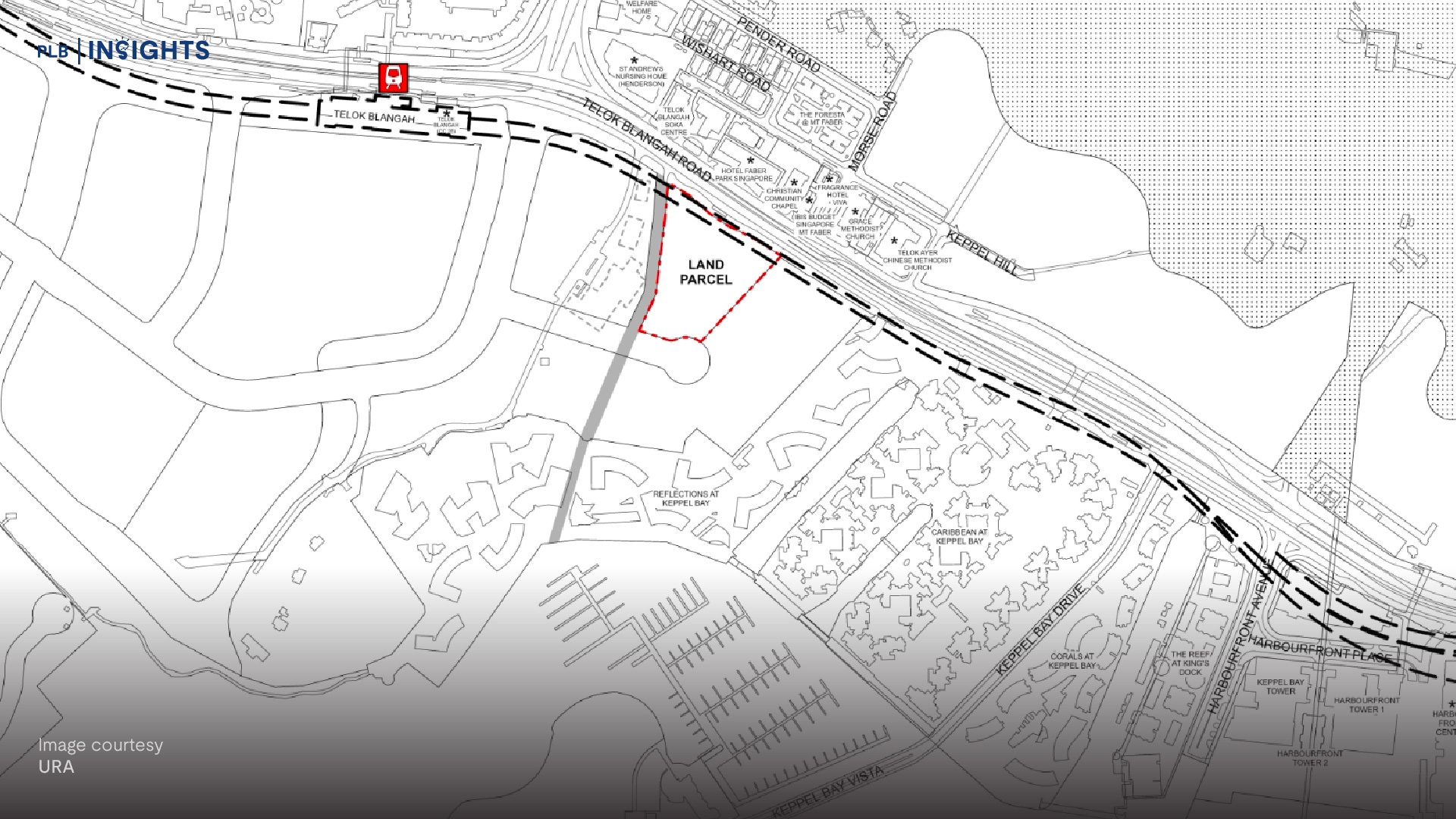

De Souza Avenue

Like the site at Canberra Crescent, the GLS site at De Souza Avenue is surrounded mainly by residential areas, with no commercial or business developments within a short walking distance. Analysts estimate the launch price for this upcoming project to be between $1,950 and $2,200 PSF.

For comparison, Verdale, a 99-year leasehold development with 258 units completed in 2023, is currently averaging $2,011 PSF in recent transactions. From 2020 to 2024, Verdale’s average PSF price grew by 16.7%. Additionally, price trends for two nearby freehold developments show impressive growth over the same period. Sherwood Condominium, completed in 1998 with 116 units, saw a 44.1% increase in its average PSF price. Charisma View, a boutique development with just 36 exclusive units completed in 2003, experienced a 45.8% growth in average PSF price.

While the demand for the upcoming De Souza Avenue development will depend on its features, as well as the developer’s pricing and marketing strategy, the strong capital appreciation seen in nearby developments suggests that this area has growth potential, even without immediate access to an MRT station or commercial amenities.

This site is located near a considerable number of landed homes, offering a potential exit strategy by appealing to empty nesters who may be looking to downsize.

2024 Residential Market Forecast

The recent housing measures, particularly the significant increase in the Additional Buyers’ Stamp Duty (ABSD), along with global economic uncertainties, rising construction costs, and other global events, have collectively contributed to cooling the local real estate market. Additionally, the market appears to be shifting towards a buyer’s market, with a steady influx of new residential supply—both HDB and private—and a general decline in demand since the pandemic.

Despite these changes, experts are confident that Singapore’s real estate market will remain resilient, though growth may be more moderate. The market is expected to be driven primarily by owner-occupiers, many of whom are seeking larger spaces for their families. For investors, a wise strategy might be to consider larger units, if financially feasible, to appeal to a broader range of buyers in the future. Though, it is also extremely crucial to take heed of the overall quantum price of the property, as a high overall price may price out potential buyers.

With Singapore’s strong economy and its ability to attract foreign talent, demand for homes is likely to stay robust in the foreseeable future. Supported by sound governance and effective housing policies, real estate in Singapore continues to offer high potential as an investment. However, it’s essential to recognise that each development and property has unique features that cater to different needs and preferences. Beyond affordability, considerations such as long-term goals, lifestyle needs, and exit strategies are crucial. Therefore, consulting with a real estate expert is vital to navigate this complex and nuanced market effectively.

In Summary

The recent GLS bids at Canberra Crescent and De Souza Avenue, coming in lower than expected, reflect a cautious sentiment among developers amid economic uncertainties and rising construction costs. While this may signal a shift towards a buyer’s market, the surrounding developments and strong capital appreciation trends suggest potential growth opportunities for these sites. Singapore’s real estate market is anticipated to remain resilient, driven by demand from owner-occupiers and supported by robust economic fundamentals. However, with each property offering unique attributes, careful consideration and expert guidance are essential for making informed investment decisions in this evolving landscape.

If you need help navigating the property landscape or a second opinion on the current offerings in the market, do reach out to us here and we will be glad to help you weigh your options. See you in the next one!