When Commonwealth Towers hit a new record of $2,536 psf in early August 2025, some were surprised. After all, the 99-year leasehold project was completed in 2017, making it neither brand-new nor freehold — two qualities often thought essential for record-breaking prices. Yet a 3-bedroom unit on the 43rd floor still fetched $2.73 million, proving that mid-life leasehold condos can not only hold their ground but also set new benchmarks.

This development challenges the conventional wisdom that only recently completed or freehold projects can enjoy capital appreciation. Commonwealth Towers shows that enduring fundamentals — not marketing gloss — are what keep values rising. For buyers and sellers today, that lesson matters more than ever.

Commonwealth Towers in Context

Completed in 2017, Commonwealth Towers sits along Commonwealth Avenue in District 3. The project comprises two 43-storey towers with 845 units, ranging from 1- to 4-bedroom layouts (441 sqft to 1,302 sqft).

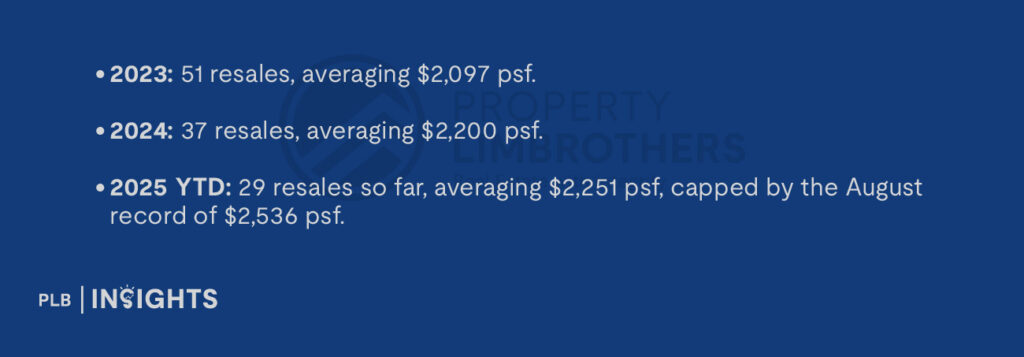

Transaction data paints a picture of steady growth:

This appreciation is striking when compared to some newer mega-developments like Parc Clematis, which has also seen record highs but is only a few years old. Commonwealth Towers proves that time on the clock doesn’t necessarily slow down value creation. Even with about 87 years left on its lease, it continues to attract buyers willing to pay premiums.

Why Commonwealth Towers Still Breaks Records

Mature Connectivity and Urban Integration

Location remains one of its strongest suits. Commonwealth Towers sits in the heart of the city-fringe, directly served by Queenstown MRT. From here, the Central Business District (CBD), Orchard Road, and Buona Vista are all within easy reach. Unlike some upcoming new launches that trade on future connectivity, Commonwealth Towers already delivers the accessibility that professionals and families prioritise.

The area around Queenstown has also been steadily rejuvenated, with upgraded malls, lifestyle nodes, and improved amenities. Buyers don’t have to speculate on what might happen — the conveniences are already there.

Family-Sized Units and High-Floor Premiums

The record transaction — a 1,076 sqft 3-bedroom unit on the 43rd floor — illustrates two truths. First, in an era where new launches often squeeze 3-bedrooms into 900–1,000 sqft, larger layouts remain in demand. Second, high-floor premiums are alive and well: unblocked city views oftentimes (but not always) still command a significant uplift.

This combination of size and liveability gives Commonwealth Towers an edge. Families seeking long-term homes often prefer a slightly older project with more generous proportions over brand-new but compact layouts.

Proof of Mid-Life Value Creation

Many buyers fear that once a leasehold project passes its first few years, values stagnate. Commonwealth Towers defies that narrative. At eight years old, it’s entering what some call the “mid-life” phase — no longer new, but far from old.

Yet instead of plateauing, its prices have risen steadily year after year. The takeaway? Leasehold depreciation isn’t linear. When the fundamentals are strong, the market continues to reward the project well beyond its initial honeymoon phase.

Neighbourhood Appeal: Queenstown as an Evergreen Hub

Beyond the project itself, the Queenstown precinct has proven to be one of Singapore’s most versatile hubs. It is flanked by employment zones at one-North and Buona Vista, boasts direct train access to the CBD, and offers proximity to reputable schools and lifestyle amenities.

The result is a consistently deep buyer pool: young professionals who value connectivity, families drawn by schools and convenience, and investors who see rental demand backed by nearby work nodes.

Advice for Sellers at Commonwealth Towers

Position Age as an Advantage

Instead of apologising for the project being eight years old, sellers should highlight it as a sweet spot. Buyers today prefer units that are move-in ready, with proven rental demand and well-maintained common facilities.

Showcase Unit Differentiation

Not every unit can command $2,536 psf. The record was achieved by a top-floor, well-sized unit with strong attributes. Sellers of lower-floor or road-facing units should adjust expectations accordingly. Emphasise strengths like efficient layouts, minimal west-sun exposure, or unique stack advantages.

Be Strategic With Pricing

With average psf prices climbing from $2,097 in 2023 to $2,251 in 2025, there’s clear upward momentum. Sellers can leverage recent data to defend firm asking prices. But overpricing relative to stack or floor can backfire in a market where buyers have abundant comparables.

Advice for Buyers Eyeing Commonwealth Towers

Don’t Fear the Leasehold Clock — 87 Years Is Still Strong

With about 87 years left, Commonwealth Towers offers plenty of value runway. For most buyers, this comfortably covers their holding horizon, whether as a home or investment. The record high demonstrates that market confidence remains robust despite the shorter tenure versus new launches.

Think in Quantum, Not Just PSF

While smaller units may show higher psf figures, larger 3- and 4-bedroom units often carry better value in absolute terms. Buyers should weigh not just psf but overall affordability and suitability for long-term needs.

Compare With New Launches Nearby

At over $2,500 psf, Commonwealth Towers may seem pricey. But some newer launches in the CCR often start higher, with smaller layouts and less established rental demand. For buyers who value livability and location, Commonwealth Towers can represent a better balance.

Prioritise Livability and Rental Resilience

Look for stacks with good ventilation, unblocked views, or quiet facings. These features not only improve day-to-day comfort but also ensure stronger rental yields and resale demand.

The Bigger Picture: Lessons From Commonwealth Towers

The record sale at Commonwealth Towers isn’t just a headline — it’s a reminder that fundamentals trump age or tenure type.

For homeowners, this means not dismissing mid-life leasehold projects when considering your next move. For investors, it’s a case study in how to look beyond labels and focus on functional strengths, location, and proven demand.

Conclusion

Commonwealth Towers’ record $2,536 psf transaction is more than a one-off — it’s proof that the right fundamentals outlast the passing of years. With strong connectivity, family-sized layouts, a rejuvenated neighbourhood, and nearly nine decades of lease left, this development demonstrates that appreciation is not reserved for shiny new launches or freehold titles.

Whether you’re a seller positioning your unit or a buyer eyeing your next home, the lesson is clear: judge a property not by age or tenure alone, but by the quality of life and depth of demand it sustains over time.

Thinking of your next move in today’s market? Reach out to our sales consultants for a tailored, data-backed strategy that helps you buy or sell with confidence.