Singapore is one of the most sought-after locations for property investments in Southeast Asia, thanks to its stable economy, high living standards, and cosmopolitan culture. However, foreign buyers who are interested in purchasing a property in Singapore must take note of the various taxes and fees that they are required to pay. These taxes are imposed by the government to regulate the property market and ensure that it remains affordable for Singaporean citizens. Understanding these taxes is essential for foreign buyers to make informed decisions and avoid any unexpected costs.

In this article, we will delve deeper into the taxes that foreign buyers have to take note of when purchasing a property in Singapore. We will be breaking these taxes down in terms of the type of properties in question.

Residential Property Taxes

Residential property in Singapore refers to any type of property that is designed and intended for individuals or families to live in. This includes apartments, condominiums, landed properties such as bungalows and terraced houses, as well as HDB (Housing and Development Board) flats.

In Singapore, residential properties are highly sought after due to the city-state’s limited land area and high population density. As such, the residential property market in Singapore is highly competitive, with prices that can vary greatly depending on factors such as location, size, and amenities.

Buyer’s Stamp Duty (BSD)

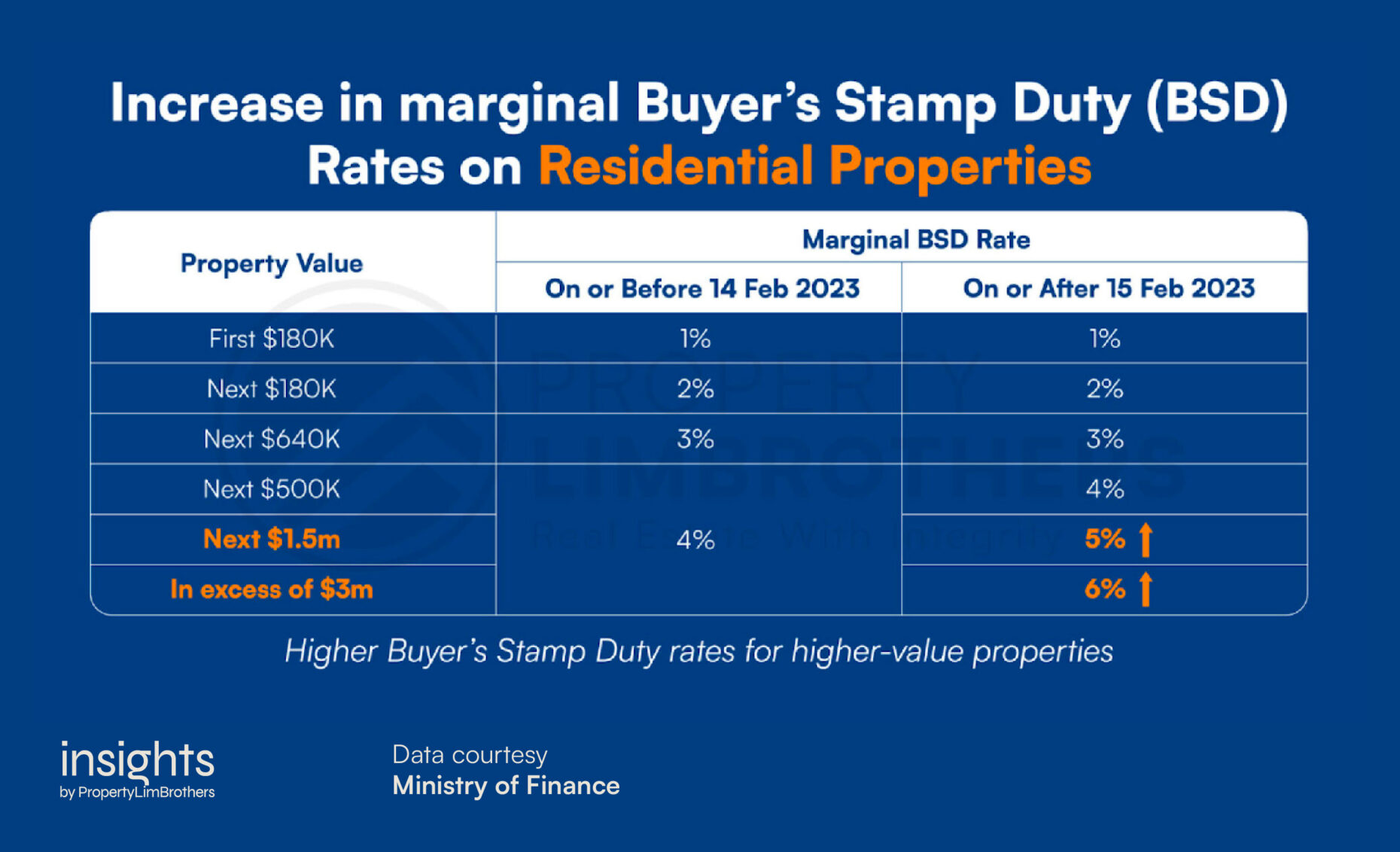

The first tax that foreign buyers should take note of is the Buyer’s Stamp Duty (BSD). The BSD is a tax levied on all property purchases in Singapore. As the name suggests, only the buying party has to pay this tax. The BSD amount is calculated based on the purchase price mentioned in the document or the market value of the property, whichever is higher. In the recent Budget 2023, it was announced that BSD rates for higher-value residential and non-residential properties would be raised with effect from 15 Feb 2023. Below are the current BSD rates for residential properties, as at the time of writing.

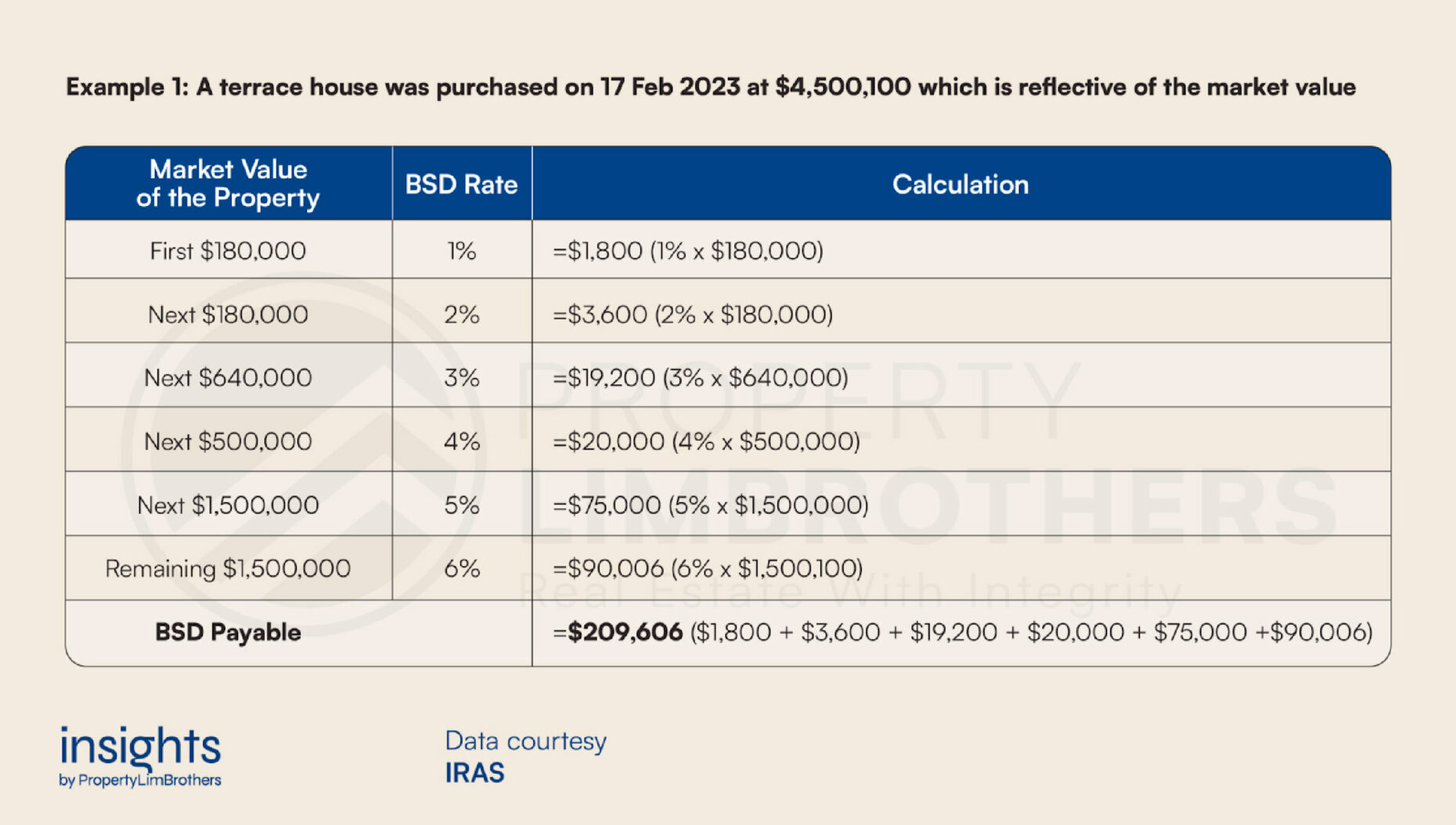

It is important to understand that the Buyer’s Stamp Duty (BSD) is not a flat tax but a progressive one. This means that the percentage rates of BSD will be applied to different market value brackets of the property being acquired, tabulated up to the full purchase or valuation price. To make this clearer, let’s take an example:

Additional Buyer’s Stamp Duty (ABSD)

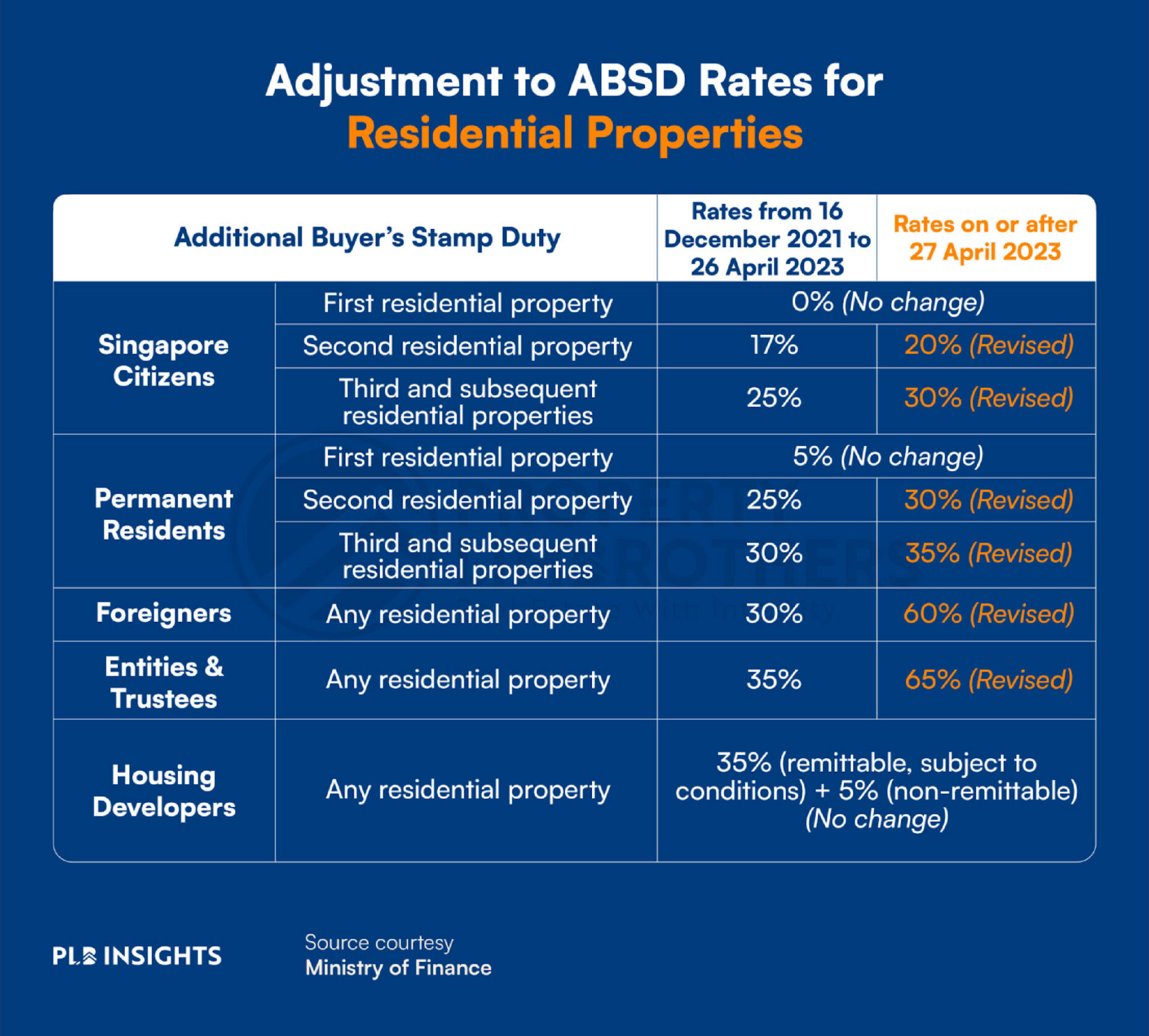

For foreign buyers who are not permanent residents, an additional tax called the Additional Buyer’s Stamp Duty (ABSD) will be levied on any residential property purchase.

In response to the surging demand for residential properties in Singapore’s real estate market, the government implemented the ABSD in 2011. This measure is intended to cool down the property market and manage the demand.

It is crucial to note that ABSD is exclusively applicable to residential properties, and the rates vary depending on the residency status of the buyer. In December 2021, the latest ABSD rates were announced, and the current rates are as follows:

- For SPRs, a 5% ABSD is mandatory for their first property, 30% for their second property, and 35% for their third and subsequent properties.

- Foreign buyers who are not SPRs, are required to pay a flat rate of 60% ABSD on all properties they acquire.

Below is a comprehensive table comparing the ABSD rates for different residency statuses. Foreign buyers need to take note of these rates as they can significantly impact the overall cost of buying a property in Singapore.

Annual Property Tax

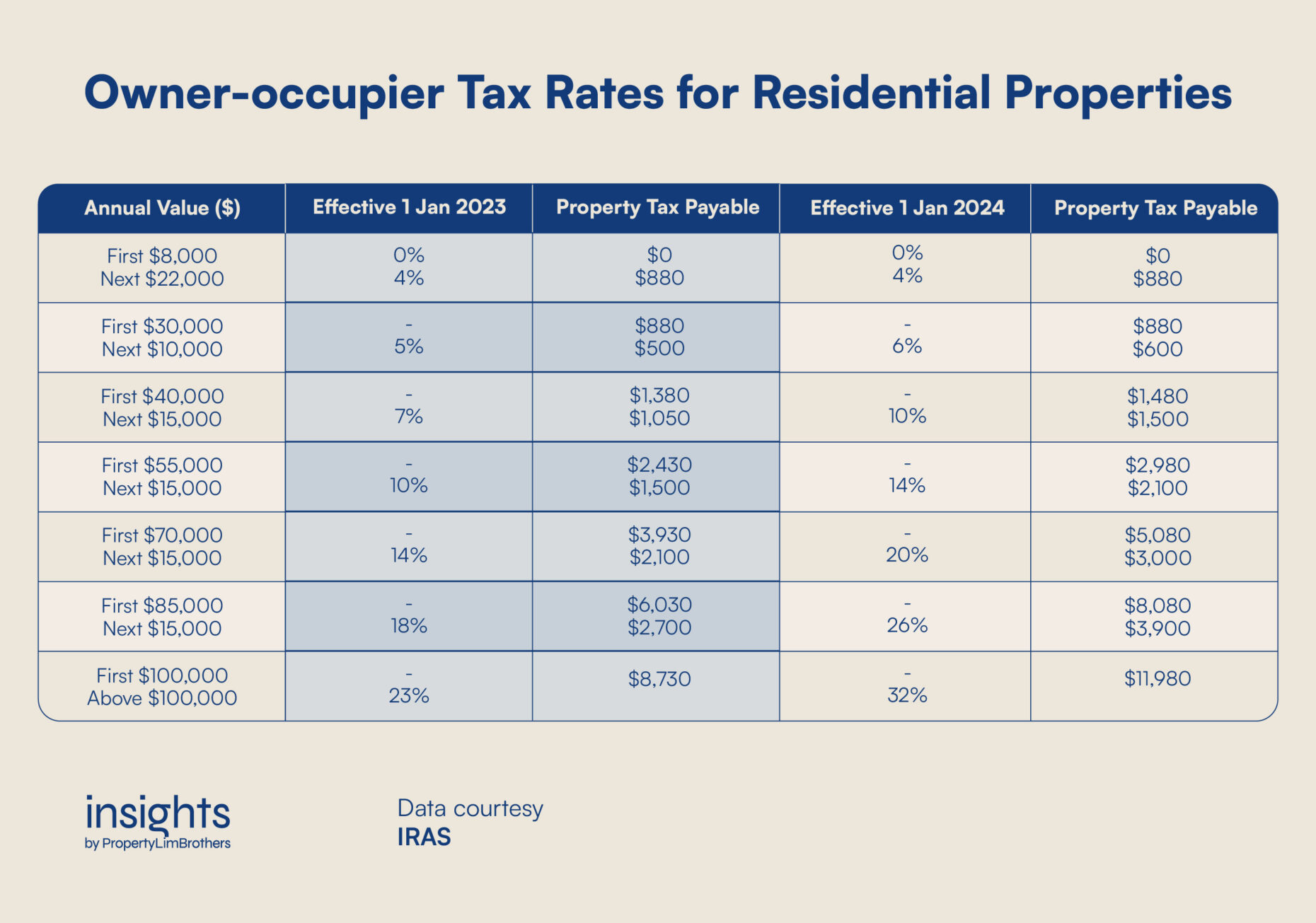

Property tax is a wealth tax levied on the ownership of properties, regardless of whether the property is occupied or vacant. However, to encourage home ownership, the rates for owner-occupier residential properties are set lower than that of non-owner-occupier residential properties and non-residential properties. Owner-occupier residential properties are residential properties where the owner lives in the property.

Property tax is calculated by a progressive tax model, and the amount payable is calculated by multiplying the tax rate with the annual value (AV) of the unit. The AV of a property is derived from an estimate of the potential rental income it could generate if leased out, taking into account the current market value of comparable properties.

Because of the rise in market rents, the AVs of properties have increased. To reflect this trend, the authorities have revised the property tax rates for 2023 and 2024. Below is a concise table showing the owner-occupier tax rates.

As mentioned, the annual property tax is a progressive tax model. Below is an example of the property tax payable for a residential property with an AV of $84,000.

Seller’s Stamp Duty (SSD)

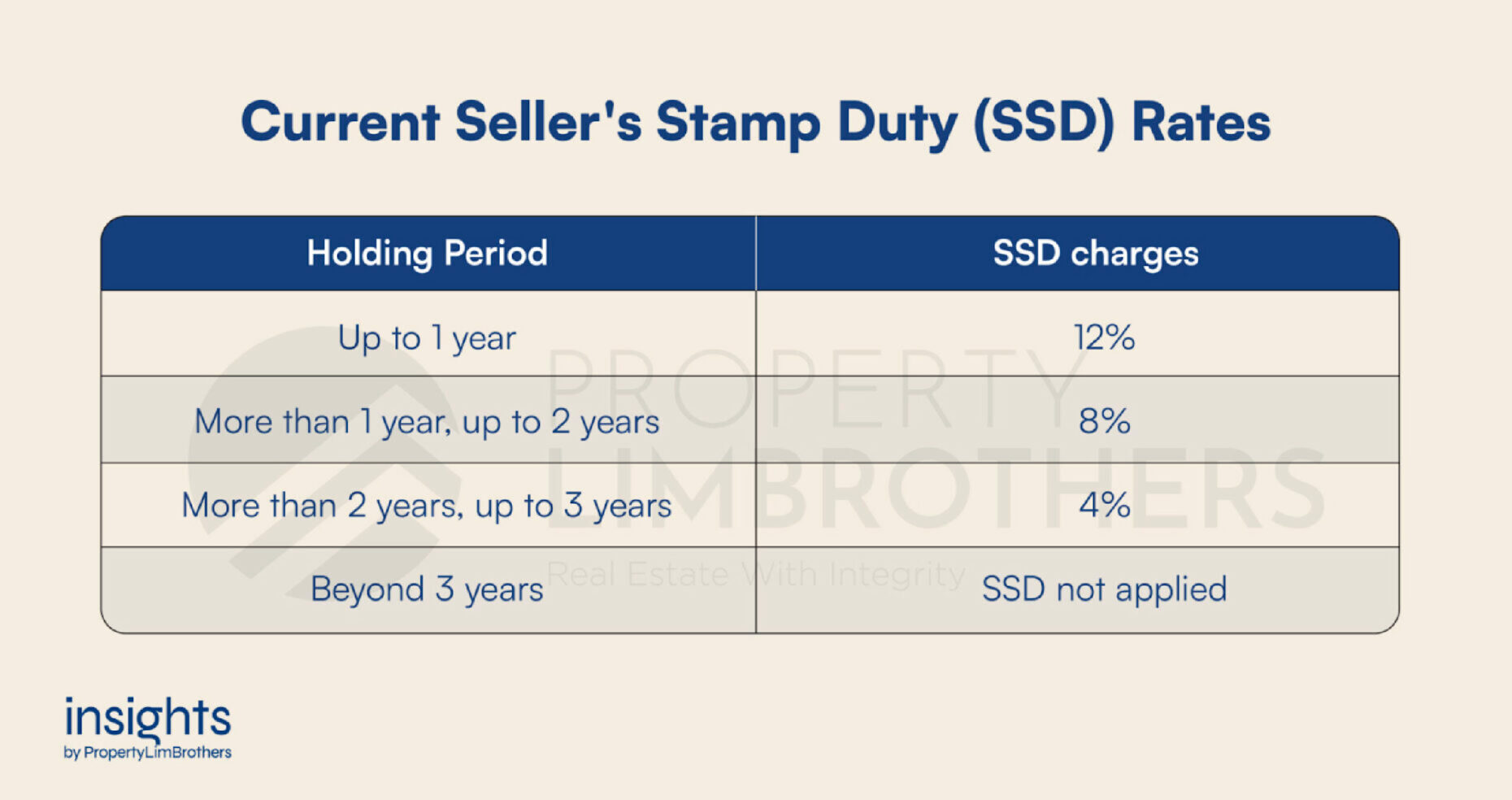

In order to prevent the flipping of properties in Singapore, the Seller’s Stamp Duty (SSD) is levied on residential properties that are sold within 3 years of acquisition. Similar to the BSD, SSD rates are based on the selling price or current market value of the property, whichever is higher.

The current SSD rates are as follows:

However, foreigners are exempted from SSD when they have to sell their residential properties in Singapore as required under the Residential Property Act. For example, under the Residential Property Act, a foreigner is required to obtain approval from the Singapore Land Authority (SLA) before acquiring certain types of residential property, such as landed property. If a foreigner acquires landed property but fails to obtain the requisite approval, they would then have to sell the property. When doing so, SSD will not apply.

Non-Residential Property Taxes

Non-residential property in Singapore refers to any property that is not intended for residential use. This can include commercial buildings, industrial facilities, retail spaces, and office spaces. Non-residential properties are generally used for business purposes, such as manufacturing, trading, or providing services.

Commercial properties, for instance, are often used for retail or office purposes, while industrial properties are used for manufacturing or production. Retail spaces are typically used for businesses that require a physical storefront, such as shops or restaurants, while office spaces are used for businesses that require administrative or professional workspaces.

Non-residential properties in Singapore are subject to different regulations and taxes than residential properties.

Not Applicable: Additional Buyer’s Stamp Duty (ABSD)

One of the biggest advantages of investing in non-residential properties in Singapore as a foreigner is that the ABSD does not extend to commercial and industrial properties. Unlike residential properties, foreign buyers of commercial and industrial properties are not obligated to pay an upfront ABSD fee, which is set at 60% of the purchase price for residential properties.

This exemption is particularly advantageous as it allows foreign investors to invest in these types of properties without the burden of a substantial tax liability, which is often a significant barrier to entry for residential property buyers.

Furthermore, it provides foreign investors with greater flexibility to diversify their investment portfolios and allocate their capital to various asset classes. By offering this exemption, Singapore is providing foreign investors with an attractive opportunity to invest in the country’s commercial and industrial property sectors and enhance their investment strategies.

Buyer’s Stamp Duty (BSD)

Similar to residential properties, the Buyer’s Stamp Duty (BSD) is applicable for non-residential properties as well. However, the rates are slightly different. Below is a table showing the latest BSD rates for non-residential properties:

The BSD for non-resident properties is also a progressive tax, which means that the percentage rates will be applied to different market value brackets of the property being acquired, tabulated up to the full purchase or valuation price (whichever is higher).

Goods & Services Tax (GST)

When purchasing a commercial property from a company that is registered for Goods and Services Tax (GST), buyers must pay GST, which is currently set at 8%, on the purchase price. However, if the buyer themselves is also registered for GST, they can claim back the amount paid. Conversely, if the buyer is not registered for GST, they must pay the full amount without the possibility of a rebate. This factor should be carefully weighed in the overall investment decision, as it can impact the total cost of the property.

It is important to keep in mind that if the property is subject to GST, the same tax will also be applicable to the rent collected from that property. Thus, investors need to be aware of this additional expense and incorporate it into their financial projections.

Looking towards the future, it is vital to note that the GST rate is set to increase by 1% in 2024, bringing the total up to 9% GST. This upcoming change should also be taken into consideration when assessing the overall costs associated with the investment.

It is crucial to follow the law regarding GST, as collecting GST on the rent of a commercial or industrial property when not registered for it is illegal and considered a criminal offence. Therefore, it is essential to be aware of the applicable regulations and ensure compliance to avoid any legal repercussions.

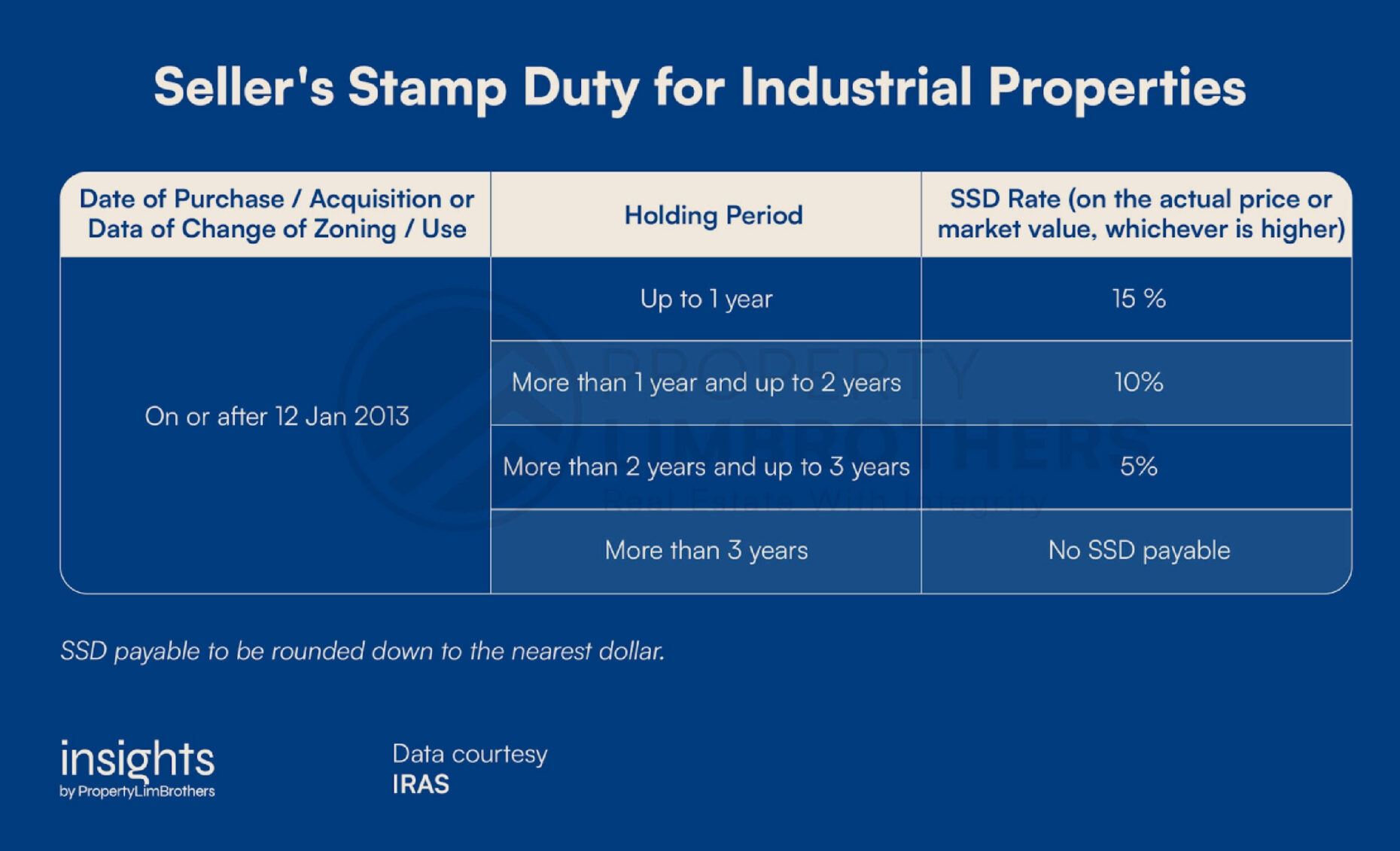

Seller’s Stamp Duty (SSD) for Industrial Properties

Short-term sale of industrial properties will be subjected to the Seller’s Stamp Duty (SSD). This applies to industrial properties (warehouses, factories, etc.) but not commercial properties (offices, shops, medical suites, shophouses) and is a key factor that distinguishes these two types of non-residential property. Below is a breakdown of the current SSD rates for industrial properties.

Annual Property Tax

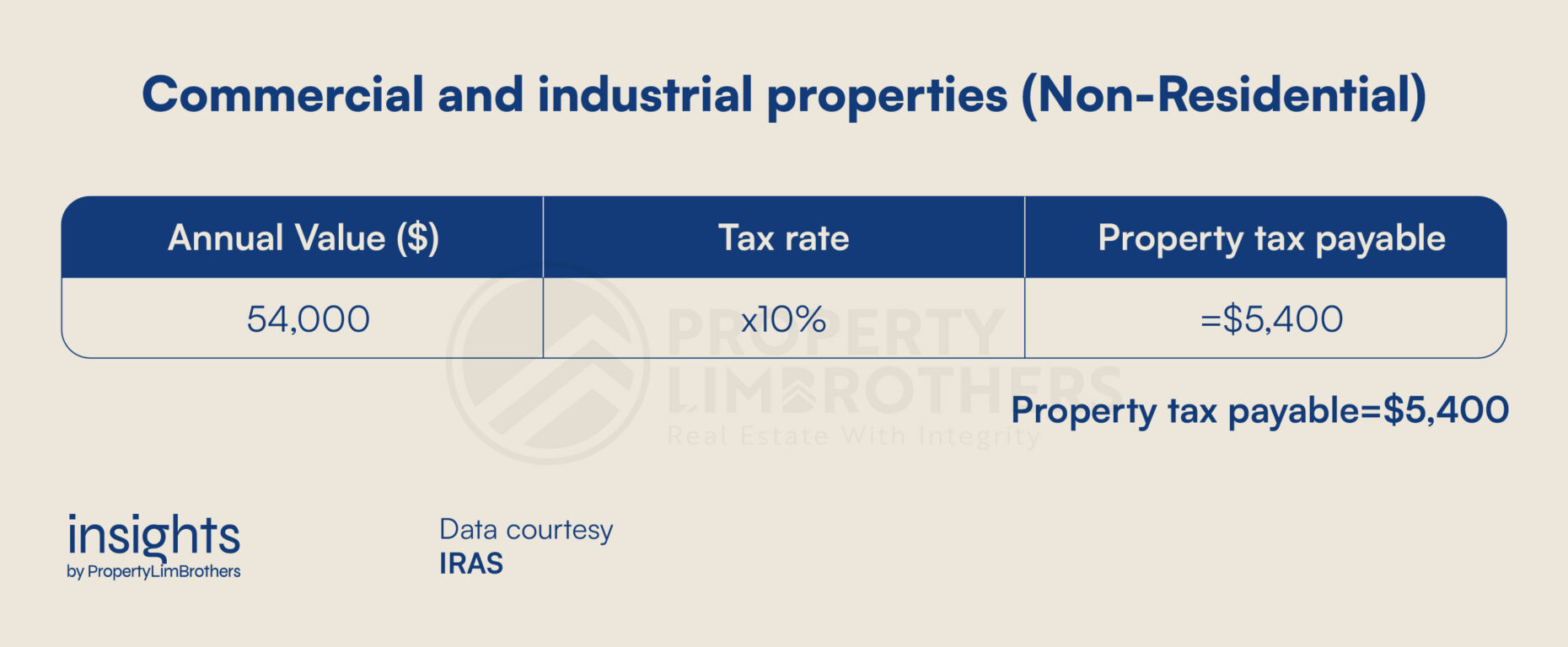

Like residential properties, non-residential properties are also subjected to property tax. Non-residential properties are subjected to a flat tax of 10% of the AV. Owner-occupier tax rates will not apply to non-residential properties even if bought for own use or occupation.

Below is an example of the property tax payable for a non-residential property with an AV of $54,000.

Closing Thoughts

In summary, the property tax applicable for foreign buyers in Singapore is an important consideration for those looking to invest in the Singapore’s real estate market. With tax policies such as ABSD and other restrictions for foreign buyers, it has become more challenging for foreigners to purchase properties in Singapore. However, these measures have been put in place to ensure that the housing market remains stable and accessible for Singaporeans.

Despite the tax policies, Singapore remains an attractive destination for property investments due to its strong economy, political stability, and strategic location. Overall, the property tax policies may act as a deterrent for some foreign buyers, but for those who are willing to navigate the tax landscape, the rewards of investing in Singapore’s property market can be significant.

If you need help navigating the property landscape in Singapore, do not hesitate to reach out to us here for guidance or a second opinion.

Disclaimer: The information provided in this article is accurate as of the date of publication and is based on the rules and regulations concerning stamp duty rates and taxes in effect at the time. While we strive to update our past articles diligently, please be aware that tax laws and regulations can change frequently, and it is essential to verify the most current rules and guidelines from the relevant government authorities or consult with a qualified professional for the latest updates and accurate advice.