In Singapore’s fast-evolving real estate landscape, it’s tempting to chase the sleek metrics—price per square foot (psf), rental yields, and capital appreciation curves. But for the everyday homebuyer, especially in the public housing segment, there’s one figure that continues to matter most: total quantum price.

That lump-sum amount—the sticker price you see on the listing—isn’t just a number. It’s the number that determines your mortgage, your loan eligibility, your CPF usage, and how much cash you’ll have left for renovations or lifestyle upgrades after the deal is done.

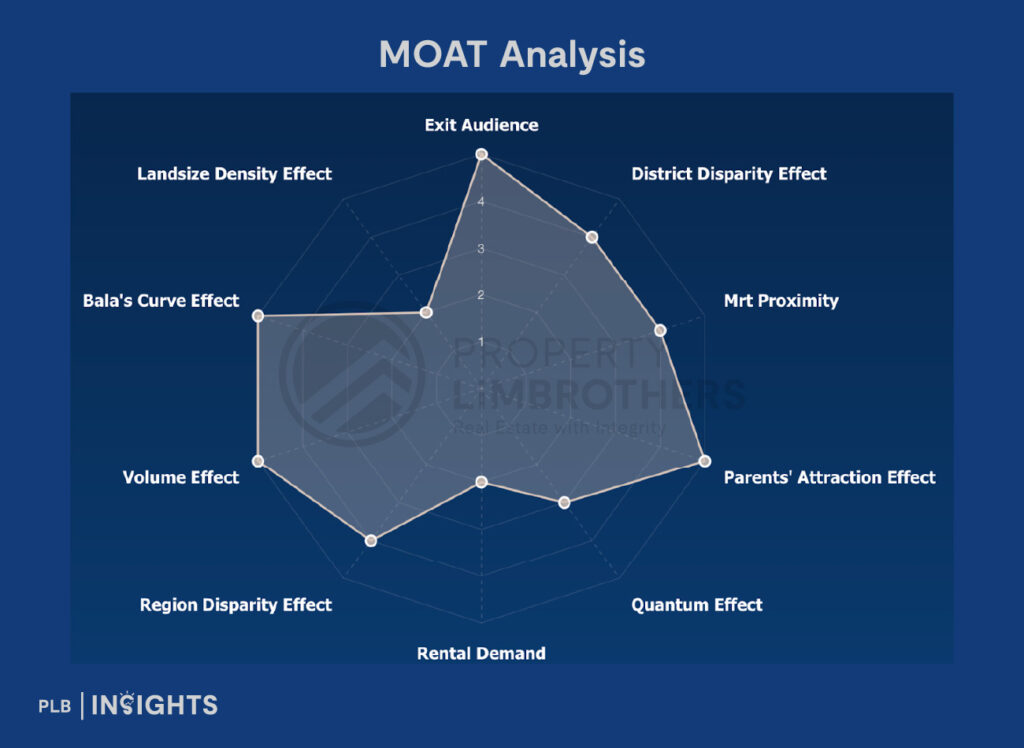

So even as unit pricing ($PSF) gains traction as a comparison tool across both public and private housing, it’s essential not to lose sight of the total quantum price. This article unpacks why, and how a balanced approach using both quantum and psf—paired with the right analytical tools like our proprietary MOAT Analysis—can make or break your real estate strategy.

The Shift Toward PSF in Public Housing—Is It Helpful?

Historically, private properties have been analysed in psf, allowing investors to evaluate apples-to-apples across vastly different units and developments. Public housing, however, has been largely marketed based on total price due to its owner-occupier nature and tighter government regulation.

But the real estate landscape is changing. HDB resale flats today are no longer homogeneous. They range from old-school corridor units to premium lofts and jumbo flats. Naturally, buyers are starting to apply a psf lens to make sense of what they’re paying for, especially when older flats offer more generous floor areas for the same price tag as newer but more compact units.

And for good reason—someone buying a 4-room resale flat for $850,000 might feel short-changed when they find out it’s only 667 sq ft ($1,274 psf), far above the national median of $594 psf. So yes, unit pricing reveals hidden truths. But here’s the catch: it doesn’t replace the importance of overall quantum—it complements it.

Why Overall Quantum Still Reigns Supreme

When you buy a home, you’re not buying square feet—you’re buying a roof over your head, financial stability, and peace of mind. Here’s why quantum should remain your north star:

1. Loan Eligibility: Banks and HDB assess your borrowing capacity based on the total loan amount, not the psf. For example, if you’re choosing between two 4-room resale flats—one priced at $680,000 and another at $780,000—the $100,000 difference in quantum can significantly impact your monthly mortgage repayments, upfront cash or CPF outlay, and total interest paid over time. This difference matters far more to your long-term affordability than whether one unit is slightly cheaper on a psf basis.

2. Grants and Subsidies: Grants for eligible HDB buyers are means-tested based on your household income, not the size or spaciousness of the flat. However, these grants come with a maximum limit, which means the amount you receive remains fixed once you qualify. When you choose a more affordable flat with a lower overall price (quantum), that grant covers a larger proportion of your purchase price—effectively lowering your cash outlay, loan amount, and monthly repayments. In other words, a lower quantum helps you make the most of the grant, strengthening your overall financial position and improving affordability.

3. Cash Outlay: CPF savings, Buyer’s Stamp Duty (BSD), and renovation budgets are all impacted by the total cost. A high psf unit may offer less value if it strains your cash flow and leaves little room for customisation.

4. Future Upgrades: A wise purchase at the right quantum price allows you to build equity faster. This directly affects whether you can afford to upgrade to a condo or landed home later, or if you’ll remain stuck in mortgage lock-in.

In short, the lower the quantum, the easier it is to manage financing, exit strategies, and long-term planning.

Layering the MOAT Analysis: A Smarter Lens for Decision-Making

Now, what if you could go deeper than just looking at price quantum or psf in isolation?

That’s where our proprietary MOAT Analysis comes in—a framework that helps buyers evaluate the strategic defensibility of a property through four core effects: District Disparity, Region Disparity, Volume, and Exit Audience. Let’s explore how each relates to pricing decisions.

District Disparity Effect: Don’t Just Compare PSF—Compare Context

This metric tells you whether a property is undervalued compared to others of the same type within the same district. If a unit is trading at 20% below its district average, it could offer substantial upside—even if the psf appears high at first glance.

Let’s say you’re comparing two resale condos in D14. One is priced at $1,650 psf (above average), and another at $1,400 psf (20% below the average). The second unit might seem more appealing—but only if the total quantum fits your budget and the location serves your long-term goals.

Region Disparity Effect: Are You Entering at the Right Price Point for the Area?

Beyond districts, this effect compares your property to regional pricing benchmarks (OCR, RCR, CCR). For instance, if you’re buying a 3-bedder at $1.3M in the OCR, and surrounding resale projects average $1.5M, that discount provides both a pricing buffer and stronger capital appreciation potential—assuming all variables are constant and the cheaper property has no major layout or location flaws.

Again, this is only meaningful if the overall quantum aligns with your affordability. An underpriced unit is only an opportunity if you can afford it.

Volume Effect: What Do Frequent Resale Transactions Tell You?

High resale volumes indicate healthy demand, better bank valuations, and smoother exits. From a pricing standpoint, it helps validate whether your quantum is in line with the current market.

Low-volume projects, on the other hand, may have outdated psf benchmarks—so even if the psf looks “cheap,” banks may be reluctant to value the unit at your purchase price, forcing you to top up in cash.

This is where quantum realism helps: don’t buy into a low-volume project just because the psf seems like a steal. The total cost must reflect true market liquidity.

Exit Audience Effect: Will Someone Pay That Quantum After You?

The presence of new or future HDB supply nearby tells you if there’s a pool of future upgraders who might be willing to pay your asking price when you sell. Even if your psf is on the high side, a strong upgrader pool ensures exit demand—which supports your resale quantum.

For example, an EC priced at $1.4M today might feel expensive at $1,400 psf. But if it sits near several newly MOP-ed BTOs, you may find buyers willing to pay $1.7M five years later—because you bought at the right quantum price.

Making It Work For You: From First Flat to Future Home

Following this approach—anchoring your decision in the total quantum price while using psf and MOAT metrics to guide value—helps you:

- Buy smarter within your means, so you’re not financially overstretched

- Build equity and plan an upgrade path, from HDB to condo, or condo to landed

- Avoid overpaying for shiny metrics, and stay focused on real-world affordability and resale strategies

In other words, the psf might impress on paper, but the quantum determines whether your financial goals stay on track.

Final Thoughts

As Singapore’s housing market matures and diversifies, savvy buyers need to sharpen how they evaluate properties. PSF metrics offer valuable insights—especially as HDB flats become more varied in size and layout—but they shouldn’t overshadow the fundamental importance of the overall quantum price.

Ultimately, a property’s total price tells a fuller story. It defines not only what you can afford today, but what you’ll be able to do tomorrow—whether it’s upgrading, renovating, or simply staying financially secure. While metrics like psf and the MOAT Analysis tool can help you identify undervalued opportunities and market trends, it is the total quantum price that determines your financing options, CPF usage, and future flexibility. Even the most attractive investment opportunity on paper can backfire if the overall cost stretches you too thin or leaves you with little room to manoeuvre.

By anchoring your decisions in quantum while layering in strategic tools like the District and Region Disparity Effects, Volume Effect, and Exit Audience Effect, you gain a more grounded understanding of long-term value. A smart purchase isn’t just about price per square foot—it’s about how the entire package fits into your life plan. And when done right, that’s what sets the foundation for every successful real estate journey.

Want help assessing whether you’re overpaying—or making the right move? Our consultants are ready to guide you.