We have often heard of developments that boast an abundance of facility space to help New and Seasoned Buyers curb claustrophobia from densely packed developments. After reaching the milestone of being able to move on from Public Housing and purchase your own Private Property, more specifically Condominiums, you would expect to have a certain level of privacy and quiet enjoyment. This would include not having as many neighbours on the same floor and having the luxury of private facilities for you and your family.

We will take a look at certain developments that have yielded fewer units from their Maximum Number of Allowable Dwelling Units or have not used up their Maximum Site Coverage area. We will also discuss, What’s in it for the Developers? More importantly, What’s in it for YOU as a Buyer?

Guidelines

Before we delve into the specifics, let’s take a look at the ground rules that URA has set for Flats & Condominium developments. (Serviced Apartments not included)

-

Site Coverage

Site coverage, as defined by URA, is any building structure that protrudes more than 1m from the ground. The net site area excludes the areas vested to the State for public roads, public road widening reserves, and drainage reserves. Just in case the State decides to expand these reserved areas in the future. The purpose of this guideline is to ensure that there are adequate areas set aside for greenery and landscaping within the development. URA takes serious efforts to ensure that our developments do not look like a block of concrete in our land-scarce country. The maximum site coverage for flats and condominiums allowed by URA is 50%. Pools that are predominantly underground, do not contribute to site coverage unless they have been erected on top of structures 1m above ground.

For reference, Principal Garden’s award-winning design boasts less than 20% of coverage from its four apartment towers and facilities, which we will touch on more in the later part of this article. Having lesser site coverage translates to more open space, landscaping and even more facilities (Tennis courts, Basketball courts, Open Fitness Areas). As the pandemic has shown, having these open space facilities are growing increasingly important. Whether it is for the mental wellness of a working adult or to deplete the energy of a child in order to preserve the mental wellness of a working adult, these facilities have grown to be much appreciated.

2. Gross Plot Ratio (GPR)

GPRs affect several factors of a development. Namely, the Number of Storeys, the Total Height of the Building, the Gross Floor Area (GFA) and the Maximum Number of Dwelling Units. The GPR is the upper bound but subjected to the site limitations such as the shape of the plot, site topography or ground conditions, building setbacks, building height or technical requirements of other authorities. The GPR can be found from the web service on URA’s website called URA Space, where you will be able to view the GPR, the type of zoning and the approved uses for the land.

Examples of limitations are building height restrictions due to proximity to Airspaces used by Airports. Although the plot ratio may be 2.1 or 2.8, restrictions will only allow developers to build no more than 12 storeys due to building height limitations. Additionally, sites that are zoned Commercial/Residential and Residential with Commercial at 1st storey require further evaluation before approval for the maximum number of storeys allowable. An example of such a development would be Integrated Developments, where a Condominium sits atop a mall.

3. Balconies and Private Enclosed Spaces

A little fun fact about Balconies and Private Enclosed Spaces (PES) is that they are actually bonus GFA that URA has allowed provision for, subjected to a cap of 7%. What this means is that the balcony spaces, some buyers dread paying for, are actually additional floor areas that the developers have been allowed to build above the prescribed original GFA. So technically, the misconception where the balcony spaces “eat into” the floor space is not exactly true because this additional provision by URA states that the extra GFA has to be used for Balcony spaces.

URA has also imposed guidelines to govern the size of these balconies so that they are not unusable. It has to be of a certain width, and the Percentage of the Balcony Perimeter Opening has to be more than 40%. The last thing URA wants is for developers to shortchange the consumers and sell them unusable space, which goes against their policy of a quality living environment. Now that we have established the foundation for developments 😉 Let’s take a look at some developments that did outperform the guidelines.

Principal Garden (80-20)

Principal Gardens was completed in 2018, sale of the units started back in 2015. The development won a Landscape Excellence award for the use of only 20% of its land space to build the 4 residential towers. The other 80% is dedicated to an uninterrupted landscape of lush gardens and outdoor grounds, lawns, pools and water features. With the emphasis that COVID-19 brought about, the outdoor space and facilities would probably be better appreciated in today’s climate. Back in November 2015, about 60% of the units offered up were snapped up, including 5 out of 9 penthouses. Perhaps the abundance of open space was what attracted many buyers on the launch weekend of the development. But then again, would you pay extra for open space?

Strategic Pricing

While lifestyle factors such as facilities and open space do contribute to the decision-making process. Ultimately, most buyers would not want to pay for the space outside of their units. It is seen as more of a bonus to have that kind of facility and open space. The popularity of Principal Garden back in 2015 is likely due to the strategic pricing that the developers have chosen to go with. Comparing the average PSF across the surrounding developments in 2015, Principal Garden was priced below all of its competitors’ launch prices. Echelon did have the edge over Principal Garden because it was about to reach completion. However, because the launch price of Echelon was still higher than Principal Garden, owners were unable to exit. Otherwise, they would have suffered a loss.

We will leave the inference to you if you think that the 80-20 design was big enough of a deal for buyers to enter into Principal Garden or if it was due to other factors. But of course, the abundance of open space would have helped the target audience make their decision more promptly. Like we have mentioned, if we knew that open space and facilities would be much sought after in 2020/2021, Principal Garden would be much more popular if it were to be launched today.

After talking about the entry to this award-winning development over the years. How did it actually stand over the years?

Performance

Percentage gain from Lowest Average PSF against Highest Average PSF

Principal Garden – 16.39%

The Crest –17.18%

Echelon – 20.50%

Alex Residences – 14.89%

We can’t exactly say that the performance of Principal Garden was as good as its launch, just based on the percentage gain. However, it would be the best performing if we were to compare all the projects from their launch prices. To date, Principal Garden is the only development that has yet to see prices “dip”. Year-On-Year, there has been a gain in the average PSF prices. Only in recent years did it seem to stagnate, likely due to being one of the pricier developments since 2019. As much as we want to state that the development’s performance over the years is attributed to the award that it won. Based on price movements, it is unlikely that it contributed in any significance. Perhaps, in this year, where the average PSF prices are all consolidated, we may observe preferences for Principal Garden’s wide spaces since the playing field has been levelled.

After all this talk about Principal Garden, you may be wondering. If it was such a well-priced development, why didn’t the developers just build more units and they can stand to earn more profit. And we will answer that in our next example.

Yielding Lesser Units

URA governs the Maximum Number of Dwelling Units that a developer can build in relation to the GPR of the land site. However, this formula is a general guideline and does not apply to HDB Flats, Serviced Apartments and developments within the Central Area. URA states that all self-contained dwelling units shall be more than 35sqm nett in the internal area, which is roughly about 378sqft. The guidelines also state that there shall be a provision of a good mix of unit sizes to cater to buyers of different classifications. 20% of the units should have at least 100sqm nett internal area for larger families, and units with less than 50sqm shall not exceed 20% of the proposed units.

There are developments with more or lesser units subjected to the approval of the relevant authorities. The guidelines allow the developer to determine a few things before they bid or acquire the land for redevelopment. Such as the pricing for each unit in order to be profitable if they were to build the maximum number or fewer units. The number of residential blocks they would plan to build to achieve the determined number of units and at the same time build to the tallest potential the GPR allows for. All these considerations translate to cost factors for the developers, which would affect the price at which consumers purchase them for.

Gross Floor Area

One more thing to note is the upper equation where you have: Allowable GPR x Site Area

This equation actually computes the maximum amount of Gross Floor Area allowed for the entire development. Again, this is also a guideline. Anything more or less is subjected to approval from the relevant authorities. Combined with the guideline of 85sqm per dwelling unit, you will derive the maximum number of dwelling units.

With all that said, naturally, you would think that developers would build the maximum number of units in order to profit more and to max out the potential of the land. But there are exceptions.

Amber Park — Former Amber Park

The recently launched Amber Park, which was also formerly known as Amber Park, was part of the En Bloc fever in 2017. The former 200 unit development was sold to Hong Leong Group at $906.7 million in 2017, setting a new record for freehold property sold En Bloc. The land size of the site is 213,760sqft, which is a relatively rare sizeable plot in the Amber area. The initial statement released to The Straits Times was that joint developers CDL and Hong Realty planned to redevelop the site into a luxury condominium development with four 25-storey blocks with close to 800 units. Fast forward to 2021, only luxury condominium development remains from the initial plan. Amber Park, expected to TOP in 2023, is now a three-block 22-storey luxury condominium development with 592 units.

Why almost 200 units lesser than planned?

1. Audience

Amber Park’s current average price is $2,454 PSF. It is the second-highest PSF in the Amber area that make resale options like One Amber and The Esta, which are just directly in front of Amber Park, look like a steal in the Amber area. Being positioned as a luxury development, it certainly has the price tag that accompanies that title. This is why the developers had to be very specific in determining the audience they would want to target. If they were to just position it as “just another” development within Amber, they would never have been able to justify the price tag. With Amber being an area that is densely packed with many private developments, they would probably not have received the kind of attention they did if they were marketed in a general manner.

But you cannot just market a luxury development based on price alone, right? Well, yes, you cannot.

2. Layouts

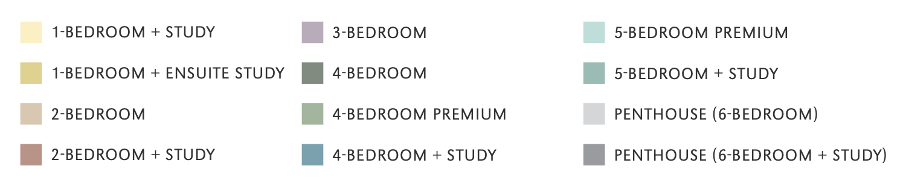

Amber Park’s targeting is also very prominent in their unit type offerings. With only 33% of the development being 2-Bedders and smaller unit types, it is pretty obvious that they are not exactly targeting investor buyers. For reference, developments that would likely target investors typically offer 50% of 2-Bedders and smaller unit types. With 66% of the offerings being 2-Bedroom + Study and above, they are likely enticing couples and families that will appreciate the luxury development.

Another observation that we have noticed from their unit offerings is the lack of variation in 3 Bedders. Typically developments that would want to target families have a few variations in 3-Bedders, such as 3-Bedroom Premium, 3-Bedroom + Study, 3-Bedroom Premium + Study, etc. Surely, you have seen these variations before. But remember, this is a luxury development. Although they still do have 101 and 3-Bedders up for grabs, they have interestingly placed more focus on the 4- & 5-Bedders. The intention behind placing more emphasis on these larger units is probably to help justify the quantum that the homeowners would be paying for. At a minimum of $3,000,000 for 1,302sqft, perhaps the developers were trying to extend more value to buyers with an extra room. But because they decided to target more substantial buyers who would be looking to stay in the unit, they had to attract these buyers with the right layouts. Bigger layouts meant lesser units. If they were to primarily target investors, then they would have likely built more 1- & 2-Bedders for that rental play positioning.

3. Aesthetics

Another point we mentioned that the developers did not proceed as planned is the number of stories the development has. The land site has a plot ratio of 2.8, which allows for up to 36-storeys but the initial plan was for 25-storeys. However, they only built 22-storeys in total with the lower 21-storeys for residential units. The 22nd storey features an elevated MBS like rooftop that has been named The Stratosphere. This is probably one of the most enticing factors of the development. With a luxury price tag, surely they had to think of something to really amp up that luxury factor. And they did exactly so with this unique structure that you will not be able to find anywhere else in the vicinity. The nearest building that has this unique rooftop would probably be MBS, which you will be able to view from The Stratosphere.

This leads us to our point. There is a possibility that they had limitations to the height that they can achieve due to the structural integrity of the building, but it could also be due to GFA restrictions. Although only at the height of 22-storeys, The Stratosphere sufficiently tops most of the surrounding developments. The most direct facing of the sea is slightly obscured by Seaview Point, but Seaview Point only has 16-storeys. There are also pockets of spaces where you will be able to view the sea.

Benefits For Developers

Developers are not all that charitable. They do not seek to give you a deal where they will lose out. Of course, they are not out to rip you off as well. Ultimately developers understand that consumers are just out searching for the best possible deal they can get. All the points mentioned in this article are just for that purpose. Developers benefit the most when the units they build get sold. The faster, the better. Even if that means building lesser units or using lesser space. Every development will have its own different attribute to engage and attract consumers to buy into the development. Like what our boss at PLB loves to say, “Every property sure has its own audience one. Otherwise, the whole building will be empty!”.

Developers decide on the price to fork out for the land and work closely with architects in order to achieve their business objectives. If the current climate requires them to perhaps utilize more land are for facility space, then they will have to figure out a way to achieve that, like the example in Irwell Hill Residences. Other than being priced strategically, Irwell Hill Residences similarly boasts close to a 70/30 land to building block ratio. In the CCR, where most developments are quite densely packed within the land area, the developers at Irwell Hill Residences decided to give the owners more open space to utilize. This provides the benefit for owners to live in the CCR district while enjoying the landscape and open space you would typically find in developments outside of the Core Central Region. Which, in this current Pandemic climate, is much appreciated and welcomed. FYI, we also did an article on Irwell Hill Residences on the investment potential, if you have not already read it.

Regulation — ABSD

Part of the reason why developers would very much want to sell their units off quickly and entirely is Additional Buyers Stamp Duty (ABSD). Lesser units mean lesser worry for the developers. Like you and I, the developers need to pay stamp duties in order to acquire the land. They are subjected to a hefty 30% ABSD, of which 25% is applicable to be remitted if they complete the housing development and sell ALL units within 5 years from the acquisition date.

This regulation by IRAS serves a few purposes.

-

To ensure that developers do not hog the land. The last thing any government would want is if a large amount of its land is held under anybody else’s name other than their own.

-

To ensure the developers stay competitive. In order to achieve all the checkpoints to receive the 25% remission, developers need to build good developments to attract consumers to buy into. Clearing out the units at the soonest possible time would only be possible if there are good attributes in a development that consumers would want.

-

To ensure there is fairness to the consumer. Imagine if you had to wait 7 years for your new house instead of 3 – 5 years. If developers took their own sweet time to build developments because of seasonal cost increment, then it would be unfair to the owner who has to pay the money and time for the development.

Regulation is in place to ensure fair trade and happy consumers. If there were no regulations, homeowners would not have the framework to seek compensation in any form if there were mishaps. It is also because of a well-regulated market that has seen our Property Market form into a self-sustaining and flourishing one.

Benefits for Buyers

URA addressed concerns with shoebox units back in 2018 when developers had started a trend of allocating most units to be of smaller internal areas. The purpose was to price these units to fit the budget of Singaporeans so that they can own a unit in these particular developments, especially in prime areas. Since then, they revised the initial 70sqm used to determine the maximum number of dwelling units to 85sqm outside the Central Area. They also expanded the number of Central Areas, which used 100sqm to derive the maximum number of dwelling units from 4 to 9. The revised guidelines also include the percentage mix for larger and smaller units that would define a good mix of unit sizes.

How do these benefits buyers?

The intervention from URA was very important as it prevented a trend of units unsuitable for larger families or even extended families. At the same time, cramped living would not be ideal for quality living which is coincidentally URA’s policy. With the revised guidelines, unit size mixes are relatively healthier in the new developments. At the same time, we have mentioned on many occasions that consumers are getting better educated and savvy. They would appreciate something of quality, even if it meant paying a slight premium instead of a subpar product that suits their budget.

Another positive in this revision is the expansion of areas that a family can consider shortlisting. Without the revision, buyers may be limited to certain areas where developers decide to offer larger units. However, in today’s context, you can find a suitable 3-Bedder whether you are considering OCR, RCR or even CCR, according to your budget. This has indirectly caused developers to be more competitive in terms of their offerings in order to attract savvy buyers. Encouraging the rise of developments like Principal Garden with its award-winning architecture, Amber Garden that places emphasis on luxury living for those that would appreciate it, and Irwell Hill for savvy investors who have been eyeing a lower quantum entry in the CCR.

Performance over the years

After speaking quite positively and reviewing the data of the developments that have yielded lesser units or used lesser of their land space, does it mean that all developments with similar traits are good? Hold your horses. Buying a property is not the same as buying vegetables from the market.

Goodwood Park Residence

Goodwood Park Residence is relatively similar to Principal Garden, promoting lush landscaping, wide open spaces and that same 80% facility space with 20% residential coverage. The only difference is that it is also a luxury condominium development similar to Amber Park.

Wow! Having both traits, surely it is a super performing project, isn’t it? Well, not exactly.

Developed by GuocoLand Group, the development was completed in 2013. It has a similar land size to Principal Garden of 267,460 sqft but only one-third of the number of units at 210 units. That’s a lot of space for very few people. Well, it is a luxury development after all. The developers would not have planned for large crowds buying into the development. So how has it performed? Since the start of its sale of units in 2010 to date, it has done its primary role as a freehold property of being a good store of value. A quick comparison to Reignwood Hamilton Scotts, owners who have bought their units in 2008 would have profited nicely if they exited in 2013 or even 2014. But had they held through from 2008 all the way to 2021, then the performance of this development requires a little more patience before they are able to receive the good hold of value a freehold property primarily has.

However, in terms of appreciation, Goodwood Residence has not faired exceptionally well compared to Trilight, which saw a hold of value plus an appreciation twice that of Goodwood Residence. Although this would be considered relatively good performance within the D10 area, we have seen developments with 2 times the appreciation like the integrated development, The Centris, in the same time frame of 2010 to 2021. Sufficient to say that not all projects with traits like lesser units and vast open spaces perform the same. There are many factors and engines behind a property’s performance. Various underlying factors to consider and ultimately determining your intention of purchasing that property will make ease your decision-making process.

Our Take

Disparity does not just occur between projects in the same vicinity. There are also disparities between regions. We recently spoke about the consolidation phase of the Core Central Region and some comments which we think might be useful to investors and homeowners. Irwell Hill has been mentioned many times over on news portals and real estate pages. Part of the reason for that is the freshness it brings to the CCR district, more specifically, District 09. Do keep up with our podcast Nuggets On The Go for weekly Insights.

Vast open spaces and having lesser neighbours do contribute to the considerations of buyers in developments. However, they are not primary considerations. The other factors to consider have been mentioned in this article, and we would be happy to mention them to you again should you require a consult. Please do not hesitate to contact our consultants if you require further evaluation of your overall portfolio or just need some general advice on certain developments. Alternatively, you can always leave a comment down below, and we will respond to you at the soonest possible time. Once again, from the Insights team, till the next article, and we will catch you on our Signature Home Tour Series.