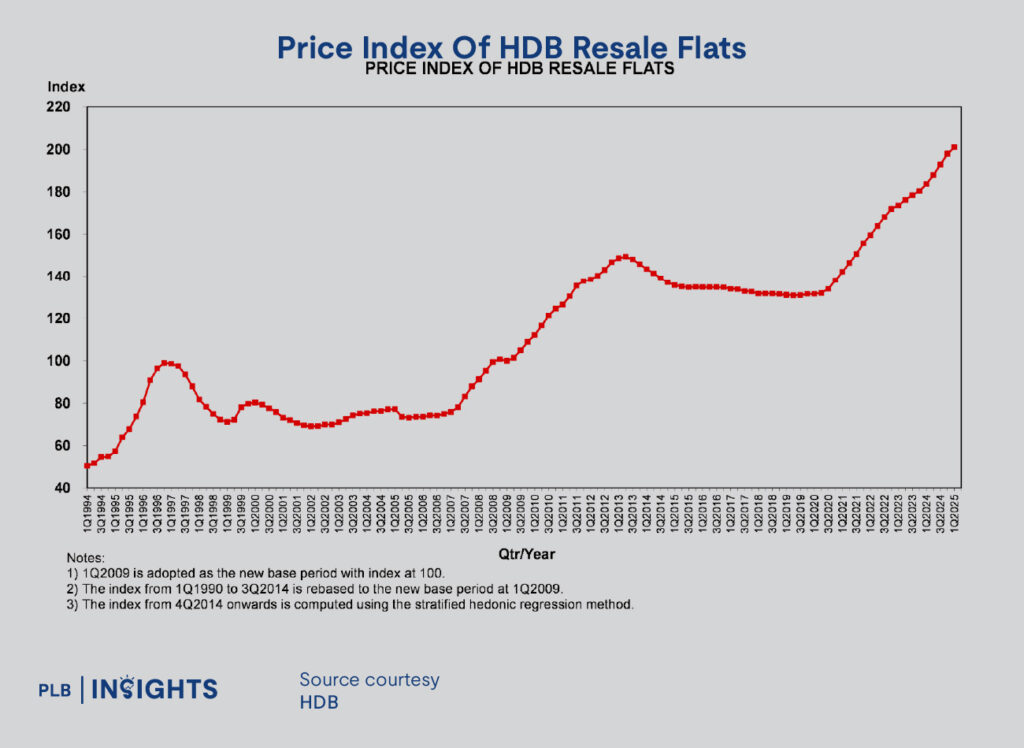

According to the Housing and Development Board (HDB), the HDB Resale Price Index (RPI) rose by 1.6% quarter-on-quarter (q-o-q) to 201.0 in 1Q 2025. This marks the 23rd consecutive quarter of price growth, although at a more moderate pace compared to the 2.6% q-o-q increase recorded in 4Q 2024.

Price Trends

- The 1.6% increase in 1Q 2025 reflects a slowing momentum in price growth, following a period of accelerated gains.

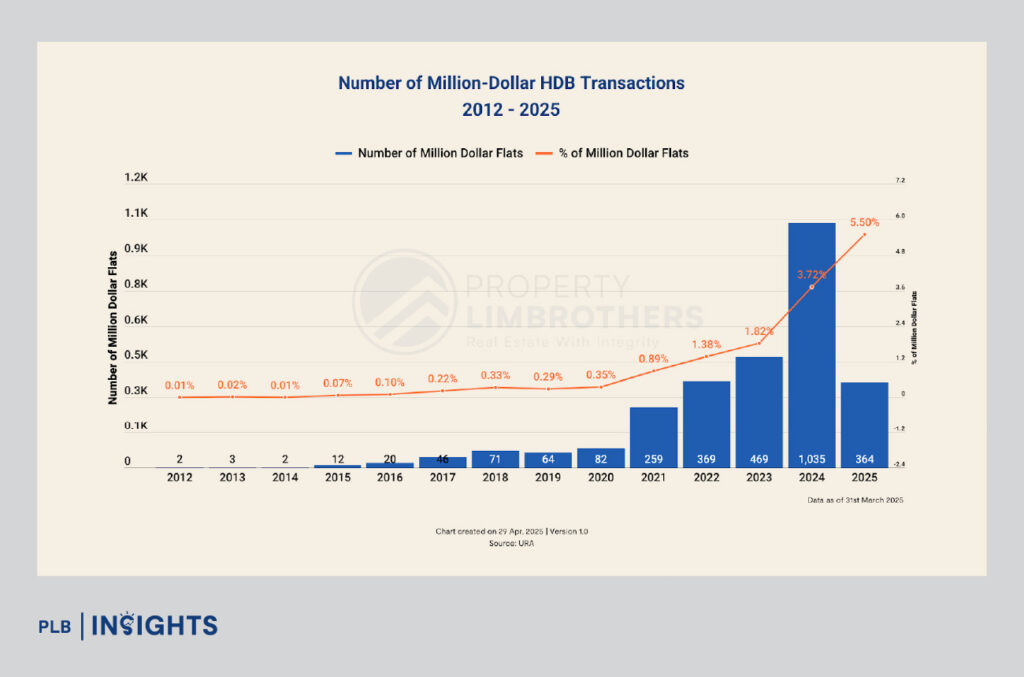

- 5.5% or 364 transactions were concluded at prices above $1million, a marked percentage higher than the 3% in 4Q 2024.

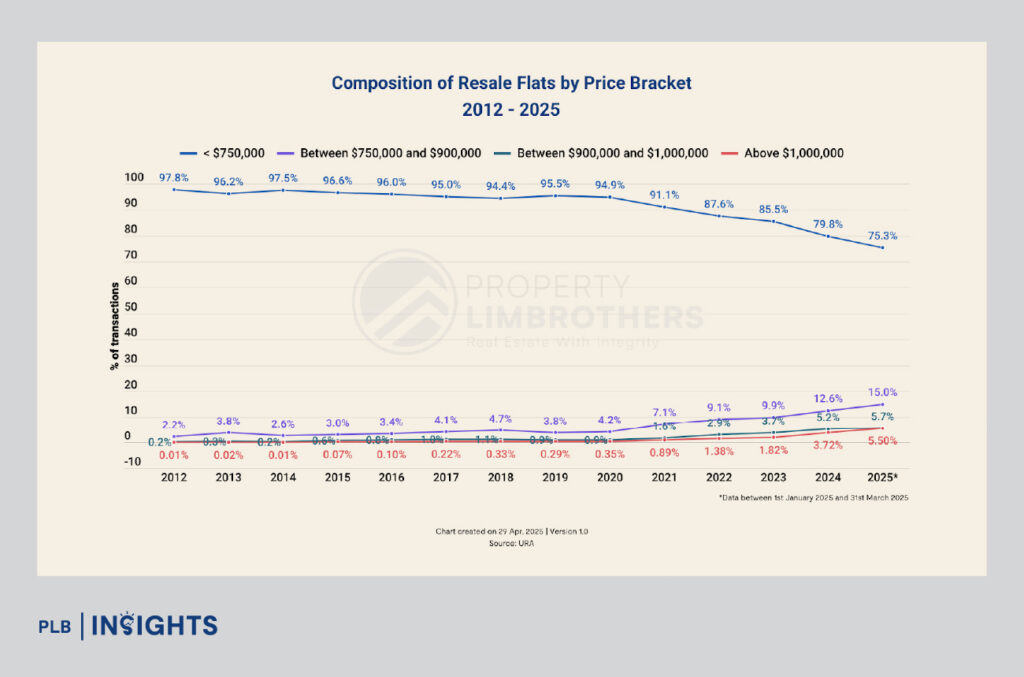

- However, 75% of the flats fall below the price of $750,000. This figure is lower than the 80% in 2024.

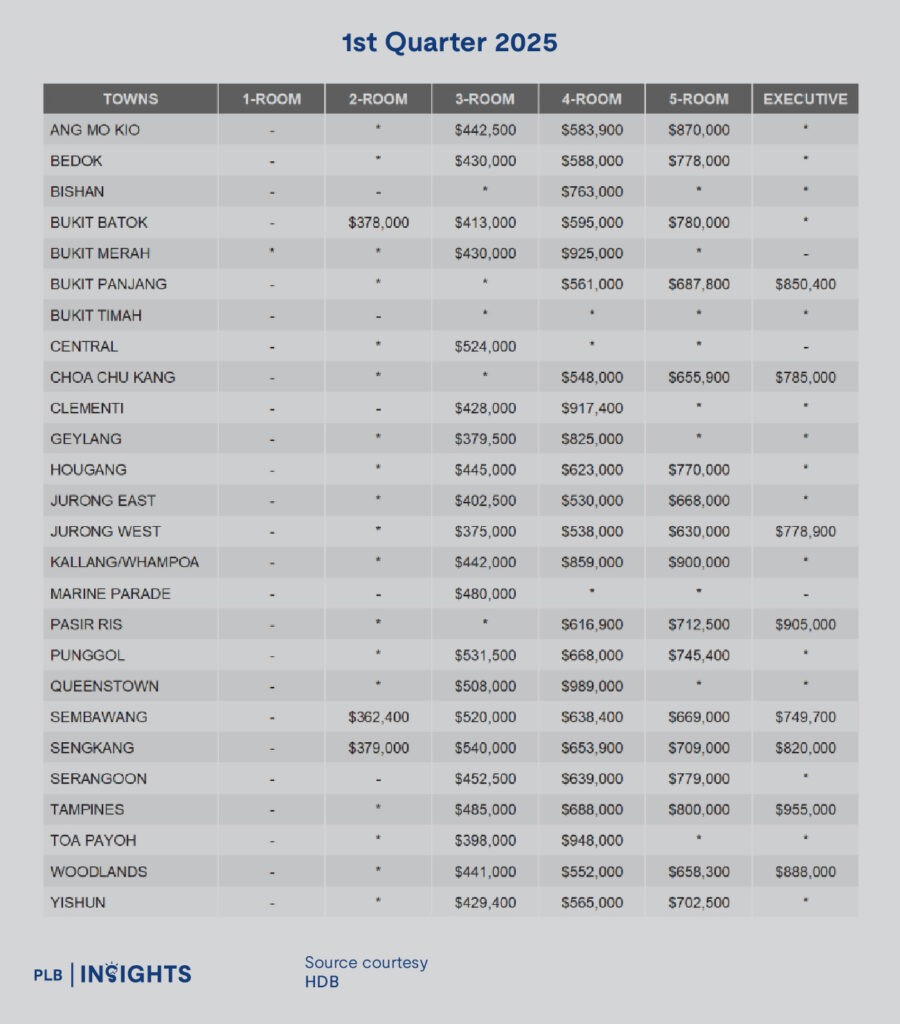

Among the towns, 4-room resale flats in mature estates such as Queenstown ($989,000), Bukit Merah ($925,000), and Toa Payoh ($948,000) commanded premium prices, reflecting the strong preference for central and well-connected locations.

Similarly, 5-room and executive flats in areas like Tampines ($955,000), Pasir Ris ($905,000), and Woodlands ($888,000) also transacted at higher price points, especially for newer, well-maintained units.

In total, 6% or 376 of the transactions fell between $900,000 and $1,000,000 in 1Q 2025.

Observation:

The rising share of million-dollar transactions signals sustained demand for well-located, newer flats, despite an overall moderation in market-wide price appreciation.

Transaction Volume

- 6,590 resale flats were transacted in 1Q 2025, representing a 2.6% q-o-q increase from 4Q 2024.

- However, resale volume fell 6.8% year-on-year (y-o-y) compared to 1Q 2024, where 6,790 units changed hands.

Even as transaction volumes have already slowed down as seen from the 1Q data, prices continue to climb, suggesting a bifurcation phenomenon. The case where flats with strong locational attributes — such as proximity to MRT stations, good schools, and desirable amenities — are likely to see premium pricing sustained, while older or less well-located flats may experience slower price growth.

Supply & Market Composition

- The composition of resale flats by price bracket continued to shift:

- Units priced $750k to $1M accounted for over 20% of transactions in 1Q 2025, up from 17% in 4Q 2024.

- The proportion of units priced below $750k shrank to 75% in 1Q 2025, compared to 80% for the whole of 2024.

- Units priced $750k to $1M accounted for over 20% of transactions in 1Q 2025, up from 17% in 4Q 2024.

- 364 million-dollar flat transactions were recorded, accounting for 5.5% of the total transaction and marking a new quarterly high, led by 4-room and 5-room flats in central locations such as Bidadari and Dawson.

- By flat type:

- 4-room flats continued to dominate transaction volume.

- 5-room and executive flats also saw a growing number of deals within the $750k–$1M range, particularly in city-fringe estates.

Rental Market

- HDB rental applications increased by 12.3% q-o-q to 9,662 cases in 1Q 2025.

- This represents a 2.8% y-o-y increase, underpinned by high private rental costs and upgrading activities among Singaporean households.

Upcoming Supply

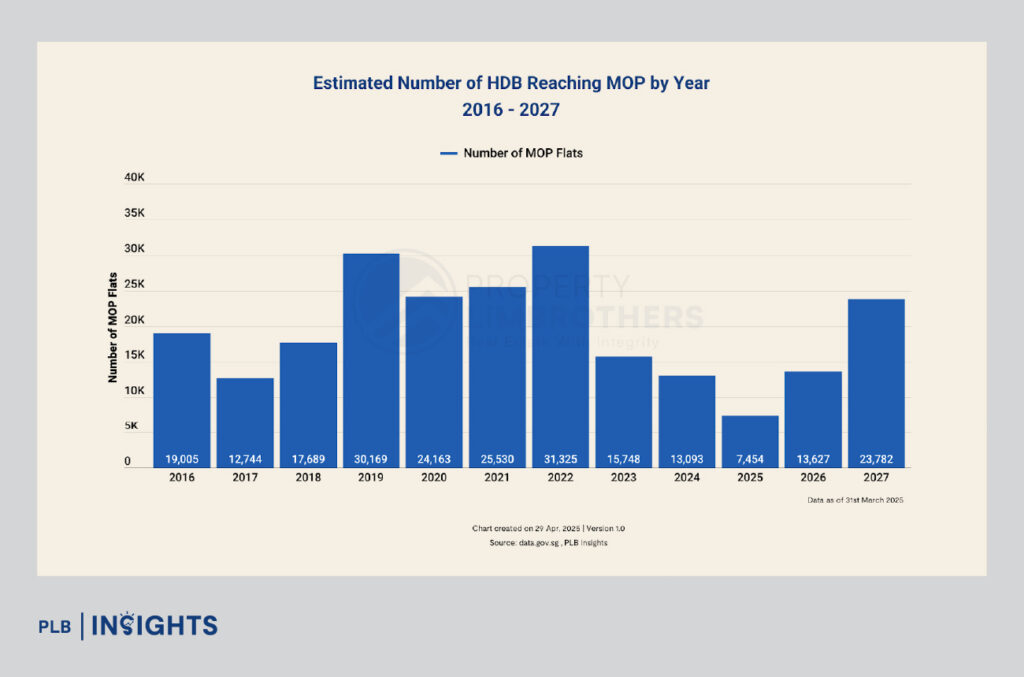

- Approximately 7,500 flats will reach Minimum Occupation Period (MOP) in 2025, with numbers expected to climb to 13,627 in 2026 and 23,782 in 2027.

- HDB will launch around 5,400 Build-To-Order (BTO) flats and 3,000 Sale of Balance Flats (SBF) in July 2025, in locations such as Bukit Merah, Clementi, Tampines, Toa Payoh, and Woodlands.

PLB Commentary

The HDB resale market in 1Q 2025 reflected a more measured pace of price growth amid evolving market forces.

While prices continued their upward trajectory, transaction volumes have softened compared to a year ago, highlighting a shift towards greater buyer selectivity.

The market is showing signs of bifurcation — with flats in strong, central or well-connected locations maintaining premium prices, while older or less accessible flats may see price growth moderating.

Meanwhile, the broader market faces supply pressures from upcoming BTO launches and MOP completions, which are expected to provide buyers with more options and could gradually ease competition in the resale segment.

Looking ahead, monetary policy is expected to take an expansionary stance, as slowing global economic growth and renewed trade tensions prompt central banks to lower interest rates.

A more accommodative environment may improve affordability and support transaction activity, but global uncertainties and cautious household sentiment are likely to cap excessive price growth.

Overall, we expect the HDB resale market to remain resilient but increasingly segmented, as buyers focus sharply on location, age, and long-term value.

Stay Updated and Let’s Get In Touch

Questions? Do not hesitate to reach out to us!

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. While every effort has been made that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be executed, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this website or for any resulting loss or damage suffered by the recipient or any other person.