The government has released two residential sites for tender under the 1H2025 Confirmed List of the Government Land Sales (GLS) Programme—an Executive Condominium (EC) site along Sembawang Road and a prominent mixed-use site in Hougang Central. Combined, the plots could yield around 1,100 new homes, with developers expected to bid aggressively given pent-up demand and attractive locational attributes.

Sembawang Road Site

Hougang Central Site

Sembawang EC: One of the North’s Last Few Prized Plots

Spanning 18,968 sqm with a maximum gross floor area (GFA) of 26,556 sqm, the Sembawang Road EC site is expected to generate up to 265 residential units. Analysts expect top bids to fall between S$600 and S$700 psf ppr, potentially attracting up to eight developers.

This tender comes at a time when supply of ECs in the north region remains scarce. North Gaia, the last EC project in Yishun, has sold out, while only a few units remain at the recently launched Novo Place. Market watchers believe the new EC will appeal to HDB upgraders in nearby towns such as Yishun, Sembawang, and Woodlands, with over 3,500 flats expected to reach MOP between 2026 and 2029—fueling a healthy pipeline of buyers.

As EC prices continue to trend upward, they remain a compelling value proposition. In 2024, ECs averaged $1.48 million for 900–1,000 sqft units, a stark contrast to the $2.1 million median for Outside Central Region (OCR) private condos of similar size. The affordability gap continues to drive demand from middle-income households who meet the $16,000 income ceiling.

Yet despite the strong buyer pool, developers may remain cautious. The site shares similarities with other recently launched OCR plots in Woodlands and Bukit Panjang, and its 11 September closing date coincides with the tender for a large mixed-use site in Chencharu Close—also within the Yishun/Sembawang region. This clustering could split developer attention and cap bidding enthusiasm.

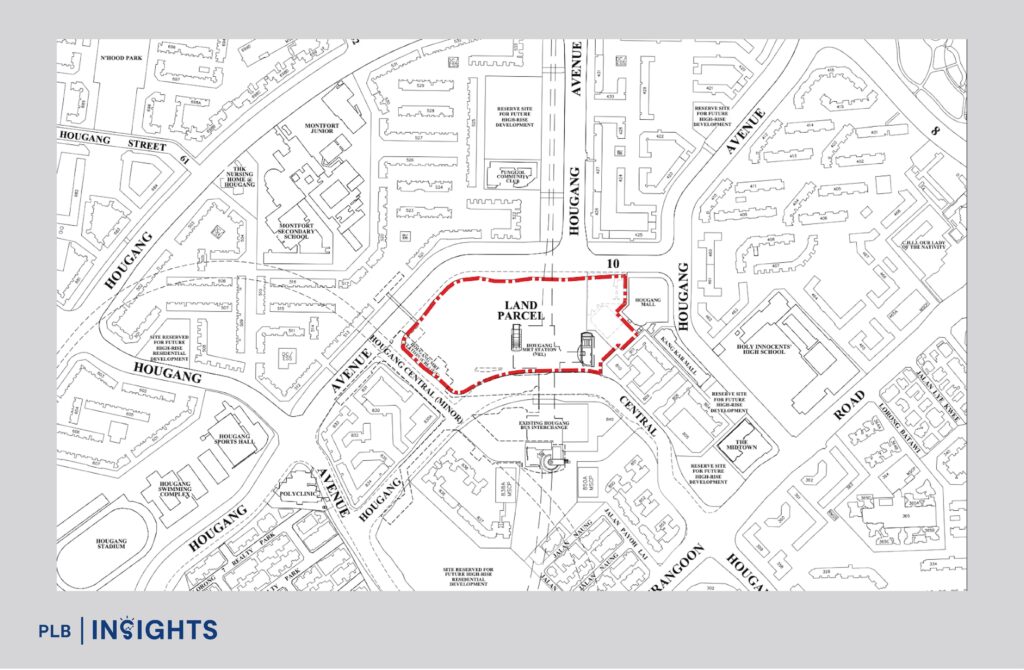

Hougang Central: The First Major Launch in the Area Since 2019

If the Sembawang site offers affordability and family-sized living, the Hougang Central mixed-use site promises integrated urban convenience.

Strategically located right above Hougang MRT station, the expansive 46,898 sqm site can support a 117,245 sqm GFA, comprising 835 residential units and a massive 40,000 sqm of commercial space—almost double the size of the existing Hougang Mall nearby.

This GLS launch is Hougang’s first since 2019, and the first in the area since the Upper Serangoon Road GLS tender in 2014. Given the long hiatus, analysts expect strong pent-up demand not just from HDB upgraders in Hougang, but also from families in nearby Serangoon, Punggol, and Sengkang. Residents in landed enclaves around the area may also be keen to rightsize.

The site is poised to be a new commercial hub for the mature estate. The URA Master Plan has already zoned surrounding plots for more housing, setting the stage for long-term retail and F&B demand in the area.

Developers are expected to submit joint venture bids for the large-scale project, with top land rates projected between $800 and $900 psf ppr. Such mixed-use launches tend to perform well—Parktown Residence in Tampines sold 90% of its 1,193 units over its launch weekend, offering a strong precedent.

Temporary Closures for HDB Facilities in Hougang

As part of redevelopment works, three HDB facilities in Hougang will shut down in phases. These include the HDB Hougang Branch (closing Sep 1), the adjacent sheltered atrium (end-Sep), and the surface car park at Hougang Ave 10 (end-Mar 2026). To support residents, a 24/7 e-Lobby will be operational from Sep 1, equipped with HDB e-service kiosks and AXS machines.

The Bigger Picture: GLS Supply Continues to Build Momentum

The dual-site tender release reinforces the government’s commitment to meeting housing demand across income segments—offering options for upgraders, investors, and right-sizers alike. While the Sembawang EC site taps into value-driven aspirations, the Hougang Central site offers the rare appeal of MRT connectivity, commercial vibrancy, and neighbourhood transformation.

With both tenders offering distinct value plays and overlapping buyer pools in the north and northeast, competition will likely be fierce—not just among buyers during launch, but among developers right from the bidding stage.

Tender Closing Dates:

- Sembawang EC Site: September 11, 2025

- Hougang Central Mixed-Use Site: December 16, 2025

Stay tuned for more updates on bid outcomes and eventual project launches.

Curious how these upcoming projects might align with your next move—whether you’re upgrading from your current flat or exploring investment options? Speak with our sales consultants for a tailored breakdown of what each site could offer once launched.