Located in Potong Pasir, MYRA is a new launch development of freehold status located within a minute’s walk to the MRT station.

Through the amalgamation of 17 different land plots, the developers have worked hand-in-hand with highly accredited architects to design a project that screams luxury. Although MYRA sits on a small plot of land, smart design has allowed the developers to build 85 units of varying unit layouts from 1-bedders to 4-bedders.

MYRA is seen as the price leader within the Potong Pasir region, but it is surprisingly priced competitively against its new launch counterparts near Woodleigh — namely Park Colonial and The Woodleigh Residences.

Is it worth getting a freehold, boutique project situated near the MRT? And if you’ve been eyeing new launches, is MYRA the choice to go for? Read on to find out more.

Developer: Tiara Land Pte. Ltd. (wholly-owned subsidiary of Selangor Dredging Berhad)

Architect: JGP Architecture (S) Pte. Ltd.

District: 13

Address: 9 Meyappa Chettiar road

Site Area: 2,851.1 sqm / 30,689.24 sqft

Tenure: Freehold

No. Of Units: 85

TOP: Est. Nov 2024

Pros:

-

Near Potong Pasir MRT

-

Brand new, freehold plot of land

-

Convenience of a mall across the street

-

Accessibility to CTE and PIE for drivers

-

Competitively priced when compared to nearby 99-year new launches in D13

Cons:

-

Relatively-limited facilities due to small land plot

-

Higher MCST fees due to low amount of units within development

Development Information

MYRA is a freehold development situated in District 13, in the heart of the Potong Pasir estate. Developed by Tiara Land Pte. Ltd., an associate company of Selangor Dredging Berhad (SDB), the company boasts a portfolio of boutique luxury residences like Hijauan on Cavenagh, Gilstead Two, and Jui Residences — all of which are 100% sold.

Another project currently in development by SDB is One Draycott, a bespoke luxury condominium located in Draycott Park of Prime District 10.

The design of MYRA was a collaboration between award-winning UK architect Pitman Tozer Architects and local firm JGP Architecture. One of Pitman Tozer Architects’ awards include Housing Project of the Year for their housing project “Windmill Place”. Local firm JGP Architecture is also not to be overlooked, having a multitude of residential & commercial projects across the ASEAN region, and in China.

The landscape design was headed by Hannah James of Aspex of Design, who has 15 years of experience with resort and condominium design throughout Asia. With the partnerships of these strong players within the field of architectural design, MYRA is expected to be an eye-catching development with functional, luxurious design.

The design profile of MYRA is centred around aluminium ‘ribbons’ that wrap itself around the facade. These ‘ribbons’ deviate in tone, starting with a soft, champagne-like tone towards the bottom of the building, and intensify towards a muted gold at the apex. These ‘ribbons’ also serve a practical purpose — to shelter the building and its occupants from the harsh weather elements that Singapore faces.

MYRA has 85 units spread over a single block with 12 storeys high. With a land plot size of approximately 30,689 sqft, this translates to a density level of 361 sqft per unit — a medium score for density when compared to adjacent, boutique freehold projects Leicester Suites (244 sqft per unit) and Intero (483 sqft per unit).

Hence, future residents at MYRA can expect to enjoy a medium level of traffic and decent exclusivity when it comes to the project’s facilities — which we will share more on later.

Unit Distribution

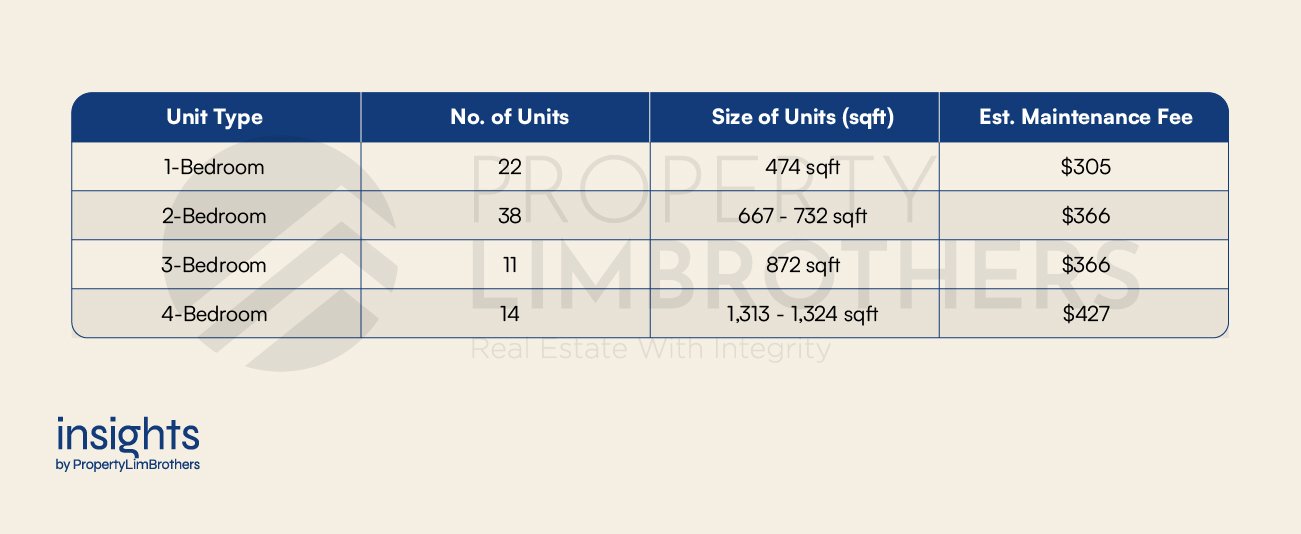

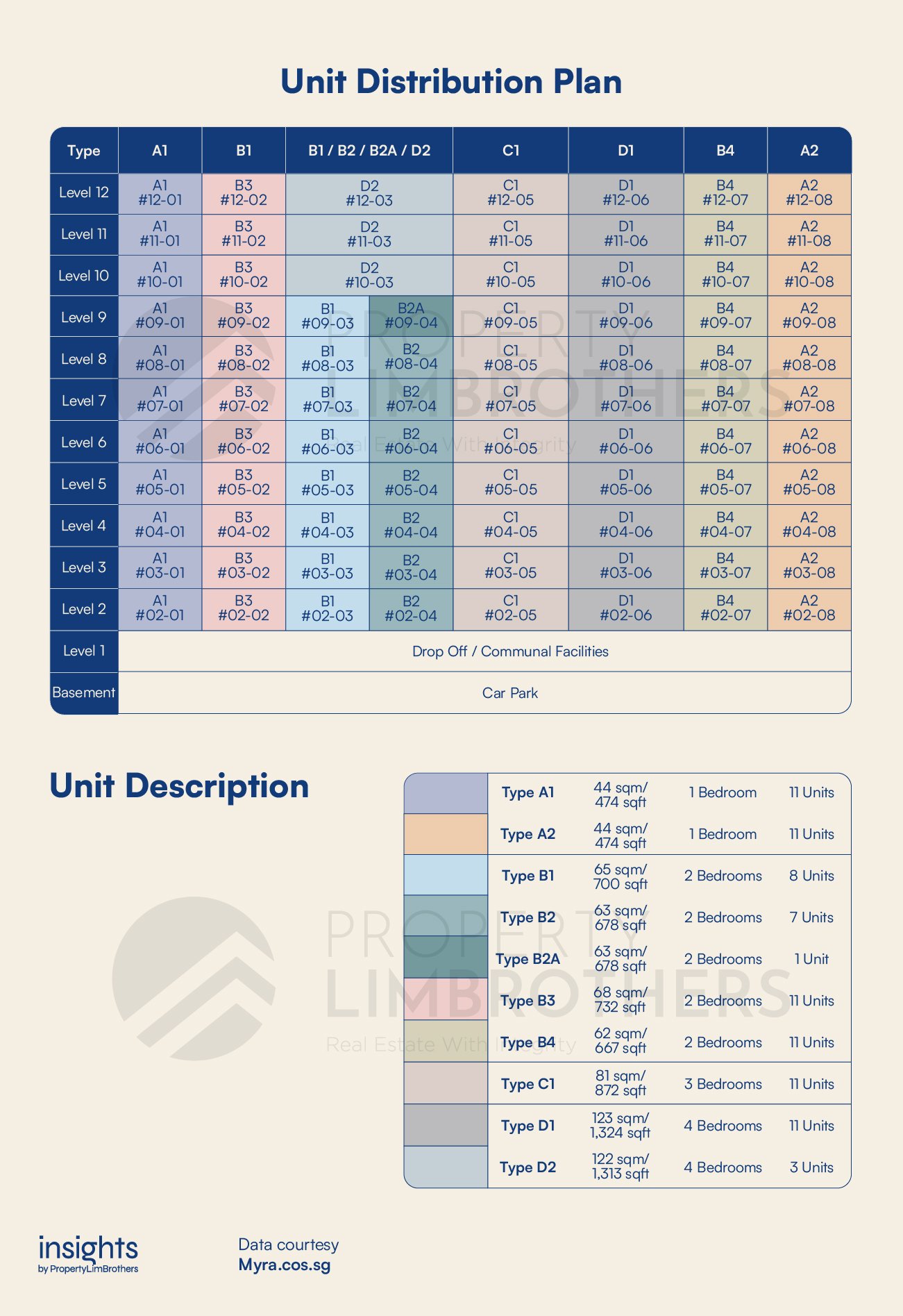

Amongst these 85 units, the unit distribution is as such:

-

22 units of 1-bedroom apartments at a size of 474 sqft / 44 sqm

-

38 units of 2-bedroom apartments ranging from 667 to 732 sqft / 62 to 68 sqm

-

11 units of 3-bedroom apartments at a size of 872 sqft / 81 sqm

-

14 units of 4-bedroom apartments ranging from 1,313 to 1,324 sqft / 122 to 123 sqm

The unit distribution chart is as such:

In the next section of the article we will dive deep and analyse the various floor plans to understand the factors that contribute to this difference in demand.

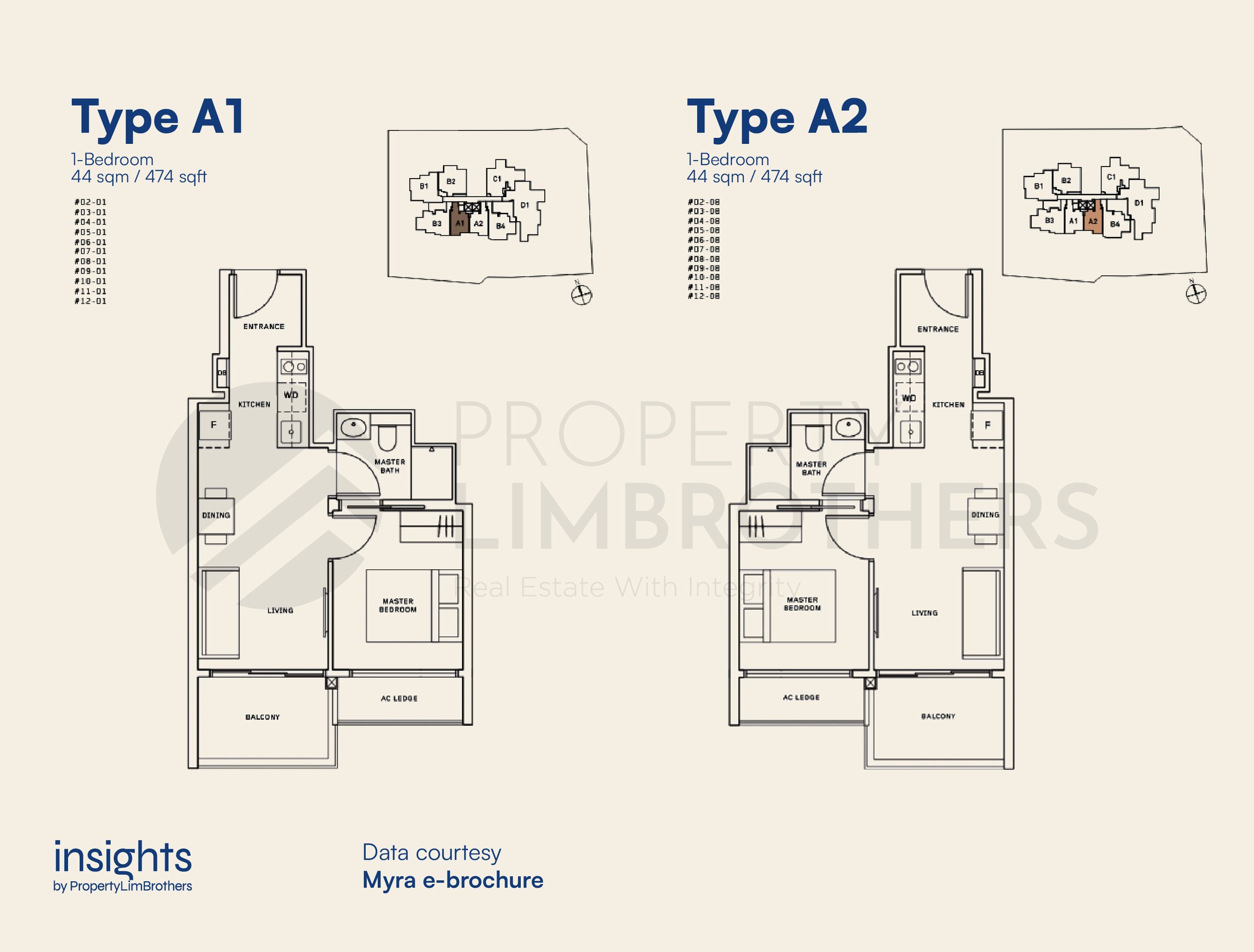

Type A1 / A2 (1-bedder units)

The 1-bedroom units are placed adjacent to each other and are mirrored layouts. These units have a more long-ish layout with the kitchen, living, dining, and balcony stacked in a single line. As the balconies of these units face towards the South-West direction and towards neighbouring development Parc Aston (building height of 9 storeys), these residents enjoy a quieter facing.

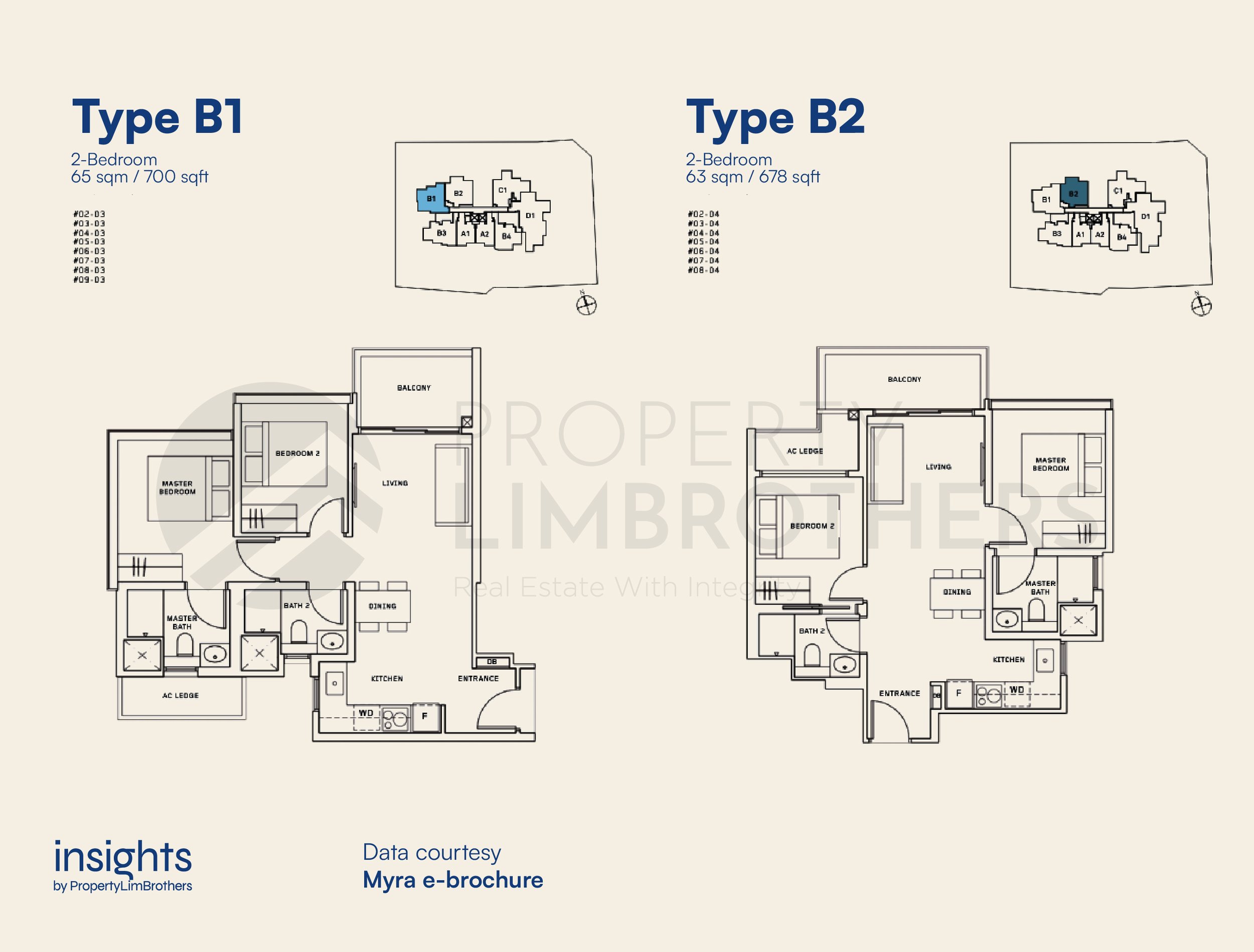

Type (B1 / B2 / B2A) — Mr. and Mrs. Popular

As the only Type B2A in the development has already been sold, we will only be taking a look at Type B1 and Type B2 — the most sought-after layouts — in this analysis.

There is a size difference of 22 sqft that the Type B1 layout enjoys due its corner position within the development. However, as a result, all bedrooms are stacked towards the left. In comparison, the bedrooms in Type B2 are organised in a dumbbell-like fashion (with a bedroom on each side of the house), and thus residents of these units get to enjoy an increased level of privacy — suitable for young couples who decide to live with parents, or if you simply wish to rent out a bedroom to supplement your mortgage payments.

The balconies of both of these layouts front towards the North-East direction, facing Meyappa Chettiar Road and mixed-use development The Poiz Residences (building height of 18 storeys). Amongst the 3-bedder layouts, Type B2 also has the widest balcony frontage.

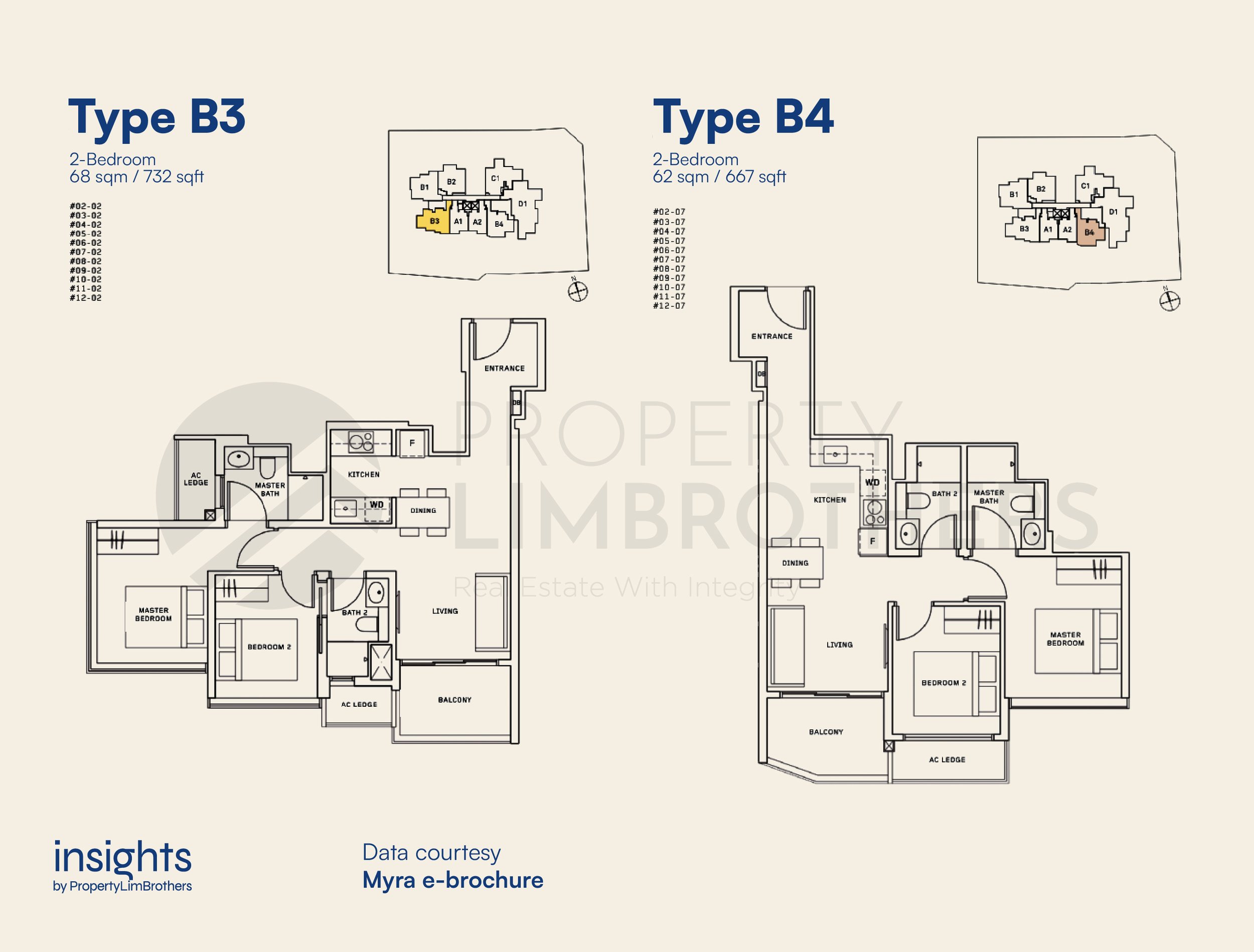

Type B3 / B4

Taking a look at the rest of the 2-bedder layouts, Type B3 and B4, the feature that stands out is the longer foyer area upon entry into the home. Although Type B3 has a 65 sqft size difference in comparison to Type B4, this extra space is translated into the walkway towards the bedrooms and the dining area, as the segregated kitchen is tucked into the corner.

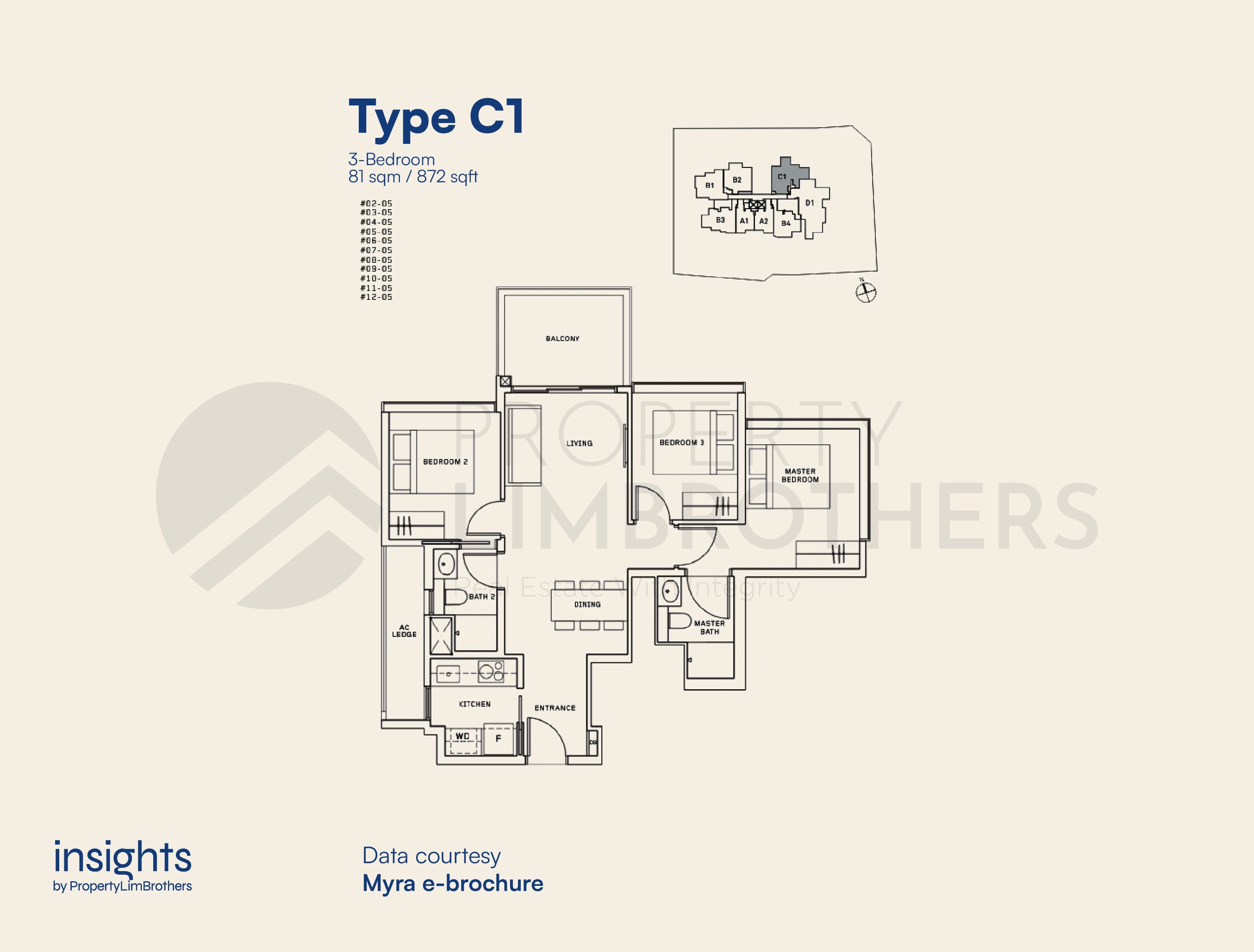

Type C1

There is only one stack of 3-bedder units in this development. The bedrooms are also organised in a dumbbell-like fashion, similar to Type B2. From the floorplan, we can tell that the common bathroom is built with a Jack and Jill feature, allowing access from both the second common bedroom as well as the dining area.

The balcony is fronting towards North East, so owners of this layout can expect a slight shade of morning sun, facing Meyappa Chettiar Road and mixed-use development The Poiz Residences (building height of 18 storeys).

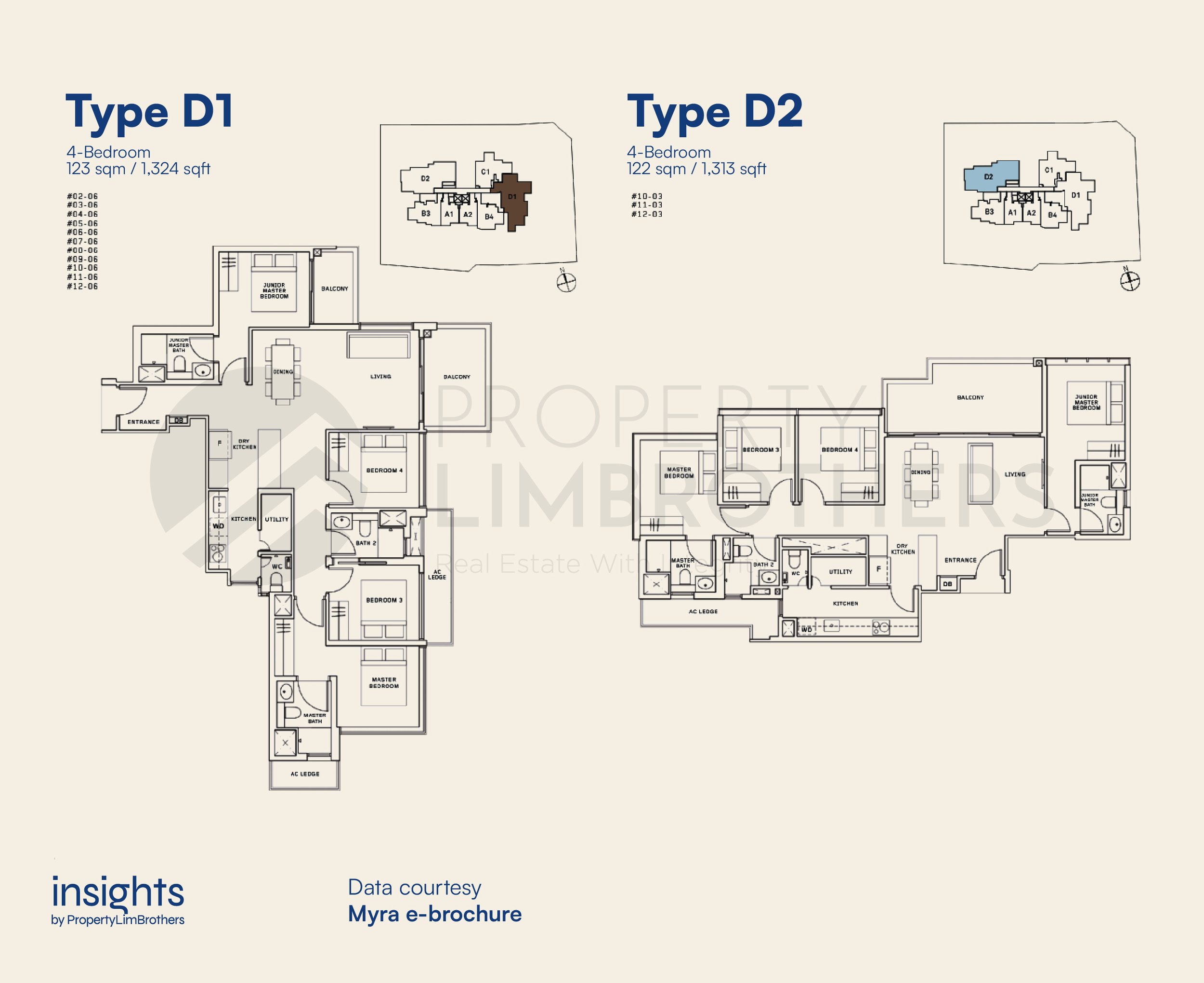

Type D1 / D2

From levels 2 to 9, there is only one stack of 4-bedder units, which is of the Type D1. From level 10 onwards, Type D2 pops into existence through the combination of Type B1 and Type B2.

The key differences between the two 4-bedder layouts would be the orientation of the living/dining areas, as well as the balcony space.

For Type D1, the balcony space is divided into a main balcony spanning across the living area, as well as a smaller balcony area for the junior master bedroom. As for Type D2, the balcony space is combined into a wider frontage which spans across the living and dining area.

This key difference is also linked to the placement of the dining/living area, where Type D2 has a luxury of width to place the dining and living in a horizontal fashion, while Type D1’s living and dining areas are positioned in a vertical-like fashion.

It is also worth noting that these 4-bedder units are the only layouts that come with a utility room and water closet area.

Facilities

Given the small land plot of MYRA, facilities are comparatively limited to that of medium to large-sized projects. However, they do still fulfil the general needs of condominium residents with a 25m lap pool, outdoor/hydro gym, a alfresco barbeque dining area, and a children’s playing area.

Taking a look at the combined floor plan, it appears that there are only two lifts servicing the entire building of 85 units. Hence, residents can expect increased waiting times during peak periods.

With regards to the basement carpark, the downside to this project is that it only has 68 carpark lots with 2 extra handicap lots. With 85 units within the development, this will mean that residents will not be allocated a carpark lot.

On the bright side, in efforts to promote a car-lite type of project, the development provides 22 bicycle bays for those who cycle.

All these facilities do come with its costs, in other words, the maintenance fees. Below is a table depicting the estimated maintenance fees of the various unit types.

MSCT Fees

Location Analysis

As an estate in Singapore, Potong Pasir is located really close to the city centre. One of the highlights that draws us to MYRA is being a freehold plot of land located within a comfortable walking distance to an MRT station — which is a rare find.

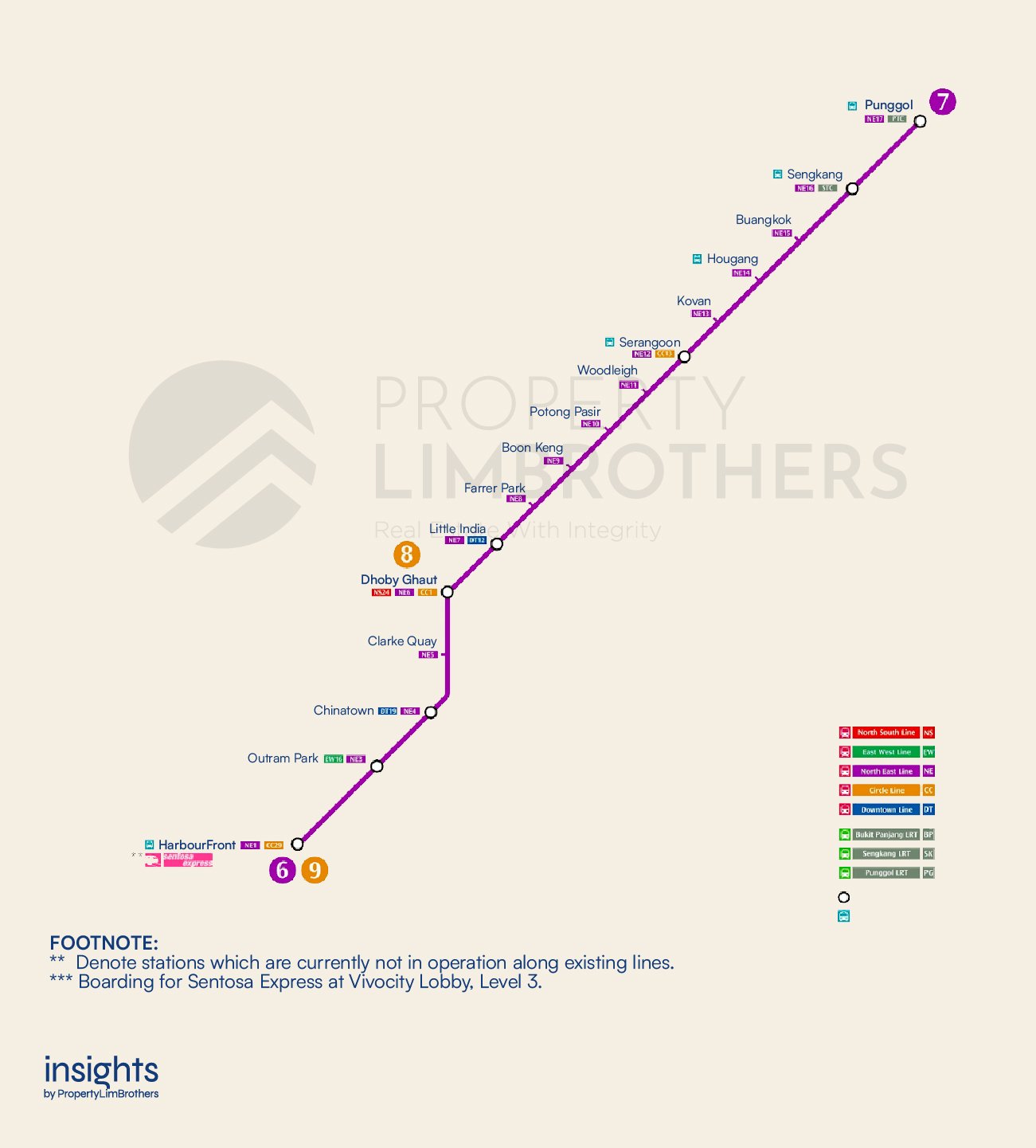

Potong Pasir MRT sits on the North-East line, and can conveniently bring you to places like:

-

Little India (cross interchange with Downtown Line)

-

Dhoby Ghaut (cross interchange with North East Line, Circle Line)

-

Outram Park (cross interchange with East West Line)

Travelling northwards, the train will also take you to Serangoon, all the way to Punggol, where the future Punggol Digital District will be, set to open in the year 2024.

For amenities serving daily necessities, there is the convenience of shopping mall The Poiz Centre right at your doorstep without having to pay the premium of being in a mixed development project. Notable to mention that there is a 24-hour FairPrice supermarket within this mall.

We also have regional shopping mall NEX just 2 train stops down, as well as the upcoming Woodleigh Mall, which is also a mixed development.

MYRA is well-positioned near the intersection of expressways CTE and PIE, which will conveniently lead drivers to the city centre in less than 20 minutes.

Primary Schools

For parents with young children, they will be pleased to know that there is a decent amount of primary schools within the 1 kilometre radius:

-

Bendemeer Primary School

-

Cedar Primary School

-

St. Andrew’s Junior School

There are also a few secondary schools within the area, albeit being in a wider radius, being:

-

St. Andrew’s Secondary School

-

Cedar Girls’ Secondary School

-

Maris Stella High School

-

St. Gabriel’s Secondary School

-

Zhonghua Secondary School

-

Bendemeer Secondary School

-

Geylang Methodist Secondary School

Last but not least, some post-secondary educational institutions are also within the vicinity such as:

-

St. Andrew’s Junior College

-

Nanyang Junior College

-

Catholic Junior College

Unfortunately for post-tertiary education and polytechnics, you’ll have to travel a bit further due to the lack of such institutes around the area. But families within the area can afford to stay throughout the majority of their children’s education without the hassle of their kids travelling too far for school.

Pricing Analysis

The land plot that MYRA sits on is an amalgamation of 17 parcels of land bought over for $60.26 million. With a land area of 30,689 sqft and a plot ratio of 2.1, this translates to a costing of approximately $935 per square foot per plot ratio (psf ppr)

Using adjacent projects for comparison, the land costings for

-

Sennett Residence, land obtained in August 2011 for $567 psf ppr

-

Sant Ritz, land obtained in July 2012 for $628 psf ppr

-

Poiz Residence, land obtained in August 2014 $775 psf ppr

Notably from the aforementioned examples, the cost of obtaining land has definitely increased over the past decade, and this increase in cost has natural trickle down effects to higher launch prices. Furthermore, with the difference in land tenure, the price premium is justified.

Being the newest upcoming development within the area that is freehold, the prices are expected to set a new benchmark. As at time of writing, units in MYRA are transacting between $2,0xx PSF to $2,2xx PSF.

But how does this fare in comparison to nearby freehold projects?

The Addition, a freehold boutique development with just 26 units, is slated to TOP in the year 2023. All units there were sold within a year of launch between $1,5xx PSF to $1,8xx PSF.

Taking a look at One Leicester, a medium-sized development of 194 units which TOP-ed in 2008, recent transactions within the development have been going for between $1,3xx PSF to the highs of $1,4xx PSF.

Boutique development Intero which TOP-ed in 2008 also observed slightly higher price action with the most recent sales going for $1,480 PSF to $1,562 PSF.

A younger freehold project Leicester Suites TOP-ed in 2013 transacted between $1,5XX PSF to $1,700 PSF. This project however, offers only 1-bedroom apartments and may not offer a good basis for comparison.

After this comparison, we observe that MYRA’s pricing does pose a $500 to $700 PSF disparity, even against freehold projects. We reckon that this difference in pricing could be attributed to the slightly nearer positioning to the MRT station, the relatively-high costs of obtaining the freehold parcels of land from 17 different owners, and MYRA being at least a decade newer than its counterparts.

Expounding on the point of land cost, as mentioned earlier, the 17 parcels of land (totalling 17,949.15 sqft) was obtained for $60.2 million

When we compare it with the second newest kid on the market, The Poiz Residences, which commands a mixed-development premium in its pricing, the units there are transacting between $1,7xx to $1,9xx PSF. We view this ~$300 PSF difference as a safe pricing disparity with MYRA, as The Poiz Residences operates on a 99-year leasehold afterall.

Now finally let’s compare it apple-to-apple and bring in the brand new developments within the area: Park Colonial (TOP 2021) and The Woodleigh Residences (TOP 2022)

Park Colonial, a large-sized development with 805 units launched in 2018 and was transacting around $1,7xx to $1,8xx PSF at point of launch. Now, units are transacting between $1,9xx to $2,1xx PSF. It poses the question as to whether MYRA is able to attain similar price appreciation, as Park Colonial is, likewise, surrounded by older freehold projects.

The Woodleigh Residences, large-sized development with 667 units launched in 2018 as well. This project has a true integrated development status, having direct access to Woodleigh MRT and will naturally command an even higher premium than mixed developments. Units were launched at an average price of $1,8xx to $2,0xx PSF, and recent transactions have seen highs of $2,2xx to $2,3xx.

We view that MYRA will continue to be the price leader within the microregion of Potong Pasir, and investors will only start to see the retention of its value in the 10 to 15 year mark, as 99-year projects start to suffer from the effects of lease decay. However, when we zoom out towards the entire District 13 of Toa Payoh and start to compare with new launches within the zone, we find that MYRA is priced competitively against its new launch buddies — considering that it is of a freehold status!

Future Developments and Exit Strategy

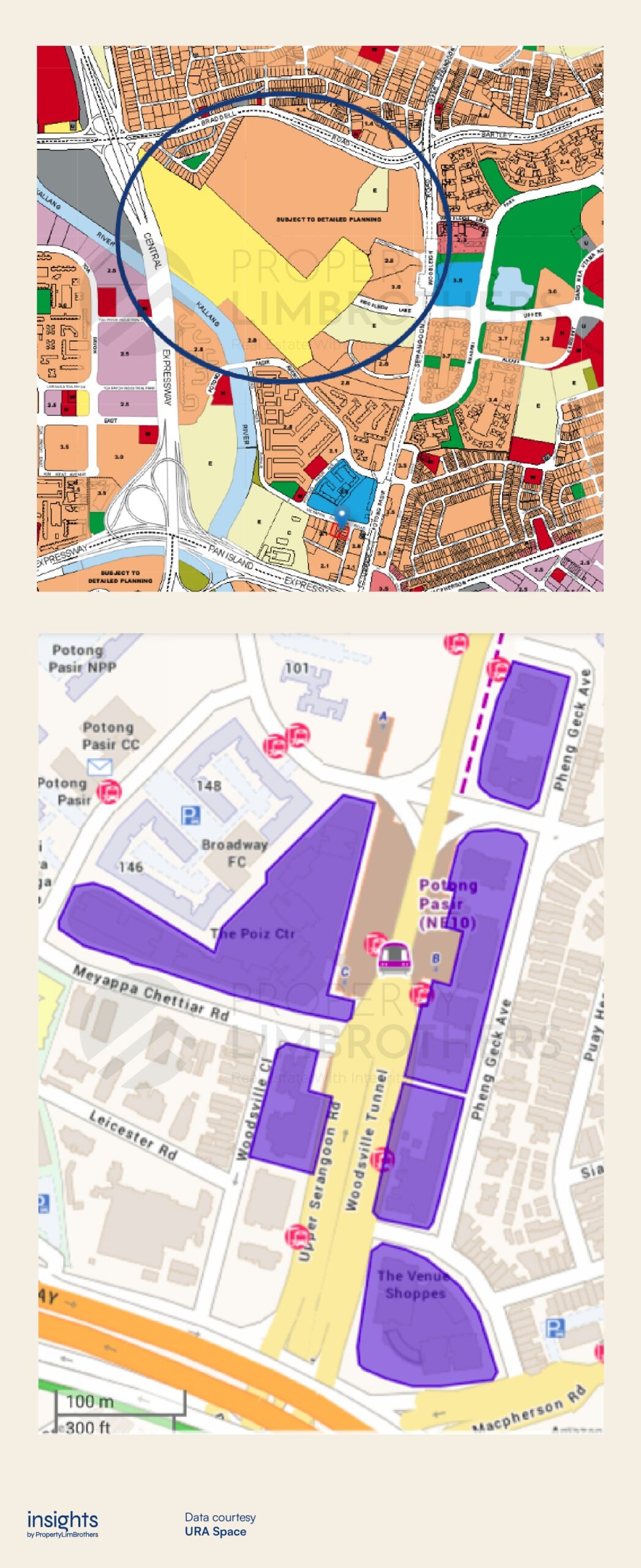

Taking a look at URA’s Master Plan, the future developments within the Potong Pasir region seem to be limited, with only one land site awaiting further development (highlighted in red circle above).

The area demarcated in yellow (reserve site zoning) currently holds a utility complex while the area demarcated in orange (residential zoning) holds a few landed residential properties. However, as seen above, the residential area is “subject to detailed planning” due to its underutilisation.

This is to be expected as Potong Pasir is a mature estate, and has faced prior revitalisation through the various government land sales five to ten years ago.

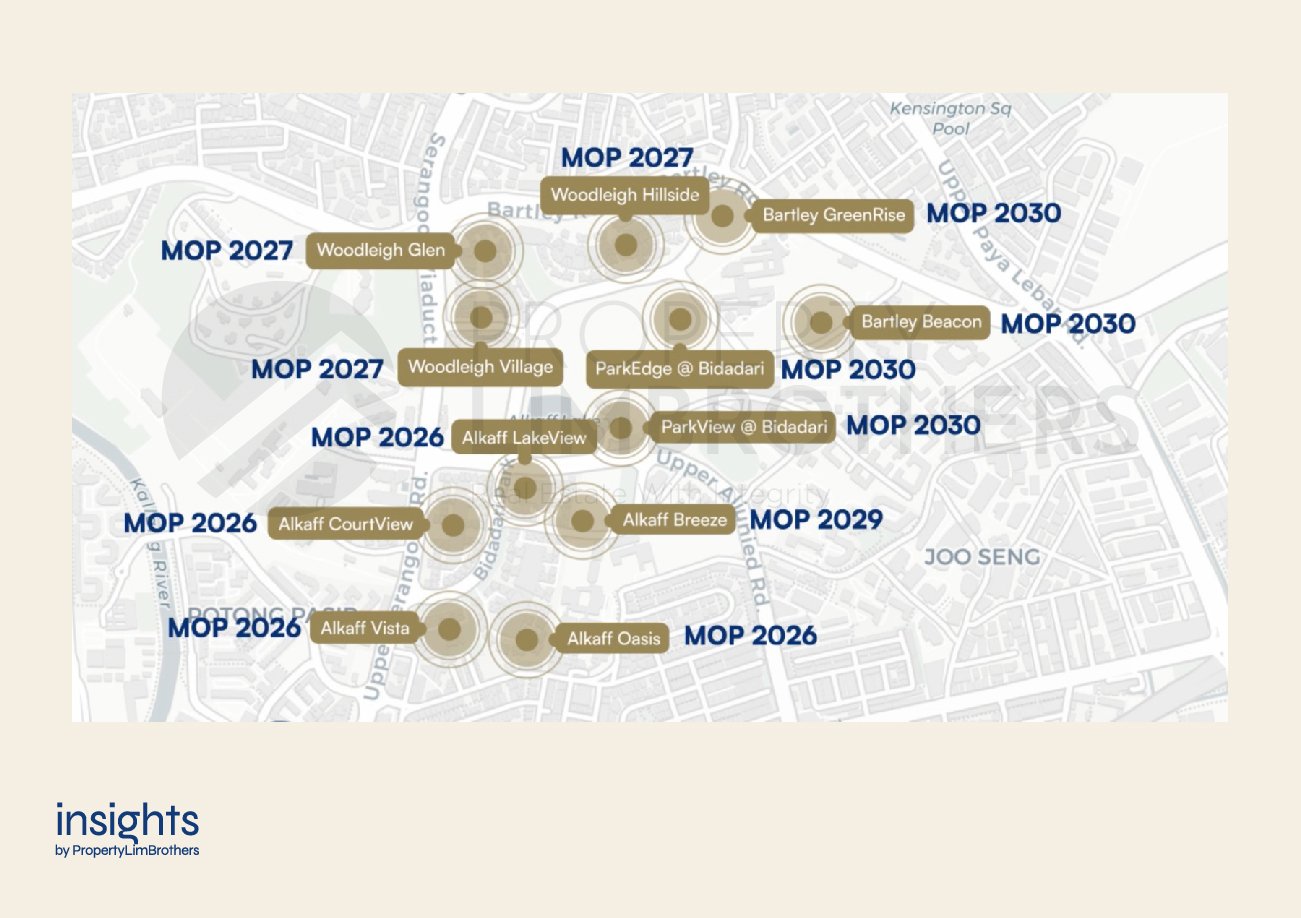

However, residents of Potong Pasir may look forward to the development of the new Bidadari estate, which includes 12 plots of BTO projects. This influx of public development will definitely bring about rejuvenation within the district, with more amenities and facilities being built for residents of the area.

From an investment standpoint, these various BTOs will hit their MOP between the years of 2026 to 2030. Based on our research, owners of the four and five room flats in the area are estimated to have a $300K to $400K paper gain from the sale of their BTO flats.

What this means for you is that these HDB upgraders will form a healthy amount of your exit audience, should they choose to upgrade into a private property within the area.

Conclusion

If you’re eyeing a new launch within the Potong Pasir region, this is about the only option you have. Given its rarity as a freehold development within walking distance to the MRT, MYRA definitely holds its ground in terms of long-term value.

However, given the huge price disparity with adjacent projects, we reckon that price appreciation is difficult to attain with a short investment horizon.

From a homebuyer’s perspective, the density of the project is average when compared to boutique projects within the vicinity, and the project’s facilities do fulfil basic requirements, but are not too comprehensive either — as to be expected of a boutique development.

Amenities are plentiful with the luxury of a mall just opposite the development, and accessibility to the city centre is great with the intersection of CTE and PIE just a 5-minutes drive away.

At time of writing, 73% of units have already been successfully sold. If this article piques your interest for this development and you wish to find out more, or you simply wish to explore options for your next property with our team, feel free to contact our property consultants.

We would be more than happy to answer any queries you may have about this development or the district in general. Till our next article and as always — PropertyLimBrothers, always happy to show you the place. Take care!