As an inexperienced or new property buyer or investor, you may feel somewhat uncertain about what you should consider towards your monthly instalments commitment. Of course, your home is probably one of the largest purchases you will make in your lifetime, so this commitment is very important.

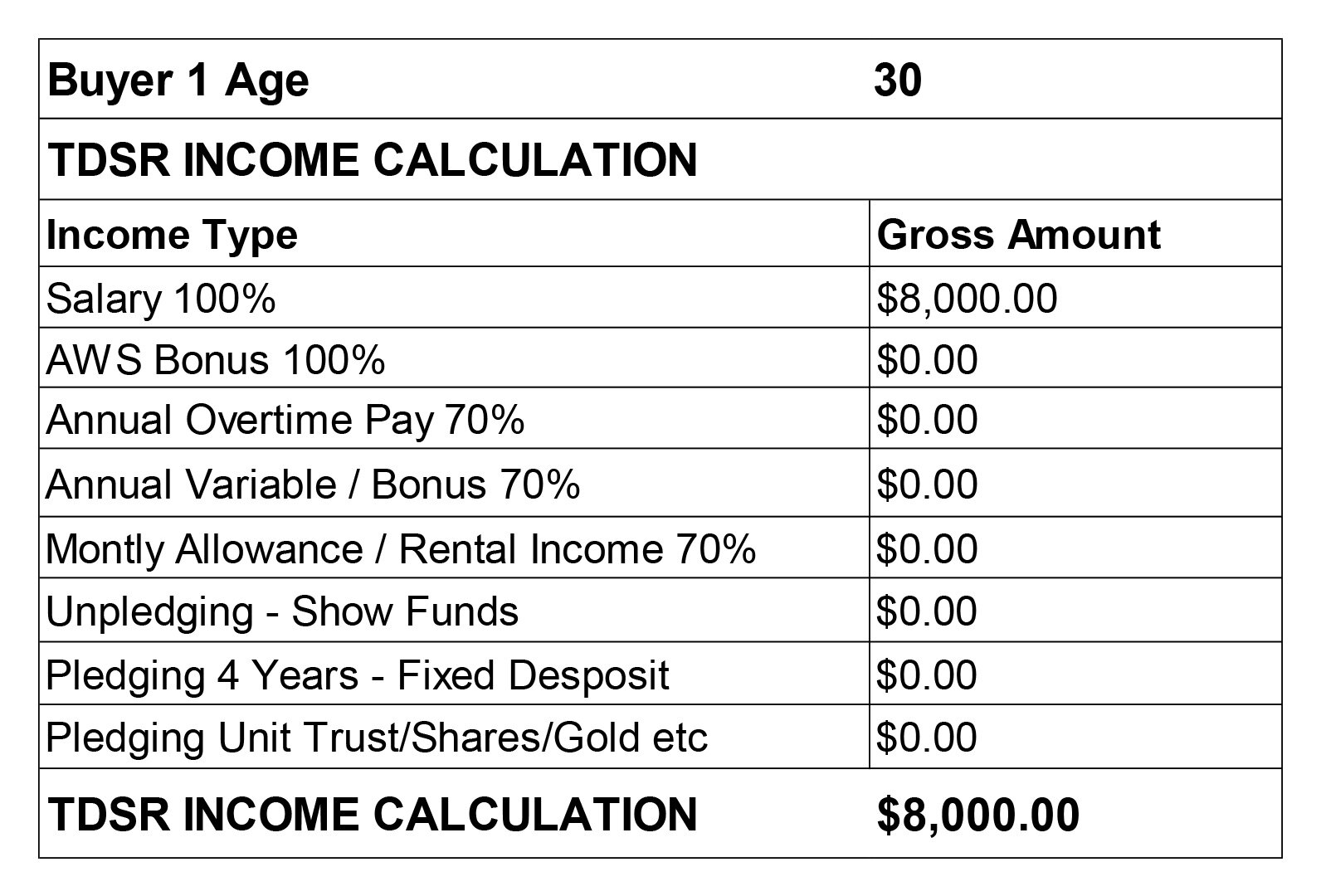

Let’s paint a scenario. You are now 30 years old. Throughout your working life so far, you have been taking home a monthly gross salary of $8,000. You are not paying off a car loan or any other debt obligations.

Based on a 60% TDSR calculator, how much would you be able to loan to purchase a private residential property?

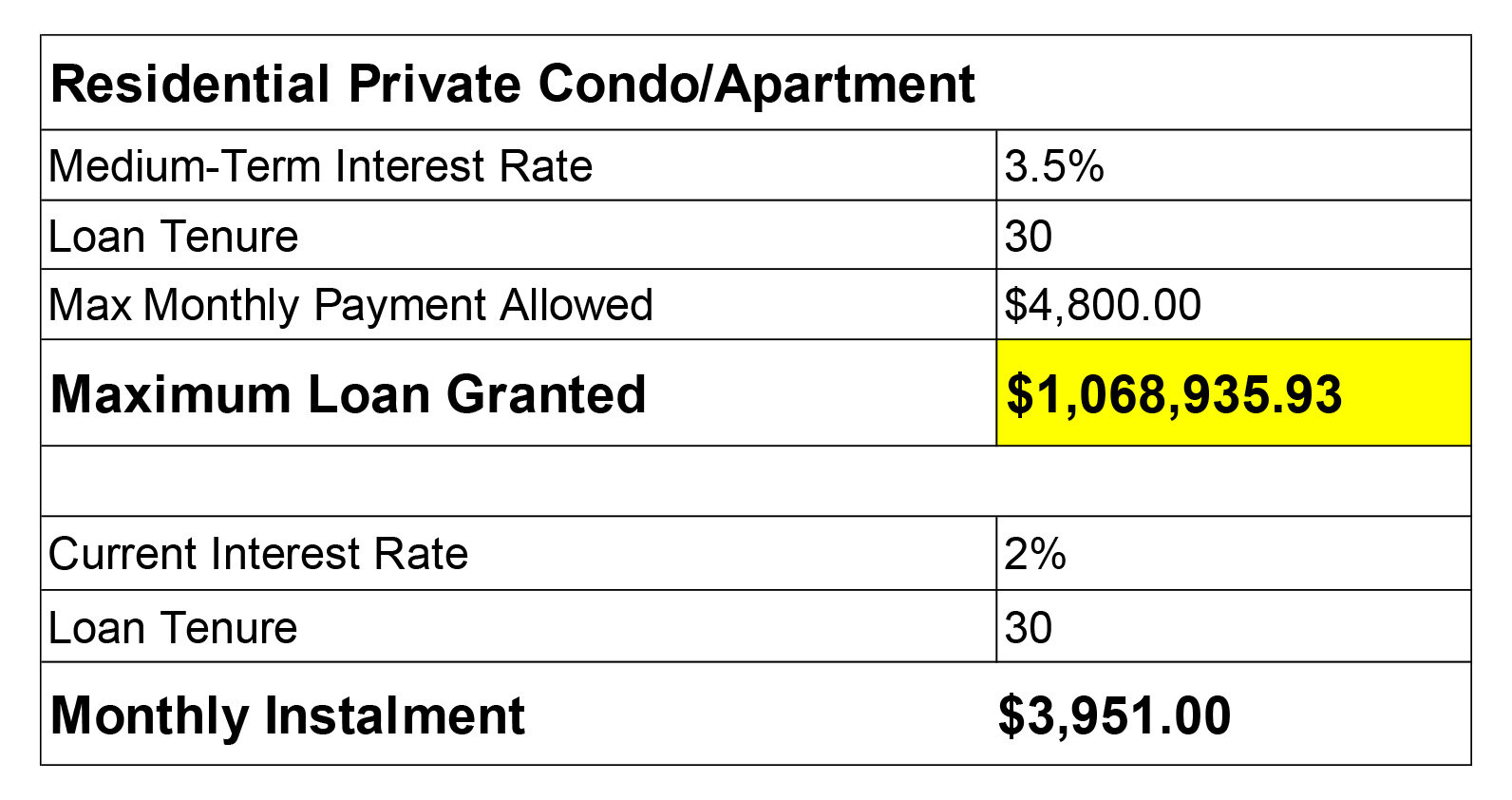

You can loan up to approximately $1.068 million based on a stress test interest rate of 3.5% according to the Monetary Authority of Singapore (MAS) loan regulations. This is the maximum loan quantum of your 75% loan against the total price of the property.

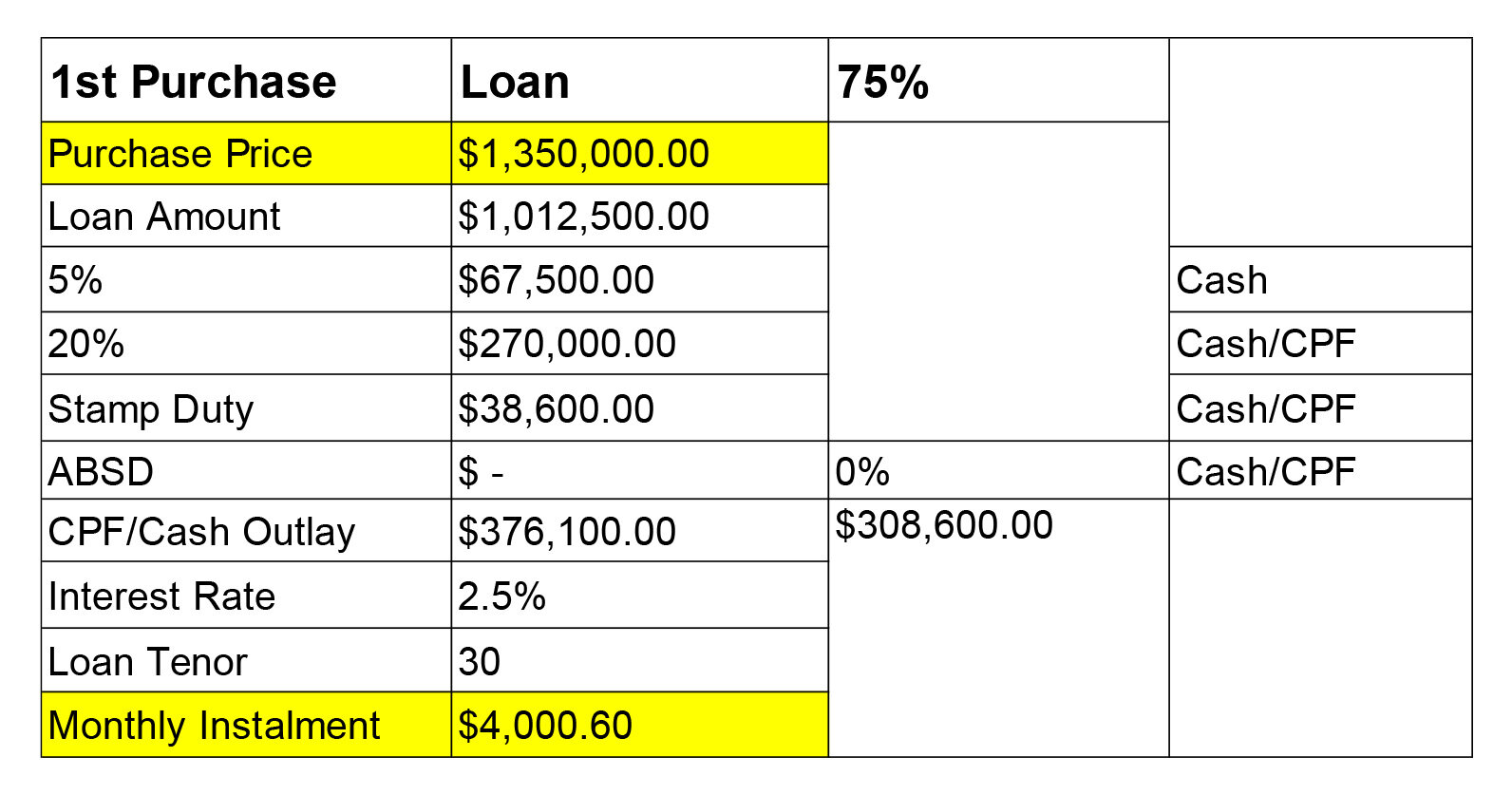

Therefore, for the remaining 25%, you would need to pay a down payment. With this, we work out the purchase price that you can afford to be approximately $1.35 million. Taking up a 75% loan, it amounts to a bank loan of $1.012 million. With a maximum loan tenure of 30 years, you will be paying a monthly instalment of roughly $4000.

Assume an interest rate of 2.5%. What does this mean to you as a borrower? If you are earning only $8000 a month, would it be wise to purchase a property at a $1.35 million quantum with monthly instalments of $4000 a month?

It is advisable to consider the factors that play a part towards deciding if this is worth it, and calculate your figures carefully, as this investment will be a mid to long-term decision.

There are six important components:

-

What is the level of disposable income you are comfortable living with after the property investment?

-

After you purchase your property, do you intend to own a car? Your monthly car instalment could amount anywhere from $700 to $1200 a month, depending on the car model you are looking at.

-

Do you have existing monthly/annual insurance premiums you have to continue servicing?

-

Do you need to set aside finances for your family – perhaps an education fund for the kids?

-

How much would you need for your daily living expenses?

-

You probably want to set aside some savings for rainy days or in the event there is a loss of income.

All in all, consider all the above factors carefully, and decide whether the monthly instalments for your property purchase is one that you would be comfortable to handle at your current financial standing.

To put things into perspective, with $8000 income a month, you have to set aside approximately $1200 in OA CPF contributions as an employee, so you will be taking home about $6800 in cash every month. If you buy that $1.36 million property with monthly instalments of $4000, at your current age, $1380 can come from your CPF Ordinary Account. This means you would have to top up $2620 in cash to service your monthly mortgage instalments. This would leave you with a disposable income of $4120 for everything else. It is up to you to decide whether this is enough for your personal expenses, savings, and so on.

So if you need some advise or help working out your financial sustainability plan and what works for you & your family, reach out to the PropertyLimBrothers team.