As Singapore continues to thrive as one of the top financial and business hubs in the world, it is not surprising that more and more foreign buyers are considering investing in its real estate market. However, buying property in Singapore can be a complicated process, especially for those unfamiliar with the local laws, regulations, and culture. Foreign buyers who are not well-informed about Singapore’s real estate market may make costly mistakes that can affect their investment in the long run.

In this opinion piece, we will discuss the top 7 mistakes that foreign buyers should avoid when buying property in Singapore. By being aware of these common pitfalls and taking steps to mitigate them, foreign buyers can make better-informed decisions and avoid unnecessary financial and legal troubles. The article will cover mistakes such as not understanding the local property market, not engaging a qualified property agent, not conducting due diligence, and not factoring in additional costs, among others. We will also explore the reasons why these mistakes are often made and provide practical advice on how to avoid them.

Overall, this article aims to emphasise the importance of seeking education on Singaporean real estate for foreign buyers who wish to invest in the country’s property market. With the right knowledge and guidance, foreign buyers can make sound investments that can yield fruitful returns in the long run.

As Singapore continues to thrive as one of the top financial and business hubs in the world, it is not surprising that more and more foreign buyers are considering investing in its real estate market. However, buying property in Singapore can be a complicated process, especially for those unfamiliar with the local laws, regulations, and culture. Foreign buyers who are not well-informed about Singapore’s real estate market may make costly mistakes that can affect their investment in the long run.

In this opinion piece, we will discuss the top 7 mistakes that foreign buyers should avoid when buying property in Singapore. By being aware of these common pitfalls and taking steps to mitigate them, foreign buyers can make better-informed decisions and avoid unnecessary financial and legal troubles. The article will cover mistakes such as not understanding the local property market, not engaging a qualified property agent, not conducting due diligence, and not factoring in additional costs, among others. We will also explore the reasons why these mistakes are often made and provide practical advice on how to avoid them.

Overall, this article aims to emphasise the importance of seeking education on Singaporean real estate for foreign buyers who wish to invest in the country’s property market. With the right knowledge and guidance, foreign buyers can make sound investments that can yield fruitful returns in the long run.

1) Not Understanding Singapore’s Residential Property Market

One of the most significant mistakes that foreign buyers make when buying residential property in Singapore is not understanding the local property market. Singapore has a unique property market, and the laws and regulations governing the purchase of property can be complicated for foreign buyers who are unfamiliar with the system.

For example, Singapore has restrictions on foreign ownership of property. Foreign buyers can only buy specific types of properties, such as condominiums or apartments without prerequisite approvals. Foreign buyers can also buy strata detached, semi-detached, and terrace houses only if they are in approved condominiums. If foreign buyers wish to purchase landed property in Singapore, they will need a Land Dealings Approval Unit (LDAU) from the Singapore Land Authority (SLA). The government also imposes additional buyer’s stamp duty (ABSD) on foreign buyers, which significantly increases the cost of purchasing a property in Singapore.

Furthermore, the property market in Singapore is highly regulated, with policies and measures put in place to manage the supply and demand of properties. The government has implemented multiple rounds of cooling measures throughout the years, such as stricter debt servicing ratios (TDSR), loan-to-valuation limits (LTV), seller’s stamp duty (SSD), buyer’s stamp duty (BSD), and medium term interest rates to prevent property prices from spiralling out of control.

It is crucial to have a strong understanding of the fundamentals of Singapore’s property market. Not only is Singapore’s property market highly regulated, it also has a strong local demand base. Singapore has one of the highest home ownership rates in the world. Public housing options (HDB) account for approximately 3 quarters of the property market by number of units. Similarly, the private property market in Singapore is predominantly driven by local demand from HDB upgraders.

Due to the scarcity of land and living space, Singaporean property tends to have a much more stable and positive trajectory than other property markets in the world. However, foreign buyers need to know that this is very sensitive to local demand and supply policies when it comes to driving price and volume in the property market here.

Not understanding Singapore’s property market is a common mistake that foreign buyers make when buying property in the country. By seeking education on the local property market, foreign buyers can avoid costly mistakes and make informed decisions that can lead to a sound investment.

One of the most significant mistakes that foreign buyers make when buying residential property in Singapore is not understanding the local property market. Singapore has a unique property market, and the laws and regulations governing the purchase of property can be complicated for foreign buyers who are unfamiliar with the system.

For example, Singapore has restrictions on foreign ownership of property. Foreign buyers can only buy specific types of properties, such as condominiums or apartments without prerequisite approvals. Foreign buyers can also buy strata detached, semi-detached, and terrace houses only if they are in approved condominiums. If foreign buyers wish to purchase landed property in Singapore, they will need a Land Dealings Approval Unit (LDAU) from the Singapore Land Authority (SLA). The government also imposes additional buyer’s stamp duty (ABSD) on foreign buyers, which significantly increases the cost of purchasing a property in Singapore.

Furthermore, the property market in Singapore is highly regulated, with policies and measures put in place to manage the supply and demand of properties. The government has implemented multiple rounds of cooling measures throughout the years, such as stricter debt servicing ratios (TDSR), loan-to-valuation limits (LTV), seller’s stamp duty (SSD), buyer’s stamp duty (BSD), and medium term interest rates to prevent property prices from spiralling out of control.

It is crucial to have a strong understanding of the fundamentals of Singapore’s property market. Not only is Singapore’s property market highly regulated, it also has a strong local demand base. Singapore has one of the highest home ownership rates in the world. Public housing options (HDB) account for approximately 3 quarters of the property market by number of units. Similarly, the private property market in Singapore is predominantly driven by local demand from HDB upgraders.

Due to the scarcity of land and living space, Singaporean property tends to have a much more stable and positive trajectory than other property markets in the world. However, foreign buyers need to know that this is very sensitive to local demand and supply policies when it comes to driving price and volume in the property market here.

Not understanding Singapore’s property market is a common mistake that foreign buyers make when buying property in the country. By seeking education on the local property market, foreign buyers can avoid costly mistakes and make informed decisions that can lead to a sound investment.

2) Not Engaging a Qualified Property Agent

The second mistake that foreign buyers make when buying property in Singapore is not engaging a qualified property agent. A good property agent can provide valuable insights into the local property market, guide foreign buyers through the buying process, and help them find the right property for their needs and budget. A qualified property agent can help foreign buyers understand the regulations and laws governing the purchase of property in Singapore, such as restrictions on foreign ownership and additional buyer’s stamp duty. They can also provide advice on the best areas to invest in and the types of properties that offer good potential for appreciation.

Moreover, property agents can assist foreign buyers in finding suitable properties that meet their specific needs and requirements. They can provide access to a wide range of properties and help negotiate favourable terms of purchase. Property agents can also help foreign buyers with the paperwork and legal procedures involved in the buying process, ensuring that everything is in order and that the transaction is legally valid.

However, not all property agents are created equal. It is crucial to engage the services of a qualified and trustworthy agent who is familiar with the local property market and has a good track record. It is recommended to check the agent’s credentials and certifications before engaging their services. There has been a recent surge in scammers posing as real estate agents. This has resulted in recent news of bogus property listings and rental scammers. You may check whether your agent is legitimately licensed here at the Council of Estate Agencies (CEA) website under the salesperson tab.

Some foreign buyers may be tempted to skip hiring a property agent to save on costs. However, this decision can lead to costly mistakes and legal complications down the road. Without a qualified property agent’s guidance, foreign buyers may miss crucial details about the property or the buying process, leading to unexpected expenses or legal issues.

Not engaging a qualified property agent is a common mistake that foreign buyers make when buying property in Singapore. To avoid this mistake, it is recommended to engage the services of a trustworthy and qualified agent who can provide valuable guidance throughout the buying process. A good agent can save foreign buyers time, money, and legal complications while ensuring a sound investment in Singapore’s real estate market. You may contact us here if you want to learn more about the industry or need help navigating your property journey in Singapore.

A qualified property agent can help foreign buyers understand the regulations and laws governing the purchase of property in Singapore, such as restrictions on foreign ownership and additional buyer’s stamp duty. They can also provide advice on the best areas to invest in and the types of properties that offer good potential for appreciation.

Moreover, property agents can assist foreign buyers in finding suitable properties that meet their specific needs and requirements. They can provide access to a wide range of properties and help negotiate favourable terms of purchase. Property agents can also help foreign buyers with the paperwork and legal procedures involved in the buying process, ensuring that everything is in order and that the transaction is legally valid.

However, not all property agents are created equal. It is crucial to engage the services of a qualified and trustworthy agent who is familiar with the local property market and has a good track record. It is recommended to check the agent’s credentials and certifications before engaging their services. There has been a recent surge in scammers posing as real estate agents. This has resulted in recent news of bogus property listings and rental scammers. You may check whether your agent is legitimately licensed here at the Council of Estate Agencies (CEA) website under the salesperson tab.

Some foreign buyers may be tempted to skip hiring a property agent to save on costs. However, this decision can lead to costly mistakes and legal complications down the road. Without a qualified property agent’s guidance, foreign buyers may miss crucial details about the property or the buying process, leading to unexpected expenses or legal issues.

Not engaging a qualified property agent is a common mistake that foreign buyers make when buying property in Singapore. To avoid this mistake, it is recommended to engage the services of a trustworthy and qualified agent who can provide valuable guidance throughout the buying process. A good agent can save foreign buyers time, money, and legal complications while ensuring a sound investment in Singapore’s real estate market. You may contact us here if you want to learn more about the industry or need help navigating your property journey in Singapore.

3) Not Checking the Property’s Title

The third mistake that foreign buyers make when buying property in Singapore is not checking the property’s title. The title is the legal document that proves ownership of the property, and it is essential to ensure that it is free from error before making a purchase (you will need a trustworthy and experienced lawyer for this). Checking the property’s title involves verifying that the seller has legal ownership of the property and that there are no outstanding claims or liens on the property. This is crucial because if there are any issues with the title, the buyer may face legal complications and financial losses down the road. For example, if there are outstanding claims or liens on the property, the buyer may be responsible for paying off these debts. This can result in unexpected expenses and financial burden for the buyer. Moreover, if the seller does not have legal ownership of the property, the buyer may face legal disputes and the risk of losing their investment.

To avoid this mistake, it is essential to conduct due diligence and check the property’s title before making a purchase. This can be done by engaging the services of a qualified real estate lawyer or conducting a title search with the relevant authorities. A title search can reveal any outstanding claims or liens on the property and provide assurance that the seller has legal ownership of the property.

Foreign buyers should also be aware that there may be cultural differences in the way property ownership is viewed in Singapore. For example, some properties may have a “permanent” or “temporary” leasehold, which can affect the length of time the property can be owned. It is essential to understand these nuances and seek professional advice to avoid any legal or financial complications. Most condominium options in Singapore come with a 99-year leasehold lease. Making sure that you check on the remaining lease of the property you are buying as well as how it would affect the financing aspect for future buyers is very important.

Not checking the property’s title is a common mistake that foreign buyers make when buying property in Singapore. By conducting due diligence and verifying the property’s title, foreign buyers can ensure a seamless ownership transfer and avoid any legal or financial complications down the road. It is recommended to engage the services of a qualified real estate lawyer.

For example, if there are outstanding claims or liens on the property, the buyer may be responsible for paying off these debts. This can result in unexpected expenses and financial burden for the buyer. Moreover, if the seller does not have legal ownership of the property, the buyer may face legal disputes and the risk of losing their investment.

To avoid this mistake, it is essential to conduct due diligence and check the property’s title before making a purchase. This can be done by engaging the services of a qualified real estate lawyer or conducting a title search with the relevant authorities. A title search can reveal any outstanding claims or liens on the property and provide assurance that the seller has legal ownership of the property.

Foreign buyers should also be aware that there may be cultural differences in the way property ownership is viewed in Singapore. For example, some properties may have a “permanent” or “temporary” leasehold, which can affect the length of time the property can be owned. It is essential to understand these nuances and seek professional advice to avoid any legal or financial complications. Most condominium options in Singapore come with a 99-year leasehold lease. Making sure that you check on the remaining lease of the property you are buying as well as how it would affect the financing aspect for future buyers is very important.

Not checking the property’s title is a common mistake that foreign buyers make when buying property in Singapore. By conducting due diligence and verifying the property’s title, foreign buyers can ensure a seamless ownership transfer and avoid any legal or financial complications down the road. It is recommended to engage the services of a qualified real estate lawyer.

4) Not Factoring in Additional Costs

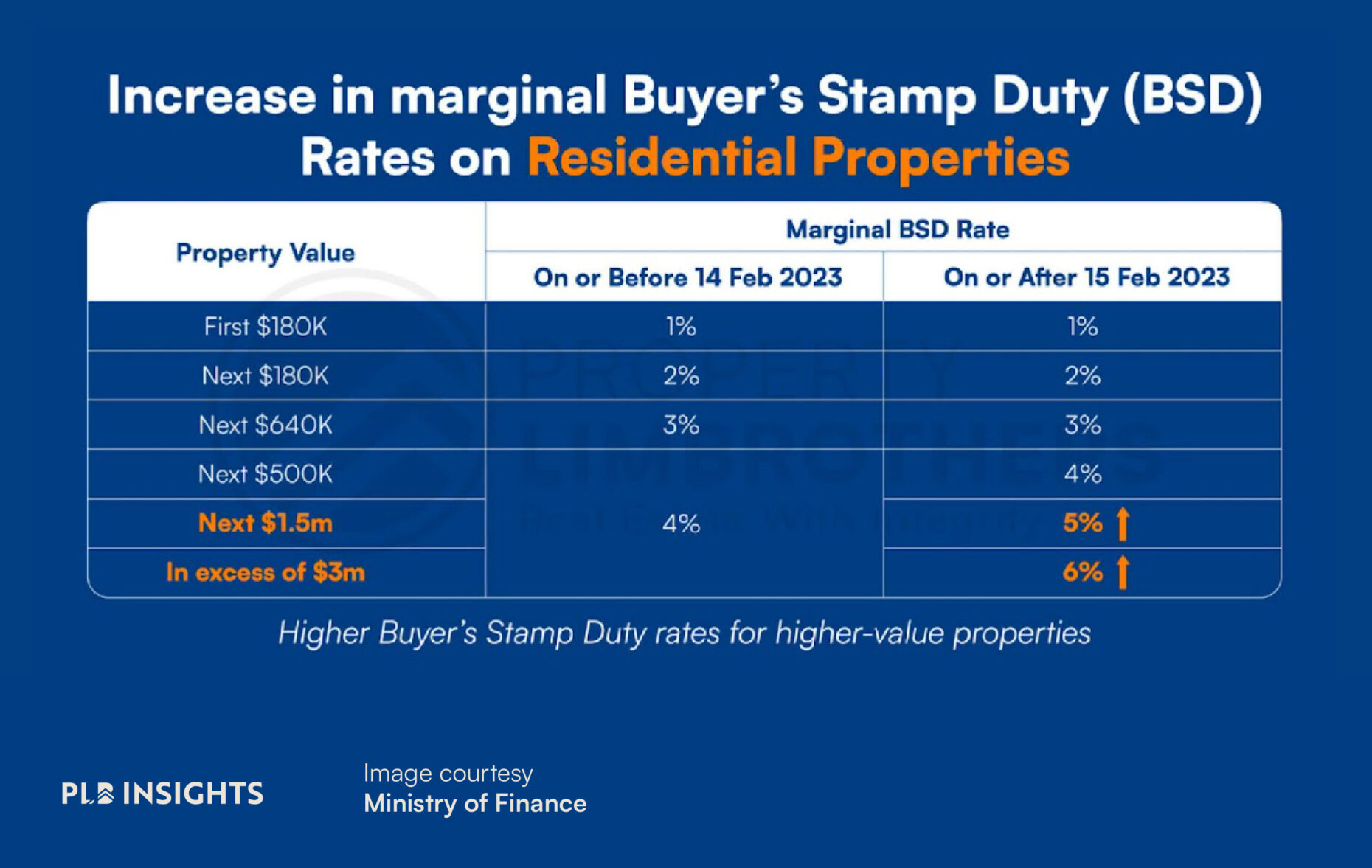

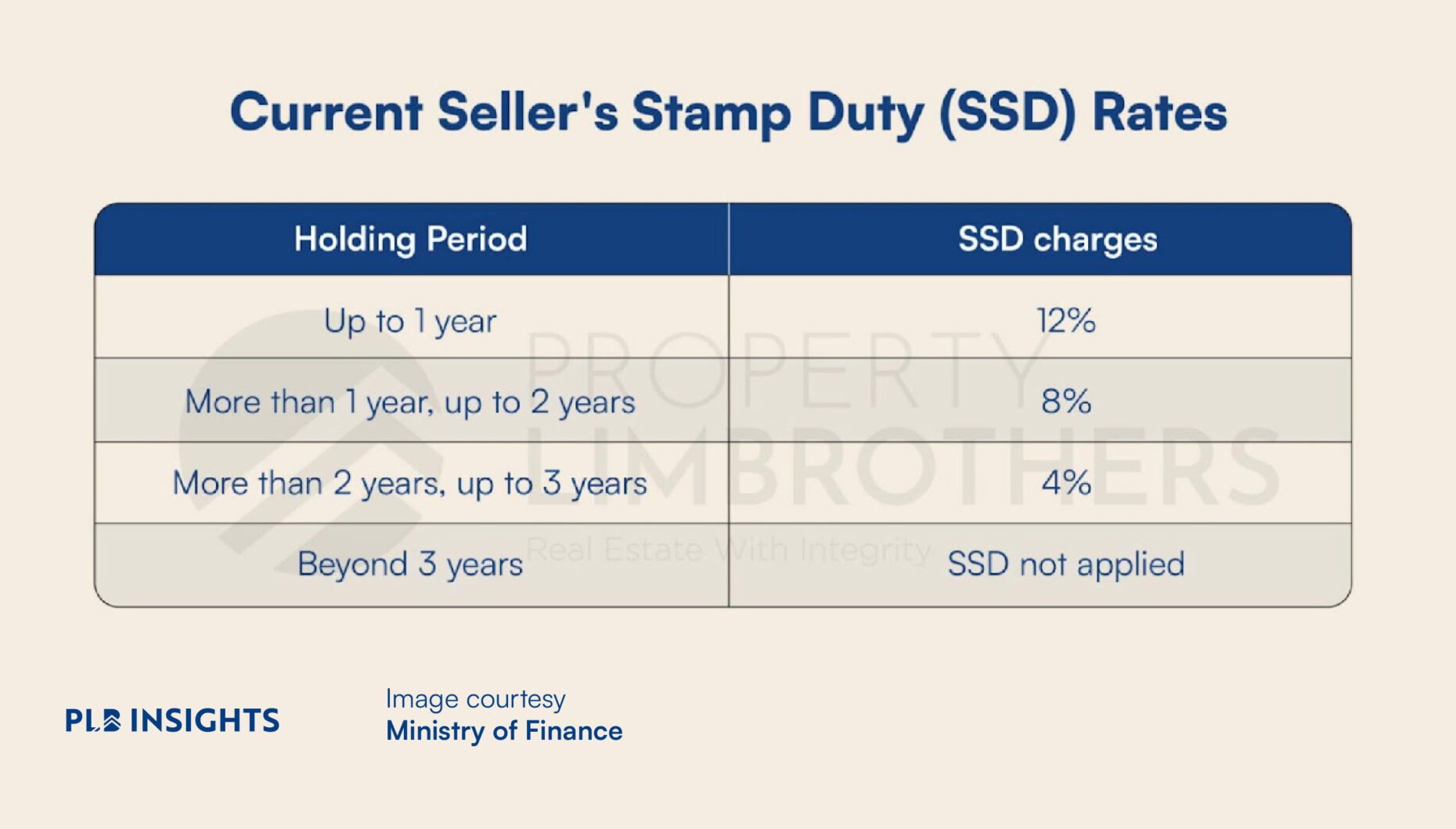

The fourth mistake that foreign buyers make when buying property in Singapore is not factoring in additional costs. Buying a property in Singapore involves more than just the purchase price; there are several additional costs that buyers need to consider. One of the significant additional costs is the Buyer’s Stamp Duty (BSD), which is a tax that is imposed on the purchase of residential properties in Singapore. The BSD varies based on the purchase price of the property and the buyer’s residency status. The government has also recently increased the BSD for higher quantum properties. Another significant cost that may be incurred would be the Seller’s Stamp Duty (SSD). This is incurred by buyers who sell their properties within three years. Implemented to mainly curb speculation in the property market, foreign buyers need to be aware of the SSD in case they are intending to dispose of their property purchase within 3 years.

Another significant cost that may be incurred would be the Seller’s Stamp Duty (SSD). This is incurred by buyers who sell their properties within three years. Implemented to mainly curb speculation in the property market, foreign buyers need to be aware of the SSD in case they are intending to dispose of their property purchase within 3 years.

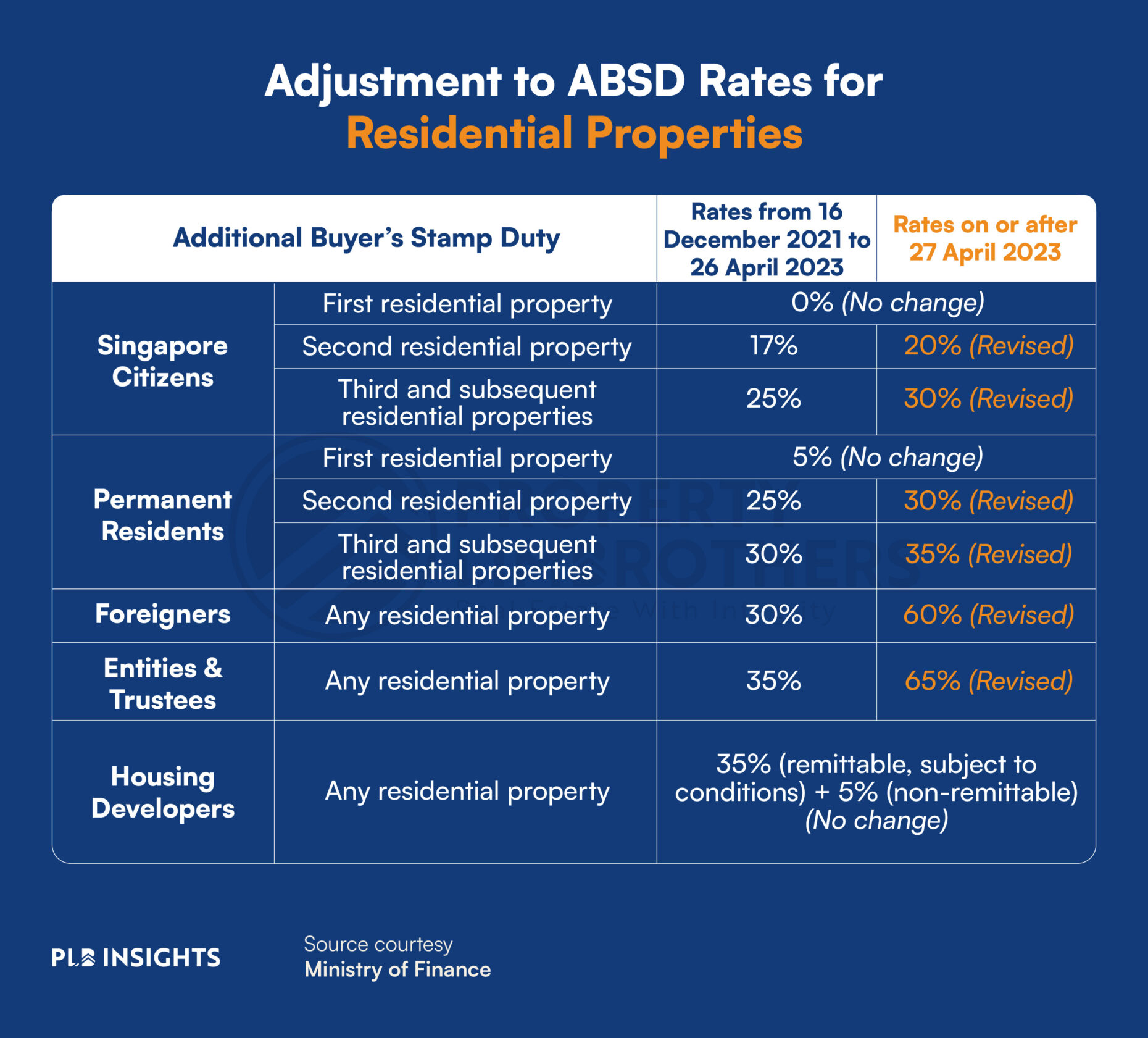

The Additional Buyer’s Stamp Duty (ABSD) is the heaviest and often most painful stamp duty to foreign buyers. For any residential property, the current ABSD rate is at 60% after the recent cooling measure, which is a considerable sum for any quantum of property being purchased in Singapore. However, there are several nationalities that have the same treatment as Singaporeans when it comes to ABSD due to the Free Trade Agreement Singapore has with these countries. They include nationalities from the United States, Ireland, Liechtenstein, Norway and Switzerland and permanent residents of the latter four countries.

The Additional Buyer’s Stamp Duty (ABSD) is the heaviest and often most painful stamp duty to foreign buyers. For any residential property, the current ABSD rate is at 60% after the recent cooling measure, which is a considerable sum for any quantum of property being purchased in Singapore. However, there are several nationalities that have the same treatment as Singaporeans when it comes to ABSD due to the Free Trade Agreement Singapore has with these countries. They include nationalities from the United States, Ireland, Liechtenstein, Norway and Switzerland and permanent residents of the latter four countries.

In addition to the BSD, SSD, and ABSD, there are other costs that buyers need to factor in, such as legal fees, agent fees, valuation fees, and renovation costs. These costs can add up quickly and significantly impact the overall cost of the property. It is essential to factor in these additional costs when budgeting for the property purchase. Moreover, buyers need to consider ongoing costs such as property taxes, maintenance fees, and utilities. These costs can vary based on the property’s location, size, and type. It is crucial to understand these ongoing costs and factor them into the overall cost of owning the property.

To avoid this mistake, it is recommended to work with a qualified property agent and financial advisor who can provide guidance on the additional costs involved in buying a property in Singapore. Buyers should also conduct thorough research and obtain multiple quotes for services such as legal fees, agent fees, and renovation costs to ensure that they are getting a fair price.

It is also recommended to have a contingency fund in place to cover unexpected expenses that may arise during the property purchase process or after the purchase is completed. This can provide buyers with peace of mind and ensure that they are financially prepared for any unexpected costs.

Not factoring in additional costs is a common mistake that foreign buyers make when buying property in Singapore. By understanding and budgeting for these additional costs, buyers can ensure that they are financially prepared for the property purchase and avoid any unexpected expenses down the road. It is recommended to work with a qualified property agent and financial advisor and have a contingency fund in place to cover any unexpected costs that may arise.

In addition to the BSD, SSD, and ABSD, there are other costs that buyers need to factor in, such as legal fees, agent fees, valuation fees, and renovation costs. These costs can add up quickly and significantly impact the overall cost of the property. It is essential to factor in these additional costs when budgeting for the property purchase. Moreover, buyers need to consider ongoing costs such as property taxes, maintenance fees, and utilities. These costs can vary based on the property’s location, size, and type. It is crucial to understand these ongoing costs and factor them into the overall cost of owning the property.

To avoid this mistake, it is recommended to work with a qualified property agent and financial advisor who can provide guidance on the additional costs involved in buying a property in Singapore. Buyers should also conduct thorough research and obtain multiple quotes for services such as legal fees, agent fees, and renovation costs to ensure that they are getting a fair price.

It is also recommended to have a contingency fund in place to cover unexpected expenses that may arise during the property purchase process or after the purchase is completed. This can provide buyers with peace of mind and ensure that they are financially prepared for any unexpected costs.

Not factoring in additional costs is a common mistake that foreign buyers make when buying property in Singapore. By understanding and budgeting for these additional costs, buyers can ensure that they are financially prepared for the property purchase and avoid any unexpected expenses down the road. It is recommended to work with a qualified property agent and financial advisor and have a contingency fund in place to cover any unexpected costs that may arise.