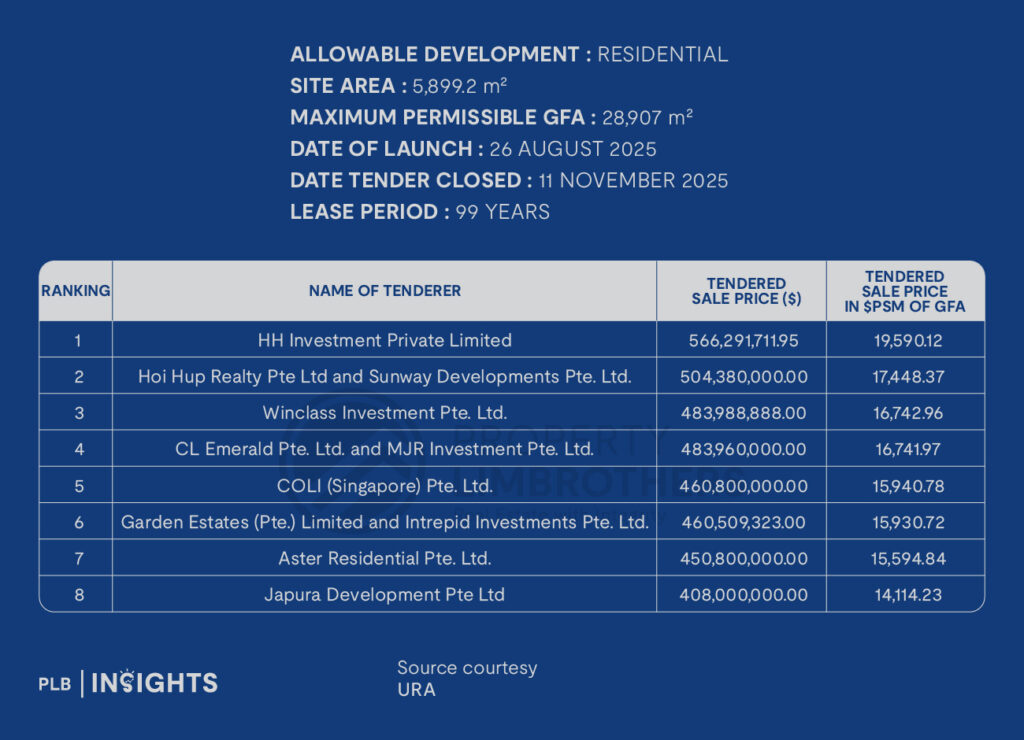

The tender for a Government Land Sale (GLS) site along Bukit Timah Road closed on November 11, attracting a total of eight bids. The site will likely yield 340 residential units.

The highest bidder, HH Investment, submitted an offer of $566.292 million, equating to $1,820 per square foot per plot ratio (psf ppr). HH Investment, the Singapore-based subsidiary of Taiwan’s Huang Hsiang Construction Corp., is well-known for its development of Balmoral Place, a 28-unit freehold apartment in District 10, completed in 2000.

This bid represents the highest psf ppr price for a GLS site in Singapore’s Core Central Region (CCR) since April 2018, when SC Global, in collaboration with New World Development and Far East Consortium, paid $2,377 psf ppr for a GLS site on Cuscaden Road, which was later developed into the 192-unit Cuscaden Reserve.

HH Investment’s offer was 12.3% higher than the second-highest bid of $504.38 million ($1,621 psf ppr), submitted by a joint venture between Hoi Hup Realty and Sunway Developments. Other bidders included Wing Tai Holdings ($1,555 psf ppr), a CapitaLand Development-Mitsubishi Estate Asia consortium ($1,555 psf ppr), and China Overseas Land & Investment ($1,481 psf ppr). The lowest bid came from CK Asset Holdings at $408 million, or $1,311 psf ppr. The spread between the highest and lowest bids was a significant 38.8%.

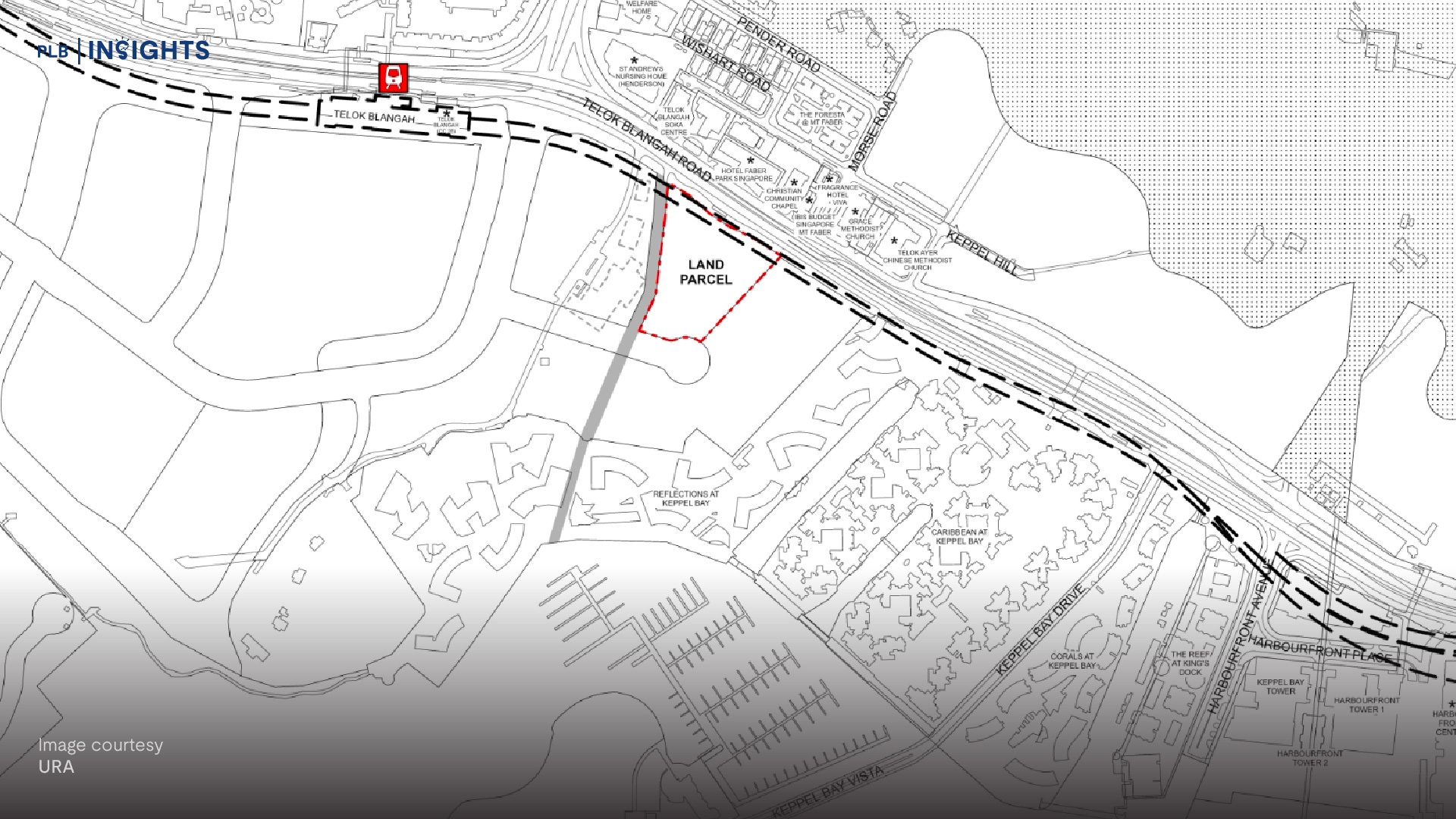

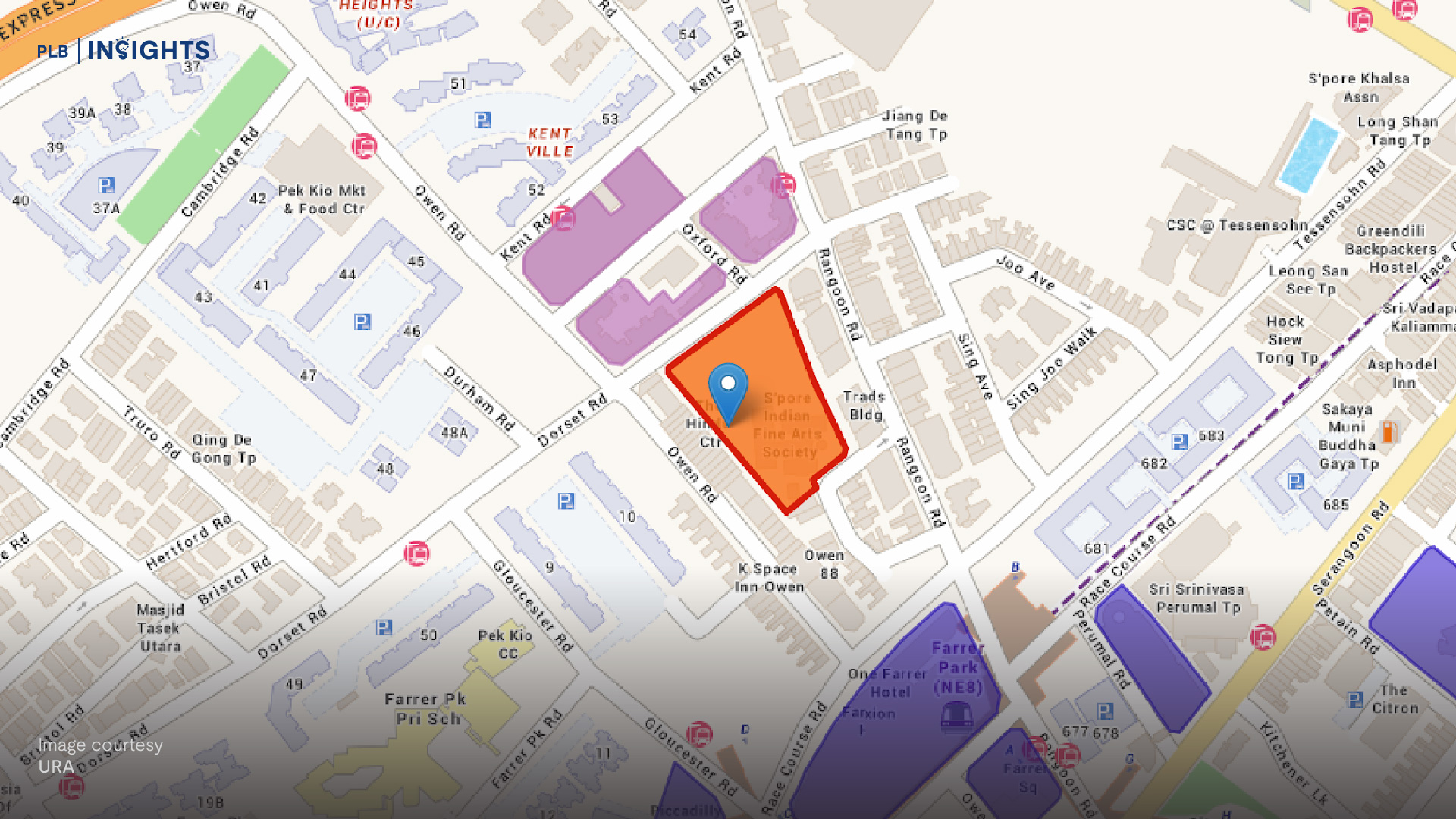

The 63,498 square foot GLS site, located next to Newton MRT Station, was launched as part of the 2H2025 GLS programme. The site is expected to yield 340 residential units and is positioned within a developing Newton neighbourhood that is slated for growth over the next decade. The station, an interchange for the Downtown and North-East MRT lines, adds to the site’s appeal, along with proximity to renowned educational institutions such as Anglo-Chinese School (Junior) and St Joseph’s Institution Junior.

At a land price of $1,820 psf ppr, future launch prices in the area are anticipated to start from $3,500 psf. The latest nearby launch, UpperHouse at Orchard Boulevard, has already seen significant interest, with nearly 54% of its units sold during a private preview in July at an average price of $3,350 psf. As of now, the project is 70.4% sold at $3,366 psf, according to caveats lodged.

The high level of competition for this Bukit Timah Road site has made it one of the most popular tenders of 2025. This follows closely behind the Dorset Road GLS site, which saw nine bids in October, and the Dunearn Road GLS site, which received eight bids in July.

The resurgence in the CCR sub-market, particularly in the second half of 2025, likely played a role in stimulating active bidding. Sales in the CCR have significantly outpaced previous years, reflecting a broader recovery in the luxury residential market. Additionally, the Newton area is undergoing significant rejuvenation under the URA Draft Master Plan 2025, which aims to transform the neighbourhood into a vibrant, mixed-use precinct with enhanced liveability and green spaces, making it an attractive location for developers seeking long-term growth potential.

Looking ahead, there are only two GLS sites currently open for tender, with six more sites set to launch in the 2H2025 Confirmed List. The Dunearn Road GLS site, scheduled for launch in December, remains the only site within the CCR available in the near term, which may shift developer focus toward other upcoming sites such as those on Dover Road, Tanjong Rhu Road, and Kallang Avenue.

PLB Research Commentary

The strong demand for the Bukit Timah Road GLS site underscores the continued confidence in Singapore’s luxury residential market, particularly within the CCR. With developers keen to secure prime land in emerging and well-connected areas, the Bukit Timah Road site’s location next to Newton MRT Station and its proximity to prestigious schools makes it a highly sought-after asset.

The competition between developers also highlights the positive outlook for the CCR, supported by ongoing urban rejuvenation and infrastructure development under the URA’s Master Plan. As developers aim to position themselves in prime locations, we anticipate further competitive bidding for future GLS sites, especially in light of the expected long-term growth in the Newton and surrounding areas.

Stay Updated and Let’s Get In Touch

Should you have any questions, do not hesitate to reach out to us!