When a resale flat in Singapore fetches $1 million or more, the headlines still come fast: “HDB flat hits record price!”, “Public housing now unaffordable!”, “Is this still public housing?” It’s easy to circle a few jaw-dropping transactions and point fingers: greedy sellers, inflation, speculative frenzy.

But what if million-dollar HDBs are not the issue — but a reflection of broader structural changes in supply, demand, incomes and evolving aspirations? If we fixate on the price tags alone, we risk overlooking what is truly driving the market.

Why Million-Dollar HDBs Grab Headlines — And Mislead Perception

Million-dollar HDB transactions are rare — yet they dominate traditional media, social media, and everyday conversations because they are attention-grabbing. One eye-catching sale can easily overshadow the thousands of resale transactions that close quietly each month at far more typical price points.

Recent 2025 data shows that roughly one-fifth to one-quarter of all resale flats still transact below $500,000, reflecting the significant availability of entry-level units across non-mature estates. The largest share of resale activity continues to sit in the $500,000 to $750,000 range, which forms the bulk of transactions across many towns and flat types. Meanwhile, only a small minority of flats cross the $1 million mark — and these are overwhelmingly rare, highly desirable units in prime or exceptionally well-located estates.

But despite their small numbers, million-dollar flats exert an outsized psychological pull. Their shock value — “public housing selling like private property!” — shapes public perception disproportionately. Many walk away from headlines assuming that all HDBs have become unaffordable, even though the vast majority of resale flats remain well below seven figures.

In reality, million-dollar HDBs represent the extreme upper tail of a broad price distribution. They are outliers — not benchmarks — and viewing them as representative can distort how we understand affordability, mobility, and the true state of the resale market.

What Million-Dollar HDBs Reflect: Root Structural Forces

1. Location Premiums and Estate Maturation Have Intensified

Million-dollar resale flats overwhelmingly cluster in mature, central, or highly connected towns — especially near MRT interchanges, established amenities, and neighbourhoods where daily convenience is exceptionally strong. As Singaporeans juggle demanding work schedules, ageing parents, childcare needs, and long commutes, the value of “living close to everything” has grown significantly.

This is not speculative hype but a reflection of structural demand. A well-located 4-room flat in a mature town, on a high floor with an open view and ready access to transport and services, naturally commands a higher premium than a larger flat in a more perceived “remote or less developed area”. The market has increasingly differentiated between flats that offer both quality living environments and prime convenience, versus flats that simply offer space.

When these well-positioned homes cross the $1 million mark, it is better understood as the result of accumulated location value rather than irrational exuberance. Their prices reflect years of estate maturation, urban development, and rising demand for accessibility — not a sudden, out-of-nowhere surge driven by emotion.

2. Household Aspirations and Needs Have Evolved Faster Than Supply

In 2024, the median monthly household income rose to $11,297, up from $10,869 in 2023.

On a per-household-member basis, the median income rose to $3,615 in 2024 (from $3,500).

What this means: many households today — especially dual-income couples, small families, or multi-generational households — have more purchasing power than before. At the same time, housing expectations have changed: people want space, flexibility (e.g., WFH, room for kids), convenience, and amenities.

However, supply — especially of large, well-located resale flats — has not kept pace with this evolution. The misalignment creates competition for the limited “top-tier” stock. Buyers willing and able to pay climb up, bidding against each other — not because they are betting on future price jumps, but because they prioritise quality of living.

This is often mis-labelled as speculative behaviour, but in reality, it is an aspirational squeeze: rising aspirations + limited top-tier supply = higher prices for the top end.

3. Policy Evolution and Supply Timing Have Created Bottlenecks

The supply side of public housing — especially resale-eligible flats — has been under pressure. Fluctuations in new flats, MOP timelines, and the rise in demand have created constraints.

Recent quarterly data shows that while resale transactions remain steady, price growth has moderated: in Q3 2025, the resale price index rose just 0.4% — the slowest quarterly increase in nearly five years. Yet million-dollar transactions hit a record high.

That divergence — between modest price growth overall and a spike in high-end transactions — suggests that the bottleneck is not across the whole supply, but concentrated on only some resale homes.

In short: policy and supply-cycle dynamics have compressed the availability of desirable resale flats, which drives up competition (and prices) for the limited pool.

4. Higher Household Incomes Mean the Price “Ceiling” Has Shifted Upwards

Because household income has risen over time, the amount a typical household can afford (while still meeting borrowing rules like TDSR/MSR) has increased. The median monthly household income in 2024 was $11,297.

Thus, what once seemed expensive — a “luxury resale flat” — may now be financially manageable for many. As more households enter the “upper middle” income band, the number of buyers who can credibly consider high-end resale flats increases. That effectively shifts the demand curve upward, raising the price “ceiling.”

Million-dollar flats therefore reflect the upward movement of the top band of demand — not just inflation or speculation.

5. The Top End of HDB Is Essentially a Different Product Class

It helps to view million-dollar HDB flats not as “normal HDB flats at high price,” but as representing a different product segment — akin to “luxury public housing.”

These units often share characteristics: prime locations; large or rare layouts (5-room, executive, jumbo, multi-gen); high floors; unblocked views; good maintenance or renovations. Their supply is inherently limited, and their demand is specific (buyers who value convenience, space, and are willing to pay for it).

As such, their price dynamics — driven by scarcity and premium demand — will naturally diverge from “average HDB flats.” Treating million-dollar units as representative of the market is misleading.

Why the Real Problems Lie Elsewhere — Not in Million-Dollar Flats

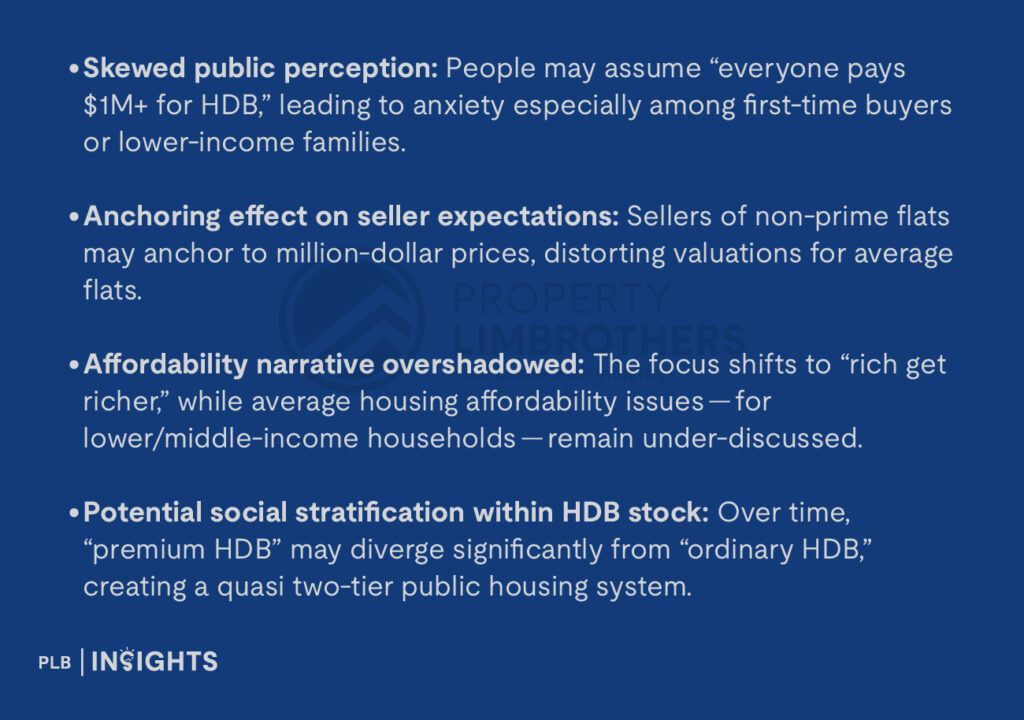

When public debate fixates on headline-making million-dollar sales, it risks ignoring the real structural challenges:

These are not sensational or easily “fixed” overnight — but they are the underlying pressures that shape the housing landscape.

Are Million-Dollar HDBs “Good” or “Bad”? — A Balanced View

What Million-Dollar HDBs Indicate (Positive Aspects)

What Risks & Misperceptions They Bring

So… Are Million-Dollar HDBs the Problem? Not Really — They’re a Signal

Million-dollar HDBs — by themselves — are not the root problem. They are symptoms, reflecting deeper currents in Singapore’s socio-economic and housing landscape.

The real issue is not that some flats hit $1M, but that demand for good-quality, well-located flats far outstrips the limited supply. That’s a challenge not of buyer greed or inflation alone — but of long-term planning, demographic shifts, evolving aspirations, and resource constraints.

If we want to meaningfully address public housing affordability, supply adequacy, and social equity — we need to focus on those root issues. Million-dollar flats tell us what families value; they don’t necessarily tell us what’s wrong.

Conclusion

Million-dollar HDBs shouldn’t be read as signs of a housing system in crisis, but rather as markers of how Singapore’s public housing landscape has evolved. As needs and aspirations diversify, policy approaches will need to reflect a wider spectrum of demand — from essential, accessible housing to the increasingly sought-after tier of top-end resale flats. For buyers, it is important to see these million-dollar transactions for what they truly are: a niche, a segment driven by scarcity and specific preferences, not the benchmark for the entire resale market. And as a society, shifting the conversation away from sensational headlines and toward structural realities will help us better understand where the true pressures lie — in supply timing, demographic change, and long-term affordability.

Ultimately, million-dollar HDBs point us toward the direction Singapore is heading, not toward a system that is fundamentally broken.

If you’re planning your next housing move and want a clearer understanding of your options, click here to connect with our sales consultants.