In the latest release under the 1H2025 Government Land Sales (GLS) Confirmed List, three residential plots have been launched for tender—two private residential sites at Dunearn Road and Lakeside Drive, and one Executive Condominium (EC) site at Woodlands Drive 17.

All three sites come with 99-year leasehold tenures. Here’s a closer look at each plot and what it could mean for the market.

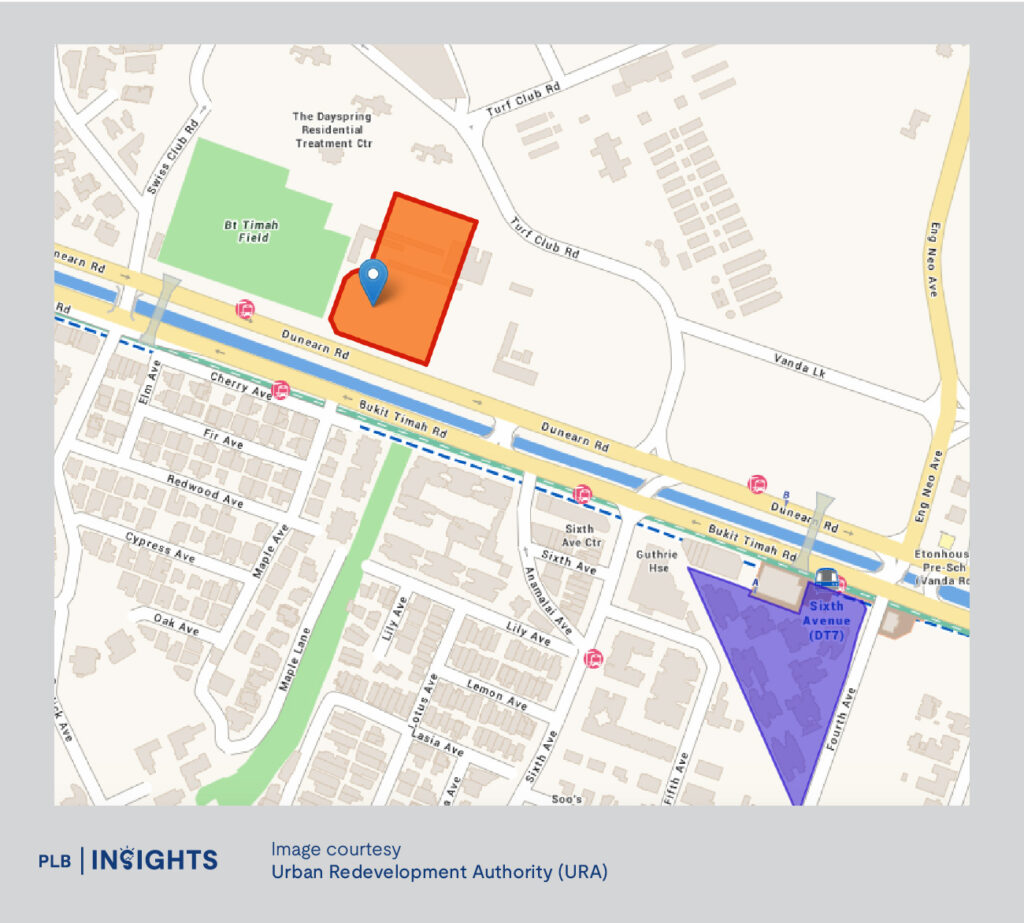

Dunearn Road: First Private Residential Plot in Turf City

Marking the first-ever private residential site in Turf City, the Dunearn Road plot could pave the way for developers keen to gain a first-mover foothold in the upcoming Stables Commune neighbourhood.

With a site area of 144,238 sq ft and a GFA of 348,549 sq ft (plot ratio 2.4), the future development is expected to yield about 380 units. The location is within walking distance to Sixth Avenue MRT (Downtown Line) and future Turf City MRT (Cross Island Line)—slated for completion by 2032.

This is also the first GLS plot launched in the Bukit Timah area since 2017, when Allgreen Properties acquired the site for Fourth Avenue Residences at $1,540 psf ppr. That project has since fully sold at a median price of $2,406 psf.

With strong locational attributes and proximity to schools like Methodist Girls’ School, industry experts expect five to six bids, with the top price likely to fall between $1,400 and $1,500 psf ppr.

Lakeside Drive: Jurong Sees First Launch in Nearly a Decade

Over in Jurong West, the Lakeside Drive site offers a land area of 145,314 sq ft and a plot ratio of 3.6—yielding 575 residential units and 10,764 sq ft of commercial space on the ground floor.

Located directly next to Lakeside MRT Station and within walking distance of Jurong Lake Gardens and the Jurong Lake District (JLD), this site presents strong redevelopment potential. It also comes on the back of a nearly 10-year lull in new launches, with the last being the 710-unit Lake Grande in 2016.

Analysts anticipate strong interest from developers—buoyed by a sizeable upgrader pool in Jurong West and limited new supply in the JLD. Notably, across J’den, The Lakegarden Residences, and SORA, only 360 units remain unsold.

Expect between five and eight bids, with a top bid ranging from $1,050 to $1,150 psf ppr.

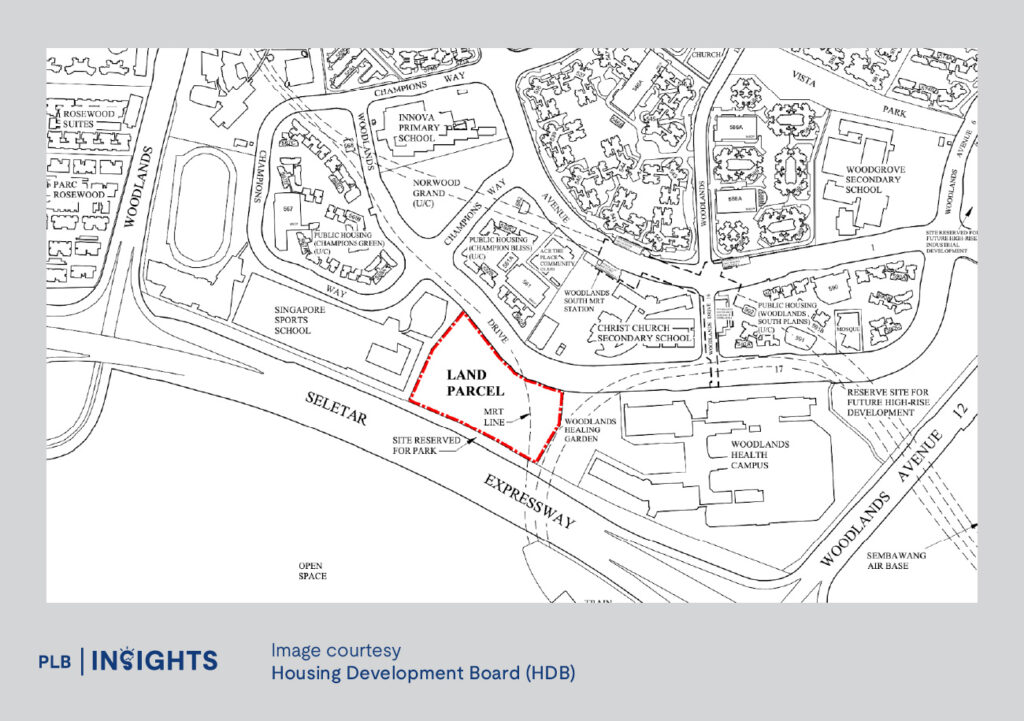

Woodlands Drive 17: EC Plot to Fill Longstanding Supply Gap

The EC site at Woodlands Drive 17 spans a larger area at 271,328 sq ft, with a plot ratio of 1.7 and a potential yield of 420 EC units. Importantly, this plot is located within walking distance of Woodlands South MRT, just one stop from Woodlands Regional Centre and two stops from the upcoming RTS Link to Johor Bahru.

This tender could see keen developer interest due to the near-decade-long gap in EC supply in the Woodlands area—the last launch being Northwave in 2016.

However, the tender will close alongside the Senja Close EC site (launched last month), which could lead to more cautious bids and slightly diluted interest. Even so, Woodlands’ positioning, along with a large number of primary schools nearby, offers strong appeal for HDB upgraders.

Expect four to six bids, with top offers potentially landing between $700 and $750 psf ppr.

Tender Deadlines:

With developers navigating current market volatility—triggered by global economic uncertainties and financial market fluctuations—bidding activity across the three sites is likely to be measured but optimistic. Strategic locations near MRT stations and long-standing supply gaps could drive competitive tenders despite cautious sentiments.

Have questions or need guidance on the latest GLS tenders or other property matters? Reach out to our sales consultants for personalised advice and support tailored to your needs.